M&A

M&A

-

Capitol Federal Financial has mostly relied on mortgages throughout its history. Its acquisition of a commercial lender will change that.

May 11 -

Mutual of Omaha Bank's purchase of Synergy One Lending will add reverse mortgages to its product line.

May 10 -

PHH Corp. took a net loss in the first quarter but was able to surpass minimums for net worth and available cash necessary for Ocwen Financial to acquire the company.

May 9 -

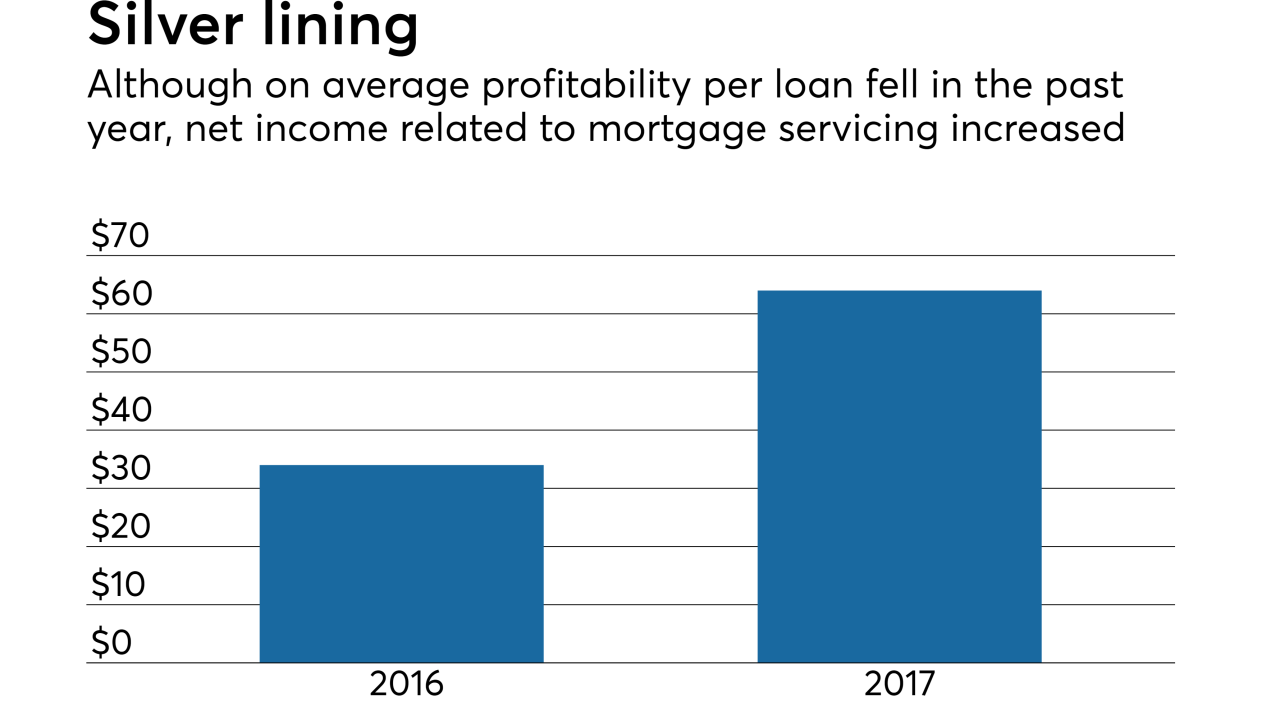

Mortgage servicers growing due to acquisitions or the increased value of servicing in the market could remain under pressure if these strategies don't outweigh other rising costs they face.

May 7 -

New Residential Investment Corp. reported a 400% year-over-year increase in net income as its servicing revenue improved dramatically over the previous year.

April 27 -

Ron Faris plans to retire as head of Ocwen Financial and pass on his position to former PHH Corp. CEO Glen Messina around the time Ocwen acquires PHH.

April 19 -

CoreLogic, which has already acquired several appraisal technology and services vendors, snagged another one with its purchase of a la mode technologies.

April 12 -

There is an oncoming liquidity crisis that will force consolidation in the mortgage industry as margins tighten and funding sources dry up.

March 28 -

Radian Group is adding 40-state title insurer and settlement services company Entitle Direct to its operations in a move aimed at complementing the geographic reach of its existing title agency.

March 28 -

Joseph Tomkinson, who first pared down and then rebuilt Impac Mortgage Holdings in the aftermath of the housing crisis, is stepping down as the company's chairman and CEO.

March 21 -

Fidelity National Financial's proposed purchase of Stewart Information Services could solidify FNF's leading market share among title insurers if regulators don't balk at its scope.

March 19 -

CoreLogic will have to provide property data to Attom Data Solution's RealtyTrac unit for three additional years to resolve allegations it did not adhere to a 2014 agreement with the Federal Trade Commission.

March 16 -

BankFirst Financial Services in Columbus, Miss., has acquired HomeFirst, a mortgage services firm.

March 15 -

From investor angst to regulatory scrutiny, here's a look at three obstacles that must be addressed before Ocwen Financial can acquire PHH Mortgage.

March 1 -

Ocwen Financial Corp.'s acquisition of PHH Corp. will help the nonbank servicer rebuild scale that's been diminished by years of regulatory restrictions and the decline in distressed mortgage volume brought about by improvements in the overall housing market.

February 28 -

From accelerating its subservicing transformation to overcoming regulatory obstacles, here's a look at three reasons behind Ocwen Financial Corp.'s $360 million acquisition of PHH Corp.

February 27 -

Blue Lion Capital, which is upset with the Seattle company's growth strategy, also wants to replace two of the company's directors.

February 26 -

The Michigan company has been acquisitive lately, buying California branches and a wealth advisory firm.

February 21 -

The company that holds Washington Mutual's legacy reinsurance business has agreed to purchase a controlling interest in Nationstar Mortgage and invest in its growth.

February 13 -

Warburg Pincus has agreed to buy a majority stake in a mortgage and consumer loan origination and servicing platform owned by Fiserv.

February 7