-

Ditech Holding Corp. returned to profitability in the first quarter, benefiting from accounting adjustments related to its emergence from bankruptcy protection in February.

June 6 -

Ocwen Financial Corp.'s Chief Financial Officer Michael Bourque has resigned, becoming the second top executive to leave the company after it agreed to acquire PHH Corp.

May 29 -

Ditech Holding Corp. has received a second notice from the New York Stock Exchange warning its common stock could be delisted for not being in compliance with the exchange's requirements.

May 29 -

Institutional investors bought more single-family rental homes in 2017 than in previous years, the first increase since 2013.

May 18 -

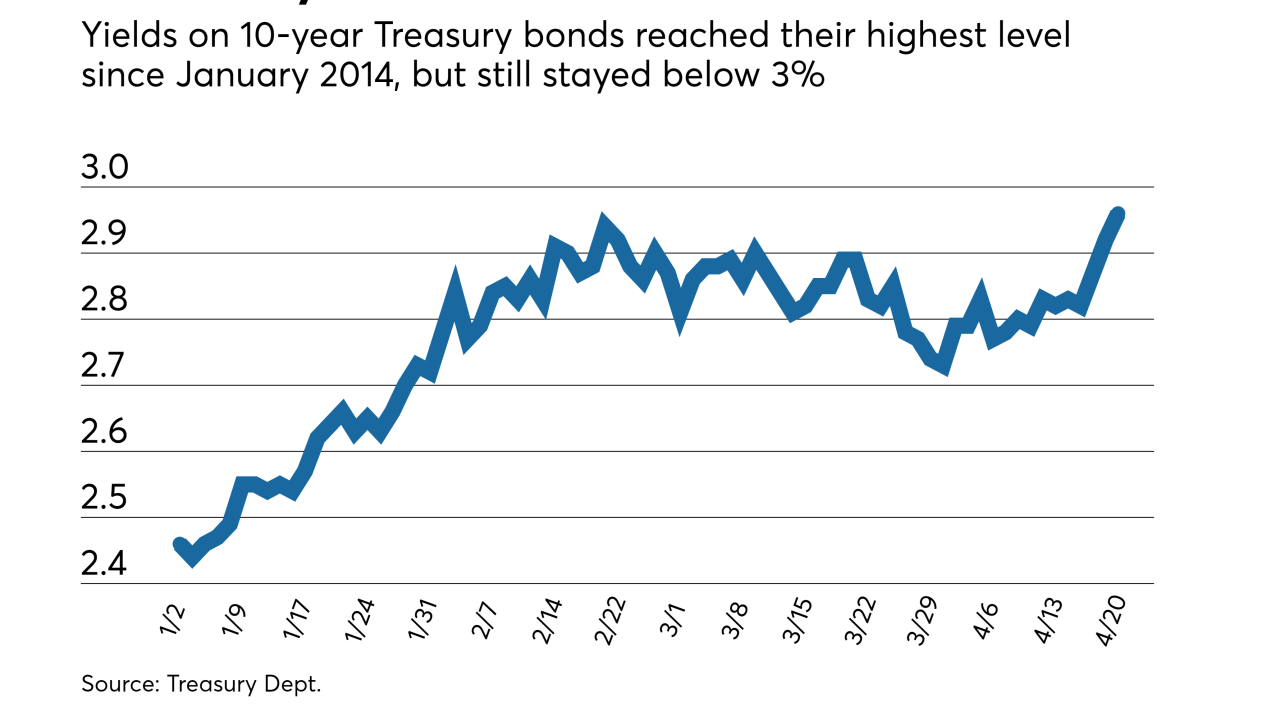

The 10-year U.S. Treasury yield rose to its highest level since 2011, extending a selloff in the world’s biggest bond market and raising fresh questions about how high America's borrowing costs will climb.

May 15 -

PHH Corp. took a net loss in the first quarter but was able to surpass minimums for net worth and available cash necessary for Ocwen Financial to acquire the company.

May 9 -

Capital One Financial Corp. plans to repurchase shares following the sale of $17 billion in mortgages to a Credit Suisse subsidiary.

May 8 -

Blackstone Group is doubling down on industrial real estate by buying Gramercy Property Trust, the second multibillion-dollar takeover of a warehouse company in as many weeks with the growth in e-commerce raising demand.

May 7 -

An increase in title orders opened helped Fidelity National Financial improve its first-quarter net income by 59% over the same period last year.

May 4 -

Fannie Mae's first-quarter profits were enough for it to rebuild its minimum capital buffer and pay the Treasury Department dividend after being forced to take a draw during the previous fiscal period.

