-

Rocket Mortgage relied on a biased appraisal when it denied a borrower's refinance application in Denver three years ago, the housing agency claims.

July 16 -

The National Association of Realtors was looking to reverse the April decision from the D.C. Circuit Court of Appeals that allowed the Justice Department to reopen its probe into the group.

July 15 -

As part of the three-year agreement, the group will fund a $1.22 million scholarship fund to recruit minorities into the appraisal profession.

July 11 -

Loandepot claims Melio's logo is too similar in style and sound to its real estate services platform Mello logo, in a recently filed complaint.

July 9 -

Of the settlement amount, $1.5 million will be doled out to the lead counsel, documents show.

July 3 -

The motion calls upon the judge to rule quickly on an Administrative Procedures Act claim involving a bank's right to reverse mortgage collateral.

June 28 -

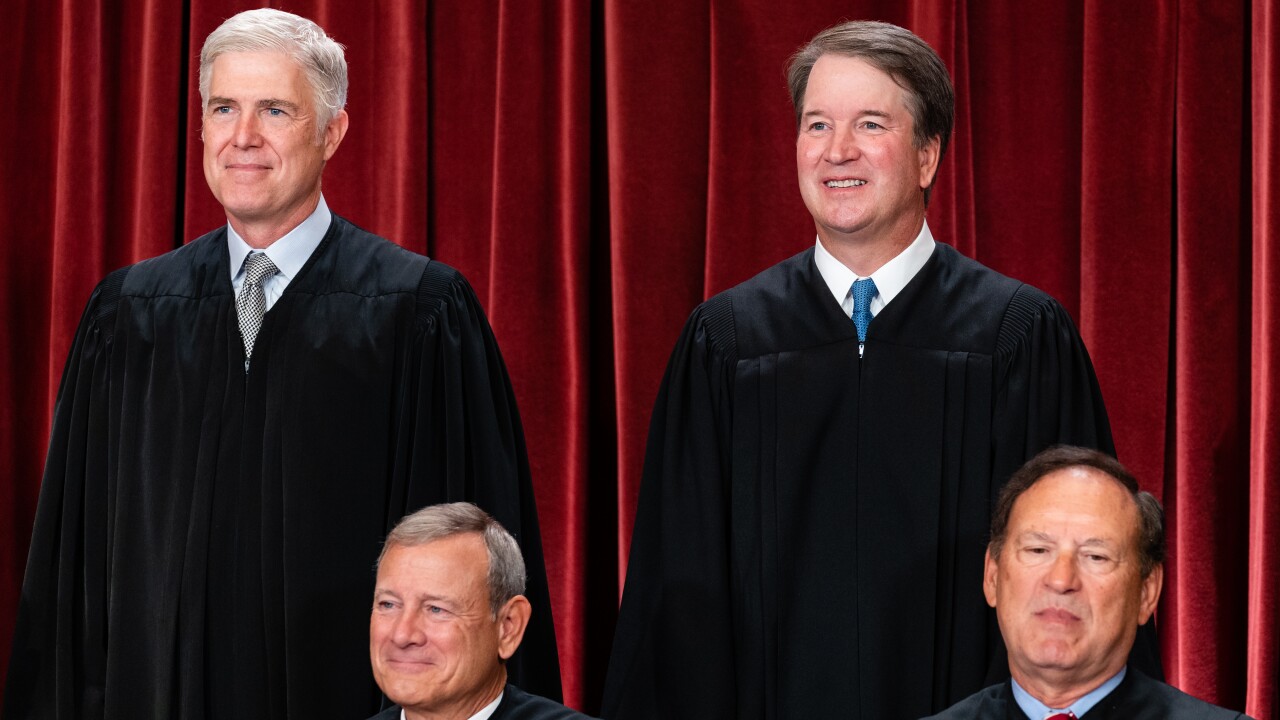

The high court's much-anticipated ruling gives federal courts — rather than executive agencies — the power to interpret ambiguous statutes. The decision is expected to facilitate an increase in litigation over banking regulations.

June 28 -

A landmark ruling by the Supreme Court's conservative majority means that defendants will have the right to a jury trial in cases where bank regulators are seeking civil penalties. The consequences for federal banking agencies are expected to be substantial.

June 27 -

Banks and financial institutions face a barrage of lawsuits from consumers alleging they failed to investigate inaccurate information on a credit report. Industry blames the uptick in litigation on social media sites and the proliferation of credit repair companies.

June 26 -

The wholesale lender called the claims in the Hunterbrook-related class action "meritless" and an attempt to smear its reputation, in a recently filed motion to dismiss it.

June 24 -

The Department of Justice filed an amicus brief in a case that also involves the National Association of Realtors and its rules around multiple listing services.

June 24 -

The nation's leading brokerages have agreed to rule changes and settlements with consumers totalling over $900 million.

-

The appeals court battle is unrelated to the association's settlement regarding buyers' brokers commissions, scheduled for final approval in November.

June 20 -

The high court will determine how much deference judges should give to regulators in interpreting laws passed by Congress. The upcoming ruling has especially big implications for the Consumer Financial Protection Bureau, which has drawn the banking industry's ire.

June 18 -

A probe by the Chicago Tribune alleges sexual harassment and verbal abuse at the workplace.

June 18 -

CCM allegedly discouraged employees from reporting that they worked overtime, a suit claims.

June 18 -

The HUD agency contends that the bank's agreements involving certain reverse-mortgage assets call for the closely watched case to be filed there.

June 17 -

From updates in mortgage-related court cases, to developments in AI and policy, here are the most-read stories from National Mortgage News over the past week.

June 13 -

Newrez wants all three of OneTrust's claims to be dismissed.

June 13 -

The Federal Deposit Insurance Corp. sued 15 lenders on loans brokered through Washington Mutual that were included in securitizations before the bank's 2008 failure.

June 11