-

The Department of Justice has agreed to a settlement with a pair of Cincinnati banks accused of redlining African-American neighborhoods in four cities in Ohio and Indiana.

December 28 -

Proponents of "recap and release" misread the political risks and the depth of interest that key lawmakers have in determining the long-term future of Fannie Mae and Freddie Mac.

December 28 Mountain Lake Consulting

Mountain Lake Consulting -

Many real estate agents expected rising interest rates to affect the type of home prospective purchasers were shopping for, according to the results of a survey by Redfin.

December 28 -

The nation's housing market remains on the outer edge of its historic benchmark range of housing activity, according to Freddie Mac's Multi-Indicator Market Index.

December 28 -

Congress wants to put the federal flood program on sounder financial footing, encourage the development of a private flood insurance market and stop the insanity of rebuilding properties subject to repetitive flooding.

December 23 -

Treasury sweep agreement set to deplete Fannie and Freddie's capital reserves by the end of 2017.

December 23 -

A consumer's ability to afford to purchase a home during the fourth quarter was at its lowest level in eight years due to rapid price appreciation, moderate wage growth and the post-election increase in interest rates.

December 22 -

Treasury Secretary nominee Steven Mnuchin is facing growing pressure from Senate Democrats to account for his leadership of a bank accused of shoddy foreclosure practices.

December 21 -

The National Association of Realtors is warning House Republicans leaders that their tax reform plan would marginalize two long-standing tax incentives for owning a home, which could hurt the housing market.

December 20 -

While the housing market is expected to cool down a bit in 2017, the National Association of Realtors has identified these 10 metro areas as the top markets for next year.

December 20 -

The transition team for President-elect Donald Trump is considering several candidates to fill key spots at the Department of Housing and Urban Development and Federal Housing Administration, including a homebuilder and former lender.

December 16 -

While depository mortgage lenders should exercise some caution before welcoming trended data and alternative credit scoring into their process, they must become inclusive or face losing market share to newer industry players like SoFi.

December 16 Sapient Global Markets

Sapient Global Markets -

A regulatory 2017 scorecard for Fannie Mae and Freddie Mac calls on the firms to transfer a significant portion of credit risk to third-party private investors on at least 90% of unpaid principal balance of newly acquired single-family mortgages.

December 15 -

During the third quarter, the negative equity rate dropped to 10.9%, representing roughly 5.3 million homeowners, from 13.4% a year before, Zillow reported.

December 15 -

The mortgage interest deduction has been a pillar of U.S. housing policy for more than a century, but Congress appears ready to consider significant changes to it that some industry players worry could effectively render it moot.

December 14 -

One step the government can take to strengthening housing is to create a unified office dedicated to housing finance and policy, streamlining and making more efficient existing agencies and programs.

December 13 The Collingwood Group

The Collingwood Group -

Millennials are the most optimistic about the state of the U.S. real estate market, while most American express favorable opinions about housing, according to Berkshire Hathaway HomeServices.

December 13 -

The Federal Housing Finance Agency finalized a rule Tuesday that will create a "duty to serve" for Fannie Mae and Freddie Mac to help low- and moderate- income consumers, including encouraging a secondary market for manufactured housing loans.

December 13 -

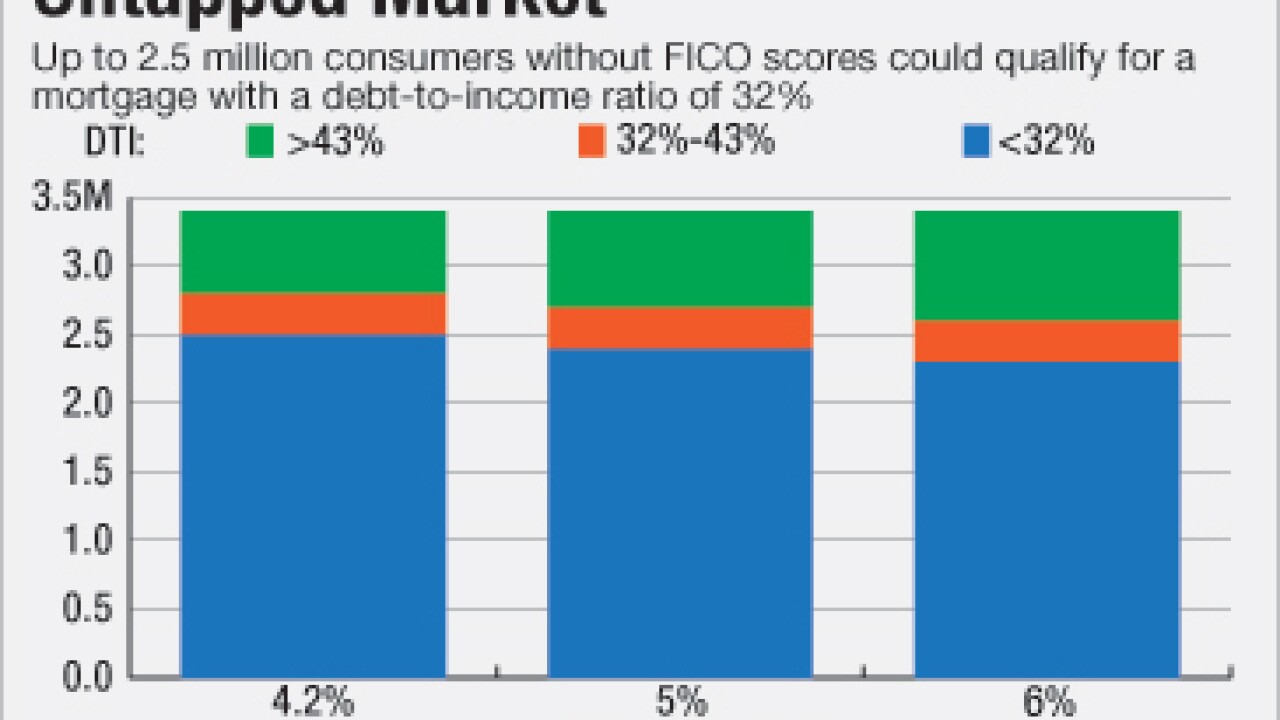

Many consumers without traditional credit scores have nearly identical risk profiles to those who can be assessed the conventional way, representing an untapped market, according to a report by VantageScore.

December 12 -

Rising mortgage interest rates affect the volume of refinance and purchase originations, but don't necessarily spell bad news for home prices, explains Fannie Mae Chief Economist Doug Duncan.

December 12