M&A

M&A

-

A $28 billion agreement with the National Community Reinvestment Coalition could help win regulatory approval for the acquisition of Michigan-based Flagstar Bancorp. The deal was originally expected to close last year.

January 24 -

The mortgage broker business was never a driving force for the Chicago-based firm's purchase of Stearns Lending, so dropping it wasn't totally unexpected.

January 14 -

But the online real estate company is eliminating nearly half of the positions in its existing mortgage business as a result of the deal.

January 12 -

Lenders took advantage of the exceptional business environment to make deals throughout the last 12 months.

December 26 -

The central bank also signed off on Webster Financial’s acquisition of Sterling Bancorp and WSFS Financial’s purchase of Bryn Mawr Bank Corp. The moves come amid a political fight over the bank merger approval process.

December 17 -

Founded in the wake of the global financial crisis, KBRA has issued more than 51,000 ratings representing almost $3 trillion in rated issuance since 2010.

December 13 -

HHC Finance, based in Bethesda, Maryland, focuses on helping to finance nursing homes, apartment buildings catering to seniors, and other facilities.

December 7 -

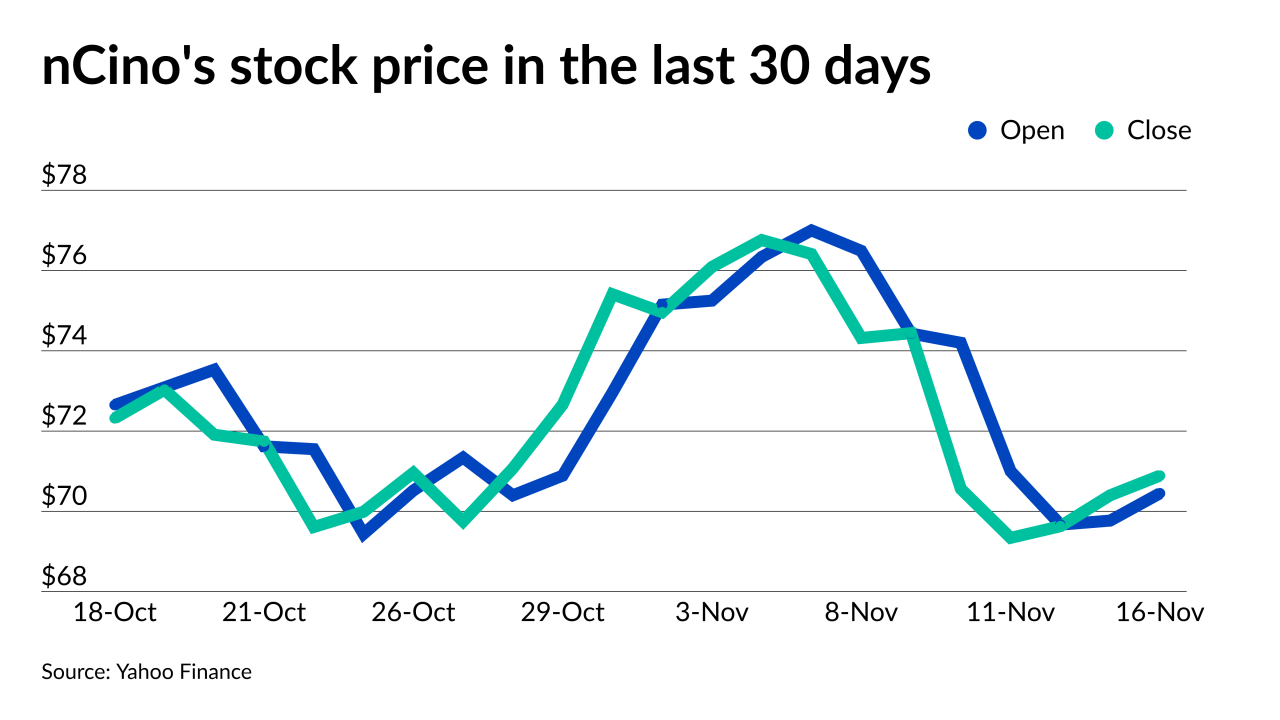

The transaction takes depository-focused nCino into the independent mortgage banking side of the lending business.

November 16 -

Advocates negotiating with the Minneapolis bank also want commitments for mortgage assistance and payouts to financial nonprofits. The pressure for Federal Reserve hearings coincides with Biden administration calls for more scrutiny of big bank mergers.

November 15 -

With its agreement to buy KS StateBank’s residential mortgage operation, Kansas-based Armed Forces is going all in on home lending.

November 5 -

The transaction expands the investment management company’s portfolio of mortgage and real estate companies, which includes Selene, Deephaven and Progress Residential.

November 2 -

After closing its merger with Caliber, the company also hopes to pare down expenses by at least 10%.

November 2 -

The deal for Michigan-based Flagstar Bancorp, announced in April, was originally expected to be completed by the end of the year. The New York bank’s CEO expressed optimism that it will still get regulatory approval.

October 27 -

The Alabama company agreed to buy two nonbank lenders earlier this year. It’s still on the lookout for possible deals, potentially in corporate finance or wealth management, its chief financial officer told American Banker.

October 22 -

The deal is the investment company’s second since it launched on Sept. 28.

October 20 -

Goldman Sachs, Truist and Regions have all made deals to acquire home improvement lenders. Here's why their executives are so bullish on the sector.

October 20 -

The Indiana company told investors that it’s ready to complete its combination with First Midwest Bancorp but that it’s unclear whether a recently filed mortgage discrimination lawsuit will get in the way of Fed approval.

October 19 -

An Indiana housing nonprofit wants the Fed to take a closer look at the proposed merger. Its latest move is a lawsuit that alleges racial discrimination by the regional bank.

October 7 -

The real estate franchisor will retain its full ownership in the title agency, escrow and settlement services business.

October 7 -

The combined companies will have over 6,500 clients for its services.

October 5