May 3 -

Arch Capital Group's mortgage insurance subsidiary slipped to No. 2 in market share just five quarters after completing the acquisition of former No. 1 United Guaranty Corp.

May 2 -

If Freddie Mac's credit-risk transfer activities continue to grow, mortgage lenders could eventually see a reduction in the guarantee fees they pay to the government-sponsored enterprise, according to CEO Donald Layton.

May 1 -

New Residential Investment Corp. reported a 400% year-over-year increase in net income as its servicing revenue improved dramatically over the previous year.

April 27 -

Ellie Mae's first-quarter net income of a little over $2 million was lower than last year's due to some one-time expenses, but continuing operations numbers exceeded analysts' expectations.

April 27 -

Mortgage industry vendors' earnings varied based on the effectiveness of the strategies they used to contend with origination declines and other factors.

April 26 -

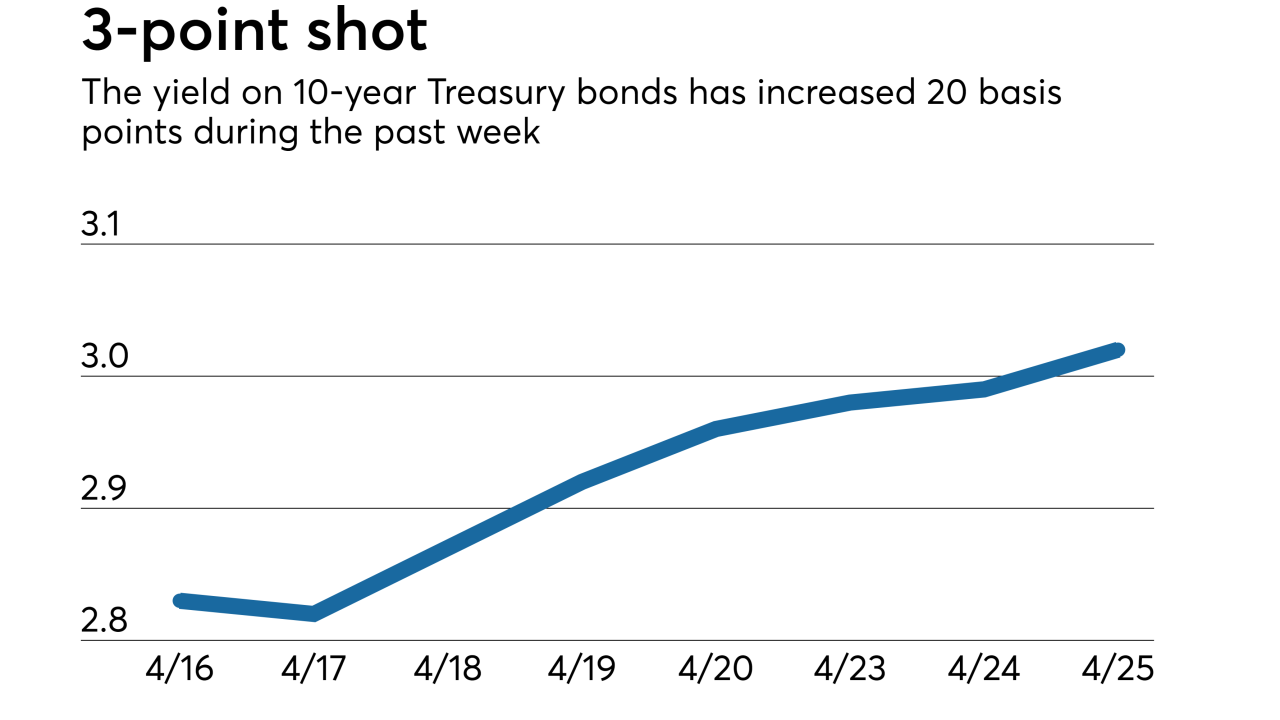

If 10-year Treasury yields remain at or above 3%, the average 30-year fixed-rate mortgage could hit 5% sooner than previously expected.

April 25 -

Flagstar Bancorp returned to profitability in the first quarter after tax reform caused a loss in fourth quarter, but its mortgage revenues dropped 15% due to margin compression and lower volume.

April 24 -

Yields on the 10-year Treasury hit their highest level since the start of 2014 and got very close to cracking the 3% mark, signaling a potential spike in mortgage rates.

April 20 -

MGIC Investment Corp.'s first-quarter net income beat analysts' estimates due to favorable loss development and that should be seen with the other private mortgage insurers.

April 18 -

Ditech Holding Corp. lost $426.9 million in 2017, with almost half of that recorded during the fourth quarter, when the company filed for bankruptcy.

April 17