-

Incorporating bill and rental payment data into consumer credit scores would be a boon for underserved Americans. New legislation in Congress could help credit reporting agencies realize this goal.

July 16 U.S. House of Representatives

U.S. House of Representatives -

The Consumer Financial Protection Bureau's massive collection of consumer data continued to raise concerns with lawmakers on Wednesday despite assurances from the agency's director that the data is anonymized.

July 15 -

Three Democratic members of Congress called on the Department of Housing and Urban Development to reissue the proposal for public comment with changes.

July 15 -

The House passed a bill Tuesday that could ease the regulatory burden on community and regional banks with mortgage servicing businesses.

July 14 -

The "deceptive" in Unfair, Deceptive, or Abusive Acts or Practices includes negligence, as demonstrated by a recent Consumer Financial Protection Bureau enforcement action.

July 14 Offit | Kurman

Offit | Kurman -

Some housing professionals have grown reluctant to participate in the Federal Home Loan Banks' Affordable Housing Program, objecting to burdensome requirements and rules that are inconsistent with other funding sources. It's time for the Federal Housing Finance Agency to make some updates.

July 13 Prospect Federal Savings Bank

Prospect Federal Savings Bank -

Two mortgage servicers have agreed to join a group of peer institutions in following a series of guidelines to address zombie properties in New York State, Gov. Andrew Cuomo announced Thursday.

July 9 -

Mortgage professionals brave enough to bring mortgage fraud to light deserve the same level of protections as workers in other businesses, rather than be subjected to a patchwork of laws designed for other industries.

July 9 The Employment Law Group PC.

The Employment Law Group PC. -

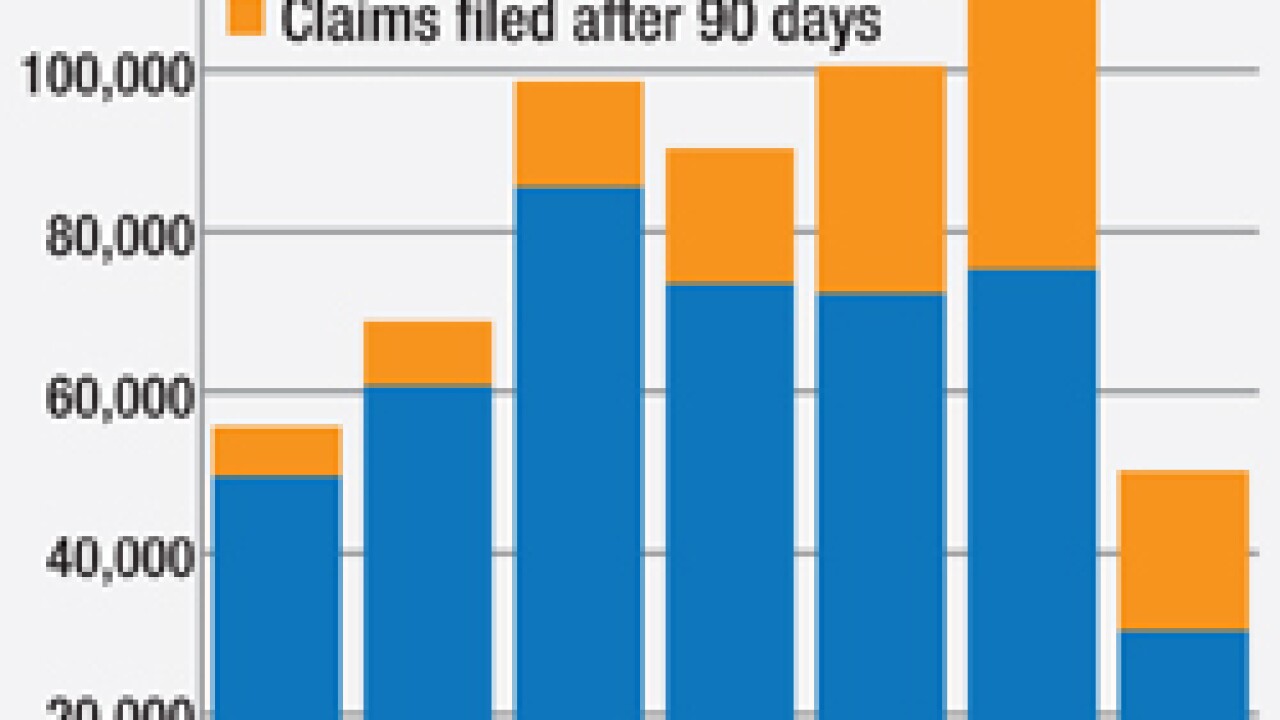

The Federal Housing Administration wants to set a hard deadline for servicers to file claims on soured mortgages. Industry executives say it should be manageable unless foreclosures surge again.

July 7 -

Nearly 25 years after a landmark deal and two subsequent legislative overhauls, glitches in the credit reporting system remain widespread. But while regulators and law enforcement officials are again raising the stakes for the credit reporting industry, critics fear it may not be enough.

July 7 -

The Supreme Court's recent ruling that the disparate impact theory of liability can be applied to the Fair Housing Act means mortgage lenders must be even more vigilant in their ongoing testing and evaluation of business practices that could be interpreted as even unintentional discrimination.

July 6 Offit | Kurman

Offit | Kurman -

BOK Financial has hired Glenn Brunker to oversee mortgage operations and manage the bank's transition to a new federally required consolidated mortgage disclosure regime.

July 2 -

The Leadership Conference on Civil and Human Rights wants to recapitalize Fannie Mae and Freddie Mac to provide a secure source of funding for affordable housing.

July 2 -

The Supreme Court decision making same-sex marriage legal nationwide could boost mortgage demand as it provides gay and lesbian couples with more financing opportunities and stronger joint property rights.

June 26 -

Despite some silver lining, analysts say the Supreme Court decision upholding "disparate impact" in fair-lending disputes will only embolden activists and regulators to bring more cases.

June 25 -

The Consumer Financial Protection Bureau went forward with a controversial move Thursday to include narratives in its complaint database.

June 25 -

A senior civil rights official at the Consumer Financial Protection Bureau is poised to tell Congress Thursday that the agency willfully disregards the process for handling internal employee complaints of discrimination and has repeatedly retaliated against staff who spoke out.

June 24 -

Two groups representing small and mid-size lenders say new proposed state mortgage servicing standards for nonbanks will add an unnecessary layer of regulatory burden, especially for firms servicing Fannie Mae and Freddie Mac loans.

June 24 -

The Consumer Financial Protection Bureau's new mortgage integrated disclosure rules will now take effect Saturday, Oct. 3, two days later than the previously rescheduled Oct. 1 deadline.

June 24 -

Bankers and commercial real estate developers are protesting new restrictions on construction lending, arguing they are poised to hurt credit availability and drive loans into risky, unregulated sectors.

June 24