-

The first-quarter loss ended a two-quarter profitability streak the company hoped to maintain.

April 30 -

Refinancing drove a 75% year-over-year increase in mortgage banking revenue during the first quarter at Flagstar Bancorp as it shored up its operations to avoid other negative repercussions from the coronavirus.

April 28 -

Low mortgage rates increased new orders, but fallout from the pandemic hurt investment income.

April 23 -

Declines in mortgage servicing rights valuations at JPMorgan Chase and Wells Fargo point to the resurgence of a dilemma that came up during the last downturn.

April 15 -

Ginnie Mae will begin taking requests for assistance from issuers who, having exhausted all other options, are having trouble advancing borrowers' principal-and-interest payments to investors amid the pandemic.

April 11 -

The coronavirus relief legislation could result in private mortgage insurers having to hold more capital, a B. Riley FBR analyst report said.

April 6 -

Real estate crowdfunding company Sharestates launched a program Wednesday offering liquidity to private lenders and loan aggregators contending with margin calls as a result of market volatility related to the coronavirus outbreak.

April 1 -

Impac Mortgage Holdings suspended all mortgage lending activity for a two-week period effective March 31, citing liquidity constraints at the company's secondary market counterparties as a result of the coronavirus.

March 30 -

Two Harbors, a real estate investment trust, sold the bulk of its nonagency mortgage-backed securities portfolio to head off margin calls and refocus on its more favorable agency-MBS investments.

March 26 -

A growing number of real estate investment trusts are facing margin calls, putting increased strain on mortgage market infrastructure and adding to pleas for relief to be included in pending legislation.

March 25 -

The credit watch involves single-borrower securitizations of commercial mortgages for high-priced resorts in Florida and Hawaii.

March 19 -

Mortgage real estate investment trusts are taking stock of their financial ability to respond to market shocks and other concerns stemming from the coronavirus.

March 17 -

The Federal Reserve's most recent economic-stimulus effort could reduce disparities between a rally in Treasurys and a relative slump in mortgage-backed securities that contributed to higher average home-lending rates last week.

March 16 -

The Affordable Housing Credit Improvement Act last week achieved a milestone by garnering bipartisan cosponsorship by more than half of the 435 members of the House.

March 16 -

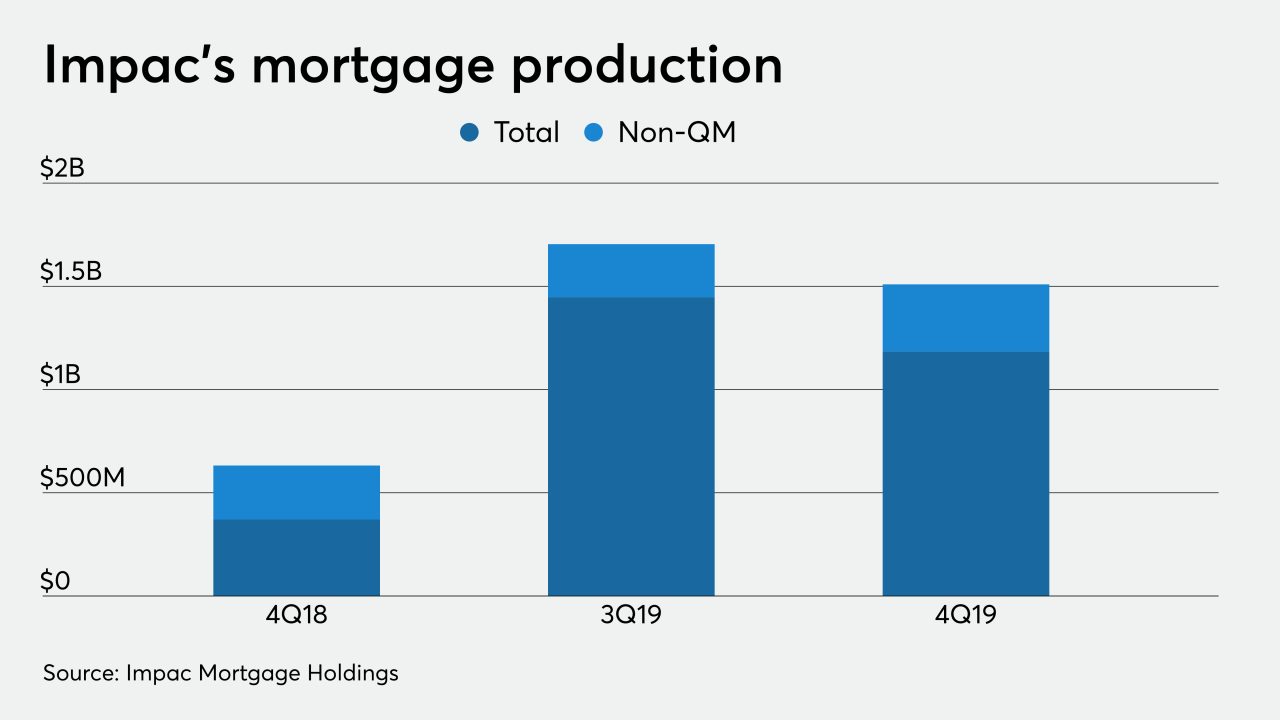

Impac Mortgage Holdings decided a year ago to emphasize its non-qualified mortgage lending operations and placed the company in position to succeed when the housing market returns to normal.

March 13 -

Bank of America cut its ratings and price targets on several homebuilders and building products companies as the firm is bracing for the "inevitable" coronavirus impact on the U.S. housing market.

March 12 -

Banks may be protected from a direct hit, but they have invested in vehicles that include such loans, potentially exposing them to defaults.

March 11 -

The 10-year Treasury yield fell below 0.5% and the 30-year yield dropped under 0.9%, taking the whole U.S. yield curve below 1% for the first time in history.

March 9 -

Altisource Portfolio Solutions lost nearly the same amount of money as it did for the whole year while it continued the business transition started in 2018.

March 6 -

An effort by the Federal Housing Finance Agency to examine membership rules for the Federal Home Loan Bank System is reigniting an argument over whether to allow more nonbanks in or impose tougher barriers.

March 1