M&A

M&A

-

The company disclosed that it paid $146 million for servicing rights associated with $13 billion in mortgages.

February 21 -

New Residential priced its second stock offering in four months, looking for gross proceeds of nearly $665 million.

February 20 -

Bridgeview Bancorp floated its name with 14 potential buyers, but it only attracted serious interest once it promised to divest a mortgage business that recorded a double-digit decline in fee income last year.

February 19 -

Mortgage insurer Radian Group was in takeover talks with an investor group earlier this month including Apollo Global Management and Centerbridge Partners, before discussions stalled over the terms of a potential deal.

February 19 -

HomeStreet Bank will attempt to sell its stand-alone mortgage business and portfolio of servicing rights, a move that comes amid growing pressure from an activist investor to exit home lending and concerns about declining demand and regulatory challenges.

February 15 -

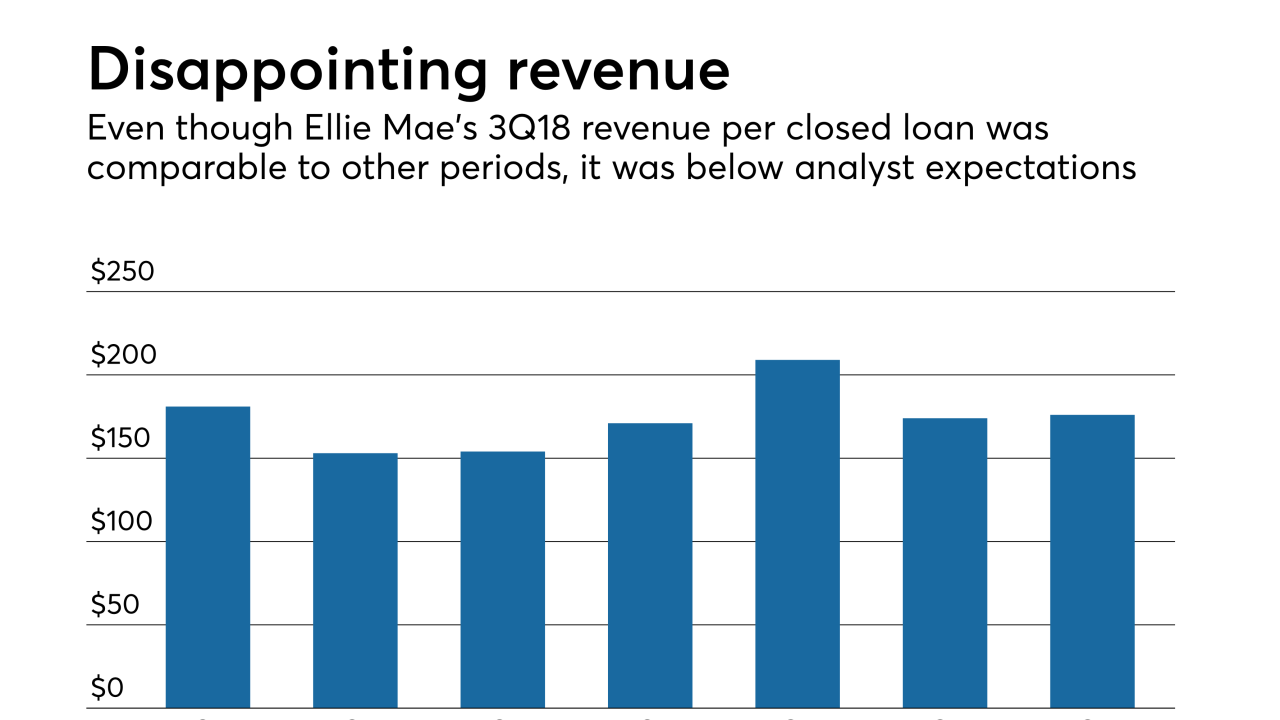

The private equity acquisition of the fintech vendor Ellie Mae will give it some breathing room in a declining originations market because it will have a more patient and strategic investor than its myriad shareholders as a public company.

February 13 -

The mortgage loan origination system developer Ellie Mae is going private, agreeing to be acquired by the private equity firm Thoma Bravo in an all-cash transaction valued at $3.7 billion.

February 12 -

Ditech Holding Corp. is refiling for bankruptcy almost a year after emerging from it in order to facilitate a restructuring agreement with lenders holding more than 75% of its term loans.

February 11 -

Why now? Will it work? How will their rivals respond? The megadeal between the two East Coast regionals offers up plenty of grist for speculation.

February 8 -

House Financial Services Chairwoman Maxine Waters said the merger is a direct result of a regulatory relief bill that was signed into law in May.

February 7