-

Ocwen Financial Corp. now alleges that Fidelity Information Services misled California officials about its ability to conduct the audit at the heart of litigation.

February 12 -

A lawsuit alleging Wells Fargo improperly compensated its California-based mortgage loan officers could have broader ramifications now that it has been granted class certification.

February 8 -

Ocwen Financial subsidiary PHH Mortgage will pay a total of $750,000 to six military members and increase employee training to settle Department of Justice allegations that it conducted foreclosures that violated the Servicemembers Civil Relief Act.

February 6 -

The U.S. Supreme Court turned away a broad challenge to the structure of the Consumer Financial Protection Bureau, the agency that Republicans say has stifled economic growth through over-regulation.

January 14 -

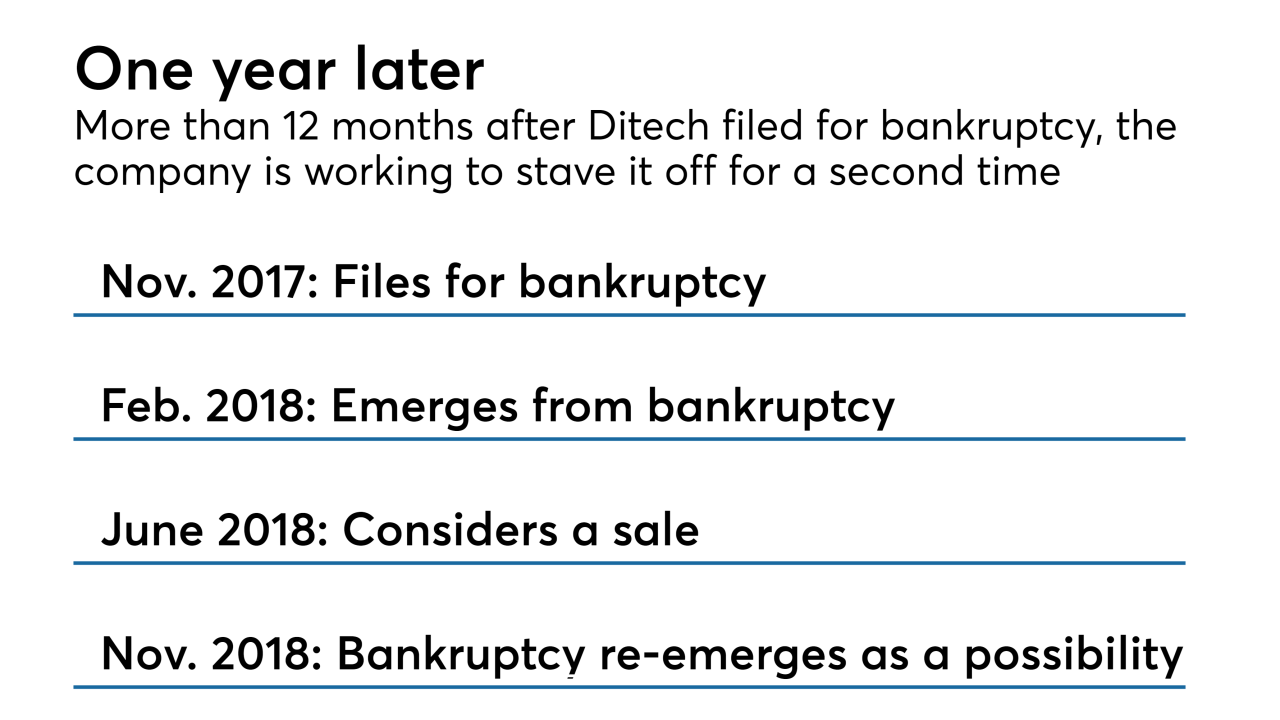

Ditech Holding Corp. is proposing to pay $257,000 and improve governance to settle a stockholder lawsuit alleging that a lack of oversight allowed improprieties to occur in several mortgage-related business lines.

December 10 -

State officials have lost two rounds in a lawsuit that says California improperly diverted money intended for homeowners to make payments on housing bonds.

September 25 -

The investors initially won the right to sue as a group in 2015 before an appeals court reversed the ruling; the $13 billion lawsuit can now proceed as a class action.

August 15 -

A ruling involving a Cleveland law firm casts doubt on CFPB claims that attorneys misrepresent their role to consumers.

July 27 -

Leandra English, who sued President Trump and Mick Mulvaney last year claiming to be the rightful director of the CFPB, said Friday that she plans to resign and drop the litigation.

July 6 -

Greg Englesbe resigned as CEO of New Jersey lender E Mortgage Management after a jury awarded $3 million to a woman who accused Englesbe of injuring her when he grabbed and forcibly kissed her at a Philadelphia restaurant.

June 29 -

A server at a Philadelphia restaurant was awarded $3 million by a jury after allegedly being injured by the CEO of a mortgage lender who attempted to forcibly kiss her.

June 29 -

Acting CFPB Director Mick Mulvaney wrote in a two-paragraph filing that the Mount Laurel, N.J., company did not violate the Real Estate Settlement Procedures Act.

June 7 -

A class action filed last week alleges that Renovate America and Renew Financial failed to provide consumer protections promised to L.A. County, that this constitutes elder abuse, and the county is complicit.

April 16 -

A panel of judges remained skeptical of claims by Leandra English, deputy director of the Consumer Financial Protection Bureau, that she is the rightful head of the agency. But they didn’t sound convinced that current acting Director Mick Mulvaney is, either.

April 12 -

Banks have not yet finished with the wave of lawsuits stemming from the financial crisis. There are ways they can better ward off those threats next time around.

April 4 Bilzin Sumberg

Bilzin Sumberg -

Banks say that an appeals court’s decision to ease restrictions will allow them to warn customers more easily when loans are past due or accounts have been compromised. But consumer groups argue that the decision gives financial firms license to market their products more aggressively and could lead to more harassing phone calls over unpaid debts.

March 20 -

The Supreme Court dealt hedge funds and other big investors a blow Tuesday by refusing to revive core parts of lawsuits that challenged the federal government’s capture of billions of dollars in profits generated by Fannie Mae and Freddie Mac.

February 20 -

In his decision Thursday, U.S. District Judge Paul Gardephe said the lawsuit brought by the Lower East Side People's Federal Credit Union lacked standing.

February 2 -

A federal appeals court handed a major victory — and a significant defeat — to the CFPB by upholding its constitutional structure while also slapping down the agency's practice of making new interpretations of law through enforcement actions.

January 31 -

The decision by the appeals court means that a president can only fire the head of the Consumer Financial Protection Bureau for cause. But the ruling also scrapped the CFPB's massive fine against a nonbank mortgage lender.

January 31