M&A

M&A

-

The real estate franchisor's stock price fell by $16.85 per share since the deal was announced in January, making it a less attractive currency.

April 4 -

More than 500 employees will be affected by the acquisition, which includes rights related to 140,000 residential loans, but Community Loan Servicing will retain its name and commercial operations.

March 23 -

The Soquel, California mortgage broker will retain its current branding for the time being.

March 18 -

The international consulting firm adds to its suite of mortgage compliance products, which includes eOriginal.

March 10 -

CEO Michael Isaacs is merging a nonbank lender acquired last year with stakes in real estate and insurance firms, and has an aggressive growth plan for servicing.

March 8 -

The Houston bank negotiated the agreement with the National Community Reinvestment Coalition after closing its merger with BancorpSouth. That deal created a lender with $50 billion of assets and operations in nine states.

February 24 -

The merger, which was initially expected to be approved last year, will create one of the 10 largest banks across Illinois, Indiana and Wisconsin.

January 27 -

Multifamily and specialty finance loans, which were highlights during the fourth quarter, should increase further in 2022, company executives said.

January 26 -

The mortgage lender's CEO Brett McGovern speaks on how the deal came together and how the two will work together once the deal closes.

January 25 -

He is leaving the Texas-based nonbank lender less than one year after it was acquired by New Residential Investment.

January 24 -

A $28 billion agreement with the National Community Reinvestment Coalition could help win regulatory approval for the acquisition of Michigan-based Flagstar Bancorp. The deal was originally expected to close last year.

January 24 -

The mortgage broker business was never a driving force for the Chicago-based firm's purchase of Stearns Lending, so dropping it wasn't totally unexpected.

January 14 -

But the online real estate company is eliminating nearly half of the positions in its existing mortgage business as a result of the deal.

January 12 -

Lenders took advantage of the exceptional business environment to make deals throughout the last 12 months.

December 26 -

The central bank also signed off on Webster Financial’s acquisition of Sterling Bancorp and WSFS Financial’s purchase of Bryn Mawr Bank Corp. The moves come amid a political fight over the bank merger approval process.

December 17 -

Founded in the wake of the global financial crisis, KBRA has issued more than 51,000 ratings representing almost $3 trillion in rated issuance since 2010.

December 13 -

HHC Finance, based in Bethesda, Maryland, focuses on helping to finance nursing homes, apartment buildings catering to seniors, and other facilities.

December 7 -

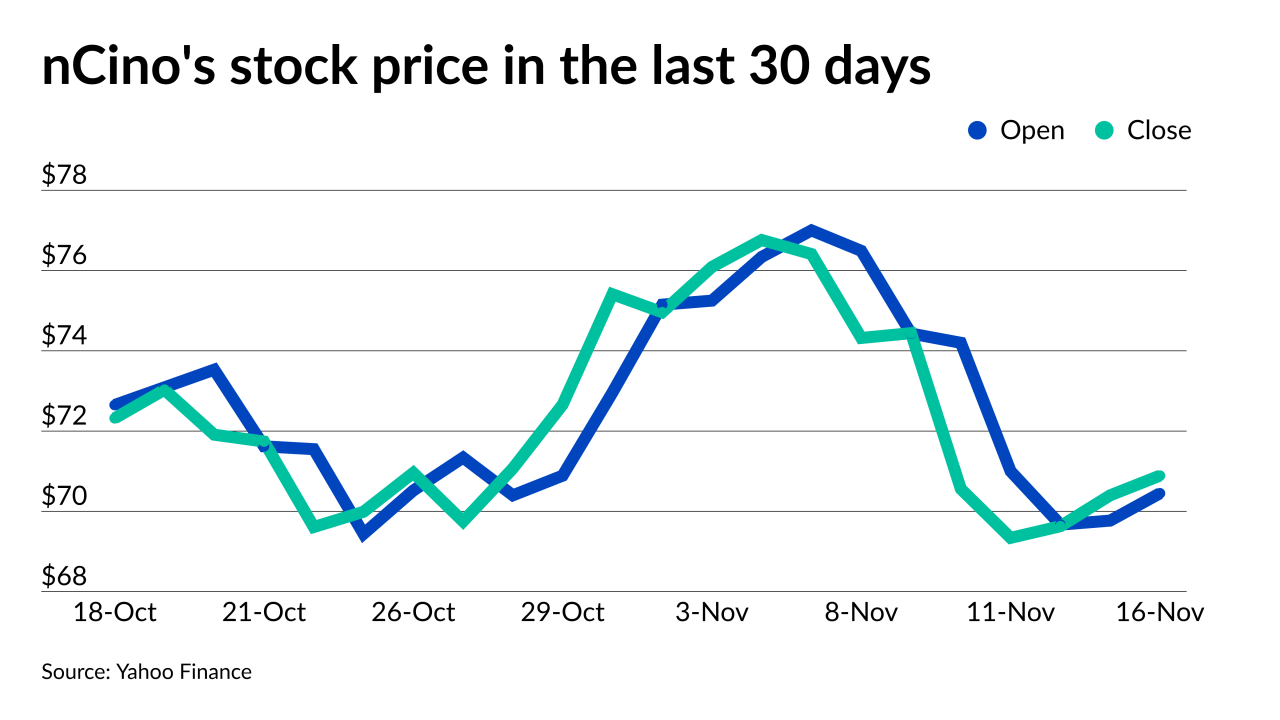

The transaction takes depository-focused nCino into the independent mortgage banking side of the lending business.

November 16 -

Advocates negotiating with the Minneapolis bank also want commitments for mortgage assistance and payouts to financial nonprofits. The pressure for Federal Reserve hearings coincides with Biden administration calls for more scrutiny of big bank mergers.

November 15 -

With its agreement to buy KS StateBank’s residential mortgage operation, Kansas-based Armed Forces is going all in on home lending.

November 5