-

The housing market displayed bright short-term and long-term trends in September, according to CoreLogic's Home Price Index.

November 3 -

American International Group Inc. CEO Peter Hancock dismissed activist investor Carl Icahn's proposal to split the company into three insurers, saying a division would limit earnings diversity and reduce the value of some tax assets.

November 3 -

A New Jersey woman and her parents were found guilty of a sophisticated mortgage equity fraud scheme by a Pennsylvania federal jury.

November 2 -

The government-sponsored enterprise is working to rebuild partnerships with church organizations and housing financing agencies as part of a broader effort to make owning a home affordable for low- and moderate-income families.

November 2 -

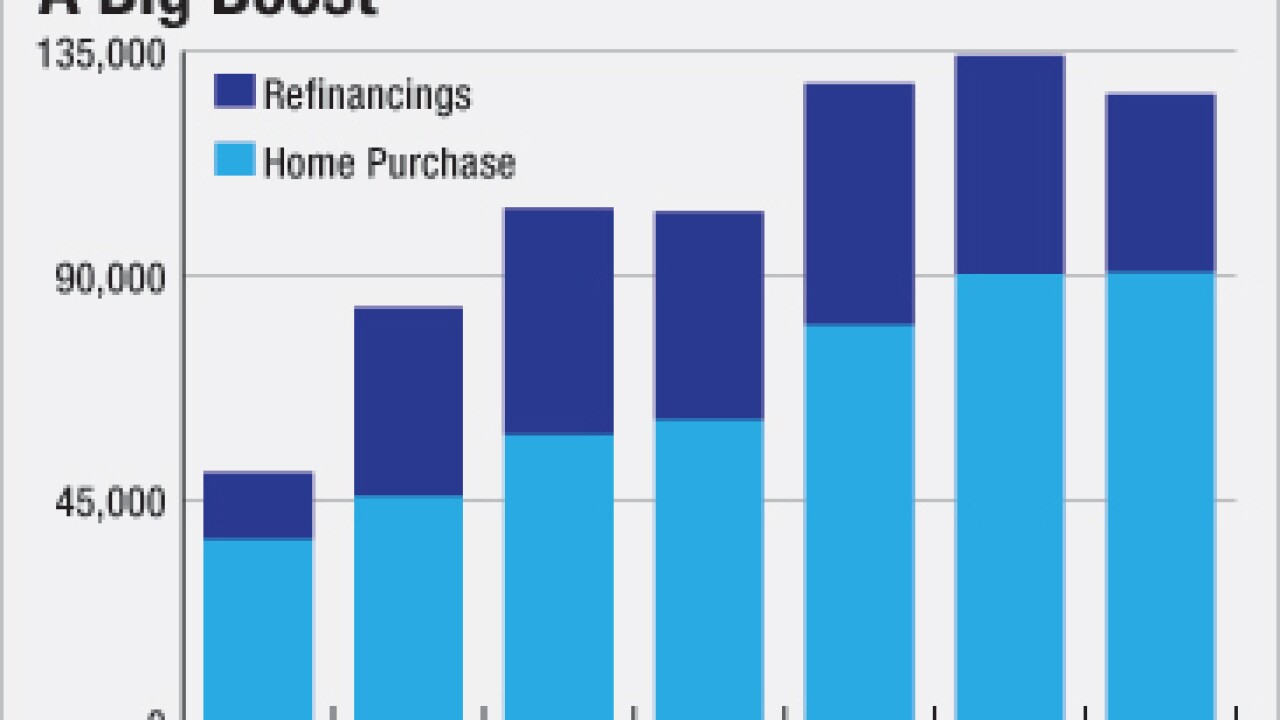

Purchase mortgage originations are soaring because of high-credit score applicants, while refinance applications are declining among the same group of borrowers, according to Black Knight Financial Services.

November 2 -

The administration apparently intends to leave office without addressing Fannie Mae and Freddie Mac's capital bases and therefore the tight credit conditions.

October 30

-

A handful of housing markets in the West showed signs of resilience in October, Pro Teck Valuation Services' monthly Home Value Forecast indicates.

October 30 -

Genworth Financial's third-quarter profit missed analysts' estimates as results deteriorated at its Canadian and Australian mortgage insurance units.

October 30 -

The report from independent auditors will likely show that FHA remains below its 2% statutory minimum capital ratio, but HUD officials and outside observers still expect it to show major improvement over last year.

October 29 -

The Mortgage Bankers Association said Thursday that it expects commercial and multifamily mortgage originations will increase year-over-year in 2016 by 6% to $485 billion.

October 29 -

Arch MI U.S. did $3.2 billion in new insurance written, approximately 60% more than the nearly $2 billion done in the same quarter in 2014.

October 29 -

Californias Richmond Community Foundation will pursue a new social impact bond vehicle with a $3 million revenue bond private placement it hopes to close next month with the local Mechanics Bank.

October 29 -

Contract signings to purchase previously owned homes unexpectedly fell in September by the most since the end of 2013, indicating the residential real estate market is cooling from its recent brisk pace.

October 29 -

Interest rates on 30-year fixed-rate mortgages fell three basis points during the week ending Oct. 29, as the market increasingly expects the Federal Reserve to hold off on raising rates, according to Freddie Mac.

October 29 -

A major investor in insurance giant American International Group is calling on the company to break itself up into three companies to get out from under its designation as one of only four systemically risky nonbanks.

October 29 -

Consumer demand to purchase housing increased slightly in September, compared to a year earlier, according to Redfin.

October 28 -

Mortgage application volume fell 3.5% on a seasonally adjusted basis for the week ending Oct. 23, compared to the previous week.

October 28 -

Department of Housing and Urban Development staff are working on a revision to the agency's condo rule and "we anticipate a rulemaking process," HUD Secretary Julian Castro said this week.

October 27 -

Flagstar Bancorp reported a third-quarter profit, as it originated more residential mortgages and recorded higher fee income.

October 27 -

Home prices in 20 U.S. cities rose at a faster pace in the year ended August, a sign the industry continues to strengthen on improving demand.

October 27