-

Sales of single-family homes and condos are on pace to reach an eight-year high this year, according to RealtyTrac's U.S. Home Sales Report for August.

September 25 -

Officials signaled that Hudson City Savings Bank's nearly $33 million settlement over redlining charges is only the first in what is likely to be a string of other cases.

September 24 -

Inclusionary housing policies can help reduce economic discrimination in neighborhoods that are gentrifying rapidly, according to a think tank's report.

September 24 -

Federal officials on Thursday ordered Hudson City Savings Bank to pay more than $27 million to resolve redlining allegations, the largest order of its kind and one that is likely to put larger banks on notice that redlining cases will be aggressively pursued.

September 24 -

The U.S. housing market continues to slowly stabilize, according to Freddie Mac's latest Multi-Indicator Market Index.

September 24 -

Purchases of new homes jumped in August to a seven-year high as Americans took advantage of historically low mortgage rates.

September 24 -

The Consumer Financial Protection Bureau's method for detecting disparate impact discrimination can overestimate potential bias, resulting in higher payments for lenders cited by the agency, according to internal CFPB documents.

September 23 -

Senior home equity rose by $117 billion in the second quarter, compared to the previous quarter, according to the National Reverse Mortgage Lenders Association.

September 23 -

Mortgage applications rose 14% on rate decreases, compared to one week earlier, on a seasonally adjusted basis for the week ending Sept.18, according to the Mortgage Bankers Association.

September 23 -

Although new HMDA data shows no negative effects from CFPB mortgage rules that went into effect last year, industry representatives argue it isn't showing the full picture.

September 22 -

The housing market is edging off a slow recovery in spite of high depreciation rates concentrated on the East Coast and Midwest, according to Zillow's August Real Estate Market Report.

September 22 -

While Congress has been unable to pass housing finance reform, Fannie Mae and Freddie Mac have done a good job of adhering to some of the spirit of recent bipartisan legislation, according to Mark Zandi, chief economist at Moody's Analytics.

September 22 -

Ginnie Mae may soon raise its liquidity and cash requirements for independent mortgage banking firms since it seems almost certain that Congress won't increase the agency's budget for fiscal year 2016.

September 22 -

First-mortgage originations to subprime borrowers have risen by 30.5% in the first five months of 2015, compared to the same period last year.

September 22 -

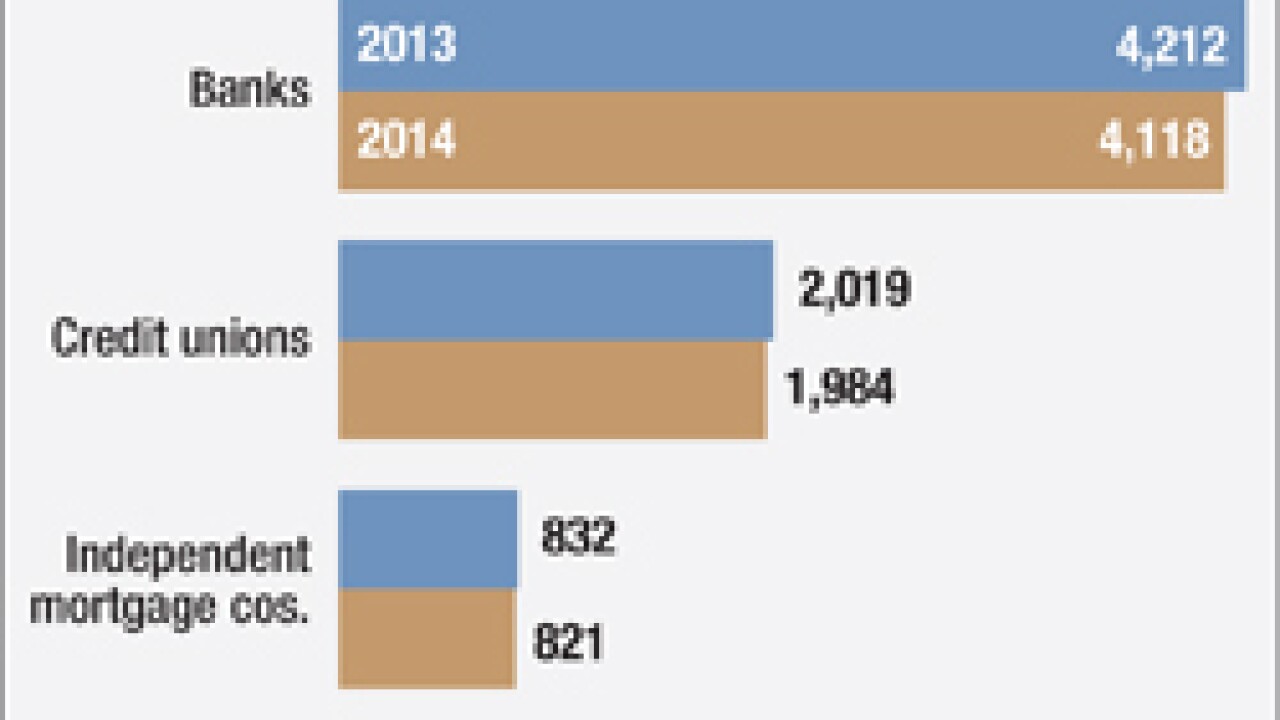

The number of mortgage originations dropped 31% to 6 million in 2014 due largely to a decline in refinancing as interest rates increased, according to a report issued Tuesday by the Federal Financial Institutions Examination Council.

September 22 -

Home prices increased more than estimated in July as the job market improved and buyers competed for a tight supply of properties.

September 22 -

Lennar Corp., the second-largest U.S. homebuilder, reported fiscal third-quarter earnings that beat analysts' estimates as demand for new homes strengthens.

September 21 -

The half a percentage point reduction in the Federal Housing Administration mortgage insurance premium provided a bigger pop to the housing market than expected, according to Mark Zandi, chief economist at Moody's Analytics.

September 21 -

Hispanic women are taking charge when it comes to purchasing a home, according to a Better Homes & Gardens Real Estate and National Association of Hispanic Real Estate Professionals report.

September 21 -

Sales of previously owned homes fell more than forecast in August as lean inventories slowed this year's momentum.

September 21