-

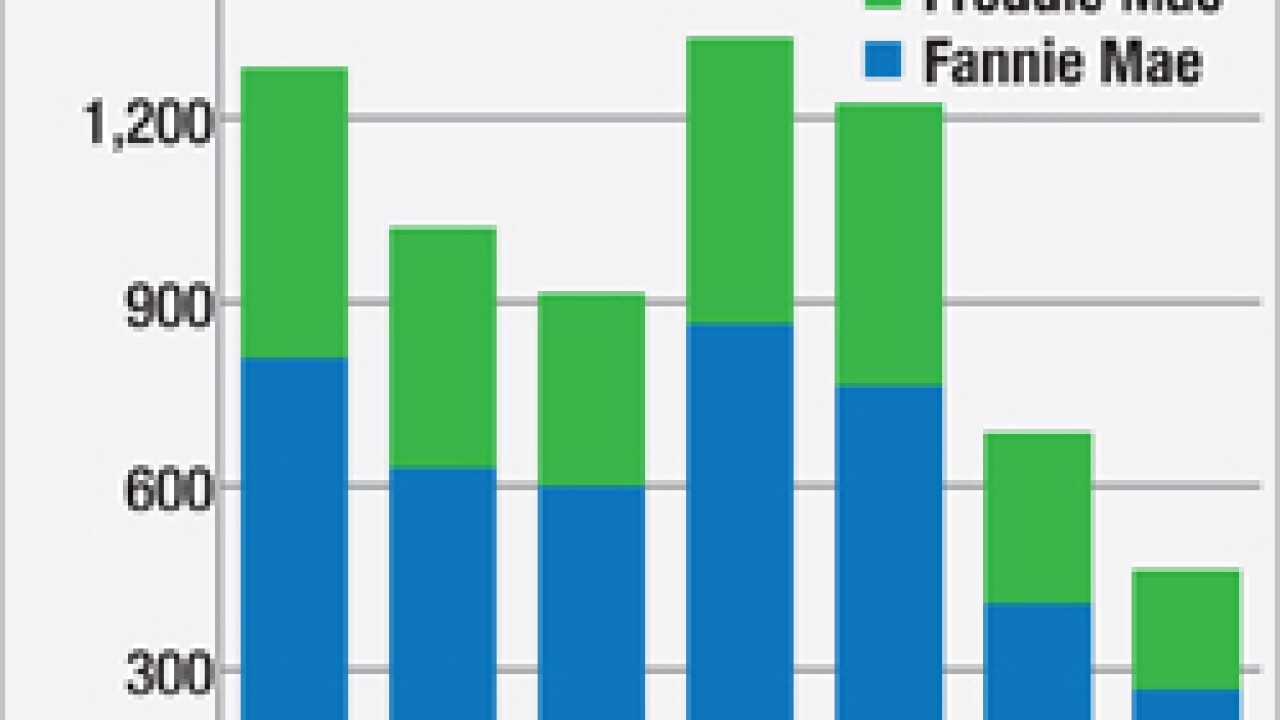

A new battle is brewing between Fannie Mae and Freddie Mac as the government-sponsored enterprises set out to boost their purchases of low down payment loans.

August 31 -

As marketing services agreements increasingly fall out of favor, a more level playing field may emerge where loan officers must aggressively compete on their skill and service to win referral business.

August 28 -

The Federal Housing Administration has resolved a long-standing conflict with municipalities and private companies that back "green energy" loans that is expected to benefit banks and other mortgage lenders. The next question is whether the regulator of Fannie Mae and Freddie Mac mortgages will do the same.

August 25 -

There's nothing like a natural disaster to make people realize how important insurance is to the banking industry.

August 21 Louisiana Bankers Association

Louisiana Bankers Association -

The only thing more ominous than a CFPB investigation is when the FDIC and OCC join in on the action.

August 20 Offit | Kurman

Offit | Kurman -

The new supplemental performance metric should encourage lenders to serve lower credit score borrowers.

August 17 -

The Federal Housing Administration's Neighborhood Watch website is back online after crashing about three weeks ago.

August 17 -

Fannie Mae and Freddie Mac have a regulatory mandate to shrink. But that's easier said than done, given the GSEs' outsized presence in the mortgage industry, as their latest quarterly results show.

August 17 -

Four more Federal Home Loan Banks have won regulatory approval to participate in a program that allows member institutions to sell jumbo mortgage loans through a conduit to Redwood Trust.

August 14 -

Banks that sold faulty mortgage-backed securities right before the crisis have suffered a string of legal defeats over the timing of government lawsuits, but some experts believe the industry may still have a shot in the Supreme Court.

August 14 -

In 1979, mortgage bankers worried that they could be undercut by "sleeping giants" like Merrill Lynch, Sears Roebuck and what was then called Master Charge.

August 14 RealtyTrac

RealtyTrac -

Neighborhood Watch, the Federal Housing Administration's "early warning system" for monitoring mortgage defaults and lender performance, crashed more than two weeks ago and it's unclear when the service will be restored.

August 13 -

The Federal Housing Finance Agency is expected to issue a proposal soon that would require Fannie Mae and Freddie Mac to purchase manufactured housing loans from lenders.

August 13 -

Homeownership is out of reach for too many Americans. The next president could change that with a few simple policies aimed at encouraging private capital to invest in residential mortgages.

August 13 Commissioner, Housing Commission, Bipartisan Policy Center

Commissioner, Housing Commission, Bipartisan Policy Center -

The Department of Housing and Urban Development fined two Texas lenders for charging bogus fees to borrowers purchasing manufactured housing.

August 11 -

A New York law that was invalidated by a federal judge was one of many efforts by big cities to pressure banks into making more investments in local communities after the crisis. Some municipal laws could be more vulnerable to bankers' legal challenges than others.

August 10 -

A federal judge has overturned a New York City law that would have required banks to make new disclosures regarding their investments in local communities.

August 10 -

M&T Bank's disclosure that it is in settlement talks with the Justice Department for not complying with underwriting guidelines on FHA loans has renewed fears that more lenders will be targeted.

August 7 -

The Consumer Financial Protection Bureau has ramped up its push for the mortgage industry to switch to an electronic closing process after results from a pilot program showed consumers favored it over in-person mortgage closing.

August 5 -

Lenders said the delay in implementing the combined loan and closing disclosures is giving them valuable added time to train their staff, according to a DocuTech survey.

August 3