-

Millennials are on the verge of becoming the largest cohort of homebuyers. If lenders want to gain and retain their trust, they must start by recruiting a younger, more diverse and gender-balanced workforce.

February 17

-

The nonbank mortgage sector ended 2015 with 12,300 more full-time employees than in December 2014.

February 5 -

The final deadline for all Top Producers Survey responses is here. All entries must be submitted online by 6 p.m. EST Monday, Feb. 1.

February 1 -

Amid concerns about the added complexity of the TILA-RESPA integrated disclosures and growing demand for purchase loans, Flagstar Bancorp plans to reduce its over-reliance on third-party originations by expanding its retail mortgage business.

January 27 -

Brokers and small lenders are being crushed under the weight of heavy regulation, leaving loan officers little choice but to shoulder the burden themselves or move to an organization that can handle the regulatory requirements.

January 15 TD Bank

TD Bank -

Employment at nonbank mortgage lenders and brokers was down in November, according to the latest Bureau of Labor Statistics data.

January 8 -

Increased enthusiasm for automated valuations presents an opportunity for the appraisal industry to develop tools that combine high-efficiency, low-cost processes with the accuracy of human expertise.

January 6 ISGN

ISGN -

National Mortgage News is pleased to begin accepting submissions for the 2016 Top Producers, an annual ranking of mortgage loan officer and broker origination volume.

January 4 -

Rather than relying on a formal marketing services agreement to get business, loan officers now have to prove that they can provide realty agents and consumers the best mortgage experience.

January 4 -

Issues with upgrading software and ensuring pricing accuracy to comply with the consumer bureau's "integrated disclosures" have been magnified in wholesale loan transactions.

December 4 -

Hiring by nonbank mortgage lenders stalled in October after adding new employees to their payrolls for eight straight months.

December 4 -

Nonbank mortgage lenders added 1,600 employees to their payrolls in September, which combined with revised August figures brought industry employment to its highest point in more than two years.

November 6 -

In addition to staying on top of the day-to-day requirements of TRID, lenders must also avoid big-picture mistakes that could disrupt their compliance

October 19 -

2016 Presidential candidate Carly Fiorina telegraphs a message that the mortgage industry would do well to heed.

October 2 STRATMOR Group

STRATMOR Group -

Employment at nonbank mortgage banking and brokerage firms was steady in August, ending a six-month run of job gains.

October 2 -

Officials signaled that Hudson City Savings Bank's nearly $33 million settlement over redlining charges is only the first in what is likely to be a string of other cases.

September 24 -

Federal officials on Thursday ordered Hudson City Savings Bank to pay more than $27 million to resolve redlining allegations, the largest order of its kind and one that is likely to put larger banks on notice that redlining cases will be aggressively pursued.

September 24 -

Non-bank originators add 3,200 new employees in July.

September 4 -

The resignation of Stonegