-

The transition team for President-elect Donald Trump is considering several candidates to fill key spots at the Department of Housing and Urban Development and Federal Housing Administration, including a homebuilder and former lender.

December 16 -

While depository mortgage lenders should exercise some caution before welcoming trended data and alternative credit scoring into their process, they must become inclusive or face losing market share to newer industry players like SoFi.

December 16 Sapient Global Markets

Sapient Global Markets -

A regulatory 2017 scorecard for Fannie Mae and Freddie Mac calls on the firms to transfer a significant portion of credit risk to third-party private investors on at least 90% of unpaid principal balance of newly acquired single-family mortgages.

December 15 -

During the third quarter, the negative equity rate dropped to 10.9%, representing roughly 5.3 million homeowners, from 13.4% a year before, Zillow reported.

December 15 -

The mortgage interest deduction has been a pillar of U.S. housing policy for more than a century, but Congress appears ready to consider significant changes to it that some industry players worry could effectively render it moot.

December 14 -

One step the government can take to strengthening housing is to create a unified office dedicated to housing finance and policy, streamlining and making more efficient existing agencies and programs.

December 13 The Collingwood Group

The Collingwood Group -

Millennials are the most optimistic about the state of the U.S. real estate market, while most American express favorable opinions about housing, according to Berkshire Hathaway HomeServices.

December 13 -

The Federal Housing Finance Agency finalized a rule Tuesday that will create a "duty to serve" for Fannie Mae and Freddie Mac to help low- and moderate- income consumers, including encouraging a secondary market for manufactured housing loans.

December 13 -

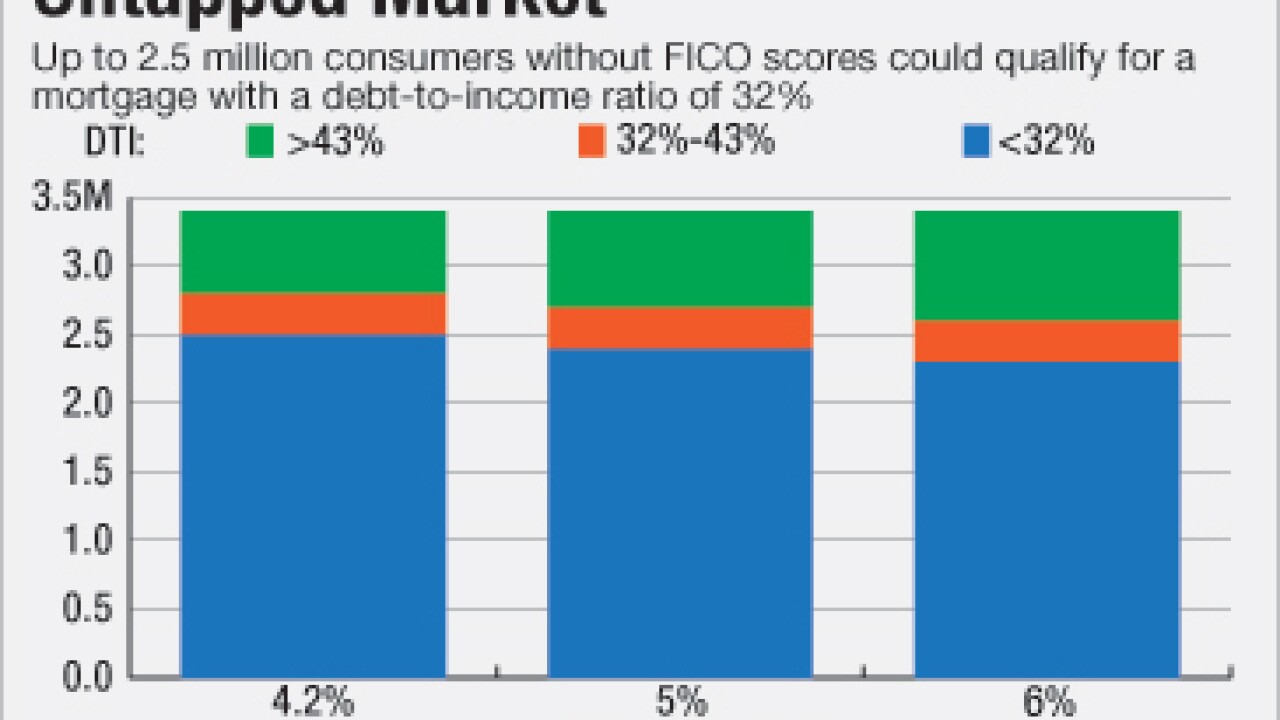

Many consumers without traditional credit scores have nearly identical risk profiles to those who can be assessed the conventional way, representing an untapped market, according to a report by VantageScore.

December 12 -

Rising mortgage interest rates affect the volume of refinance and purchase originations, but don't necessarily spell bad news for home prices, explains Fannie Mae Chief Economist Doug Duncan.

December 12 -

Canadian household confidence rose, boosted by improving sentiment about the national housing market, weekly telephone polling shows.

December 12 -

Manufactured housing advocates are "guardedly optimistic" that the Federal Housing Finance Agency will soon issue a long-awaited final rule that they hope will expand the secondary market for mobile homes.

December 12 -

From the rising influence of millennials to shifting trends in home prices and housing inventory, here's a look at the top housing market trends for 2017.

December 9 -

Affordable housing advocates are seizing on President-elect Donald Trump's call for tax reform, hoping that a new tax credit program to revitalize run-down homes in distressed neighborhoods will be attractive to the incoming administration.

December 8 -

The Office of the Comptroller of the Currency is expected to downgrade Wells Fargo's Community Reinvestment Act rating in January to "needs to improve," from "outstanding," according to a story by Reuters, citing unnamed sources.

December 8 -

Two reports released Wednesday indicate mixed reactions to the presidential election where consumers' attitudes toward housing are concerned.

December 7 -

Although he has since walked-back his original pledge to deport 11 million people, if President-elect Donald Trump attempts to fulfill his campaign promise, the damage to the housing industry would be substantial.

December 6 National Association of Hispanic Real Estate Professionals

National Association of Hispanic Real Estate Professionals -

While the designation of retired neurosurgeon Ben Carson to run the Department of Housing and Urban Development appears like an unusual choice, lenders are hoping he can bring a fresh perspective to the industry.

December 5 -

Mortgage credit availability expanded for the third consecutive month in November, according to the Mortgage Bankers Association.

December 5 -

PlainsCapital Corp. subsidiary PrimeLending is expanding its closing cost assistance program to all 50 states and the District of Columbia.

December 5