-

Every consumer with a 401(k), retirement account or brokerage account ought to care about whether the government has the right to unilaterally amend a companys operating agreement.

September 9 Consumers' Research

Consumers' Research -

Nearly 20 trade groups representing lenders, banks, credit unions, title companies and others are urging federal regulators to provide guidance on how they plan to enforce a new mortgage disclosure regime that goes into effect Oct. 3.

September 9 -

Amid growing concerns about compliance costs in title insurance, a trio of title agents has formed a consortium to help smaller firms manage their back offices more efficiently.

September 8 -

Walter Investment Management has reached a settlement with federal authorities over reverse-mortgage practices at a business unit.

September 8 -

Home Equity Conversion Mortgages have gotten a bad rap, but they're often a better alternative to home equity lines of credit for both borrowers and lenders.

September 4 Wendover Consulting

Wendover Consulting -

Two top Justice Department and CFPB officials said this week that they are seeing more instances of redlining and lenders steering minority borrowers into higher cost loans.

September 3 -

The Home Mortgage Disclosure Act data set to be released in the next few weeks will offer new proof that mortgage lending activity was stronger than expected last year. That fresh data, the likely delay in Fed action on rates and other factors could prompt higher volume estimates for 2015.

September 2 -

The Federal Housing Administration is re-issuing a loan certification proposal that has sparked industry concerns that it will make it easier for the Justice Department to sue lenders when they file claims for agency-insured loans that go into default.

September 1 -

Fraud risk has diminished as a result of widespread changes that lenders have made to their origination practices, according to Fitch Ratings.

September 1 -

M&T Bank has agreed to pay $485,000 and change its lending policies to settle a lawsuit that accused the Buffalo, N.Y., company of racial discrimination in making mortgage loans.

September 1 -

A new battle is brewing between Fannie Mae and Freddie Mac as the government-sponsored enterprises set out to boost their purchases of low down payment loans.

August 31 -

As marketing services agreements increasingly fall out of favor, a more level playing field may emerge where loan officers must aggressively compete on their skill and service to win referral business.

August 28 -

The Federal Housing Administration has resolved a long-standing conflict with municipalities and private companies that back "green energy" loans that is expected to benefit banks and other mortgage lenders. The next question is whether the regulator of Fannie Mae and Freddie Mac mortgages will do the same.

August 25 -

There's nothing like a natural disaster to make people realize how important insurance is to the banking industry.

August 21 Louisiana Bankers Association

Louisiana Bankers Association -

The only thing more ominous than a CFPB investigation is when the FDIC and OCC join in on the action.

August 20 Offit | Kurman

Offit | Kurman -

The new supplemental performance metric should encourage lenders to serve lower credit score borrowers.

August 17 -

The Federal Housing Administration's Neighborhood Watch website is back online after crashing about three weeks ago.

August 17 -

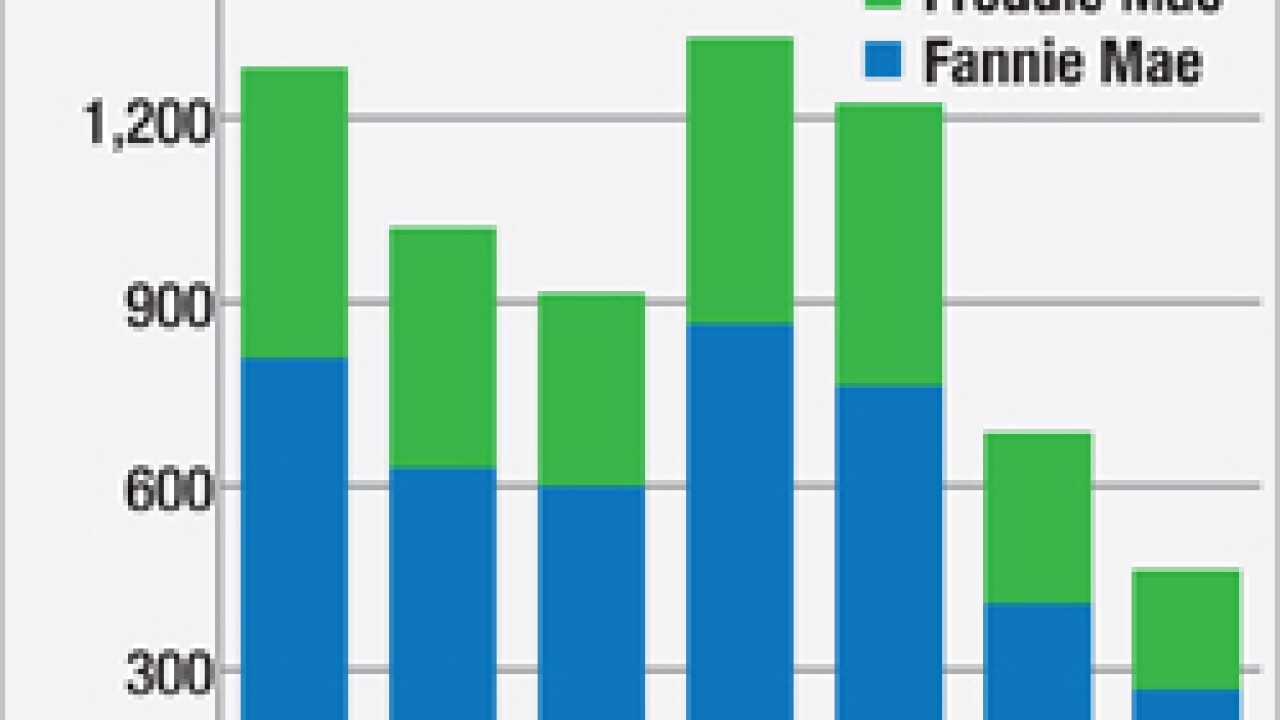

Fannie Mae and Freddie Mac have a regulatory mandate to shrink. But that's easier said than done, given the GSEs' outsized presence in the mortgage industry, as their latest quarterly results show.

August 17 -

Four more Federal Home Loan Banks have won regulatory approval to participate in a program that allows member institutions to sell jumbo mortgage loans through a conduit to Redwood Trust.

August 14 -

Banks that sold faulty mortgage-backed securities right before the crisis have suffered a string of legal defeats over the timing of government lawsuits, but some experts believe the industry may still have a shot in the Supreme Court.

August 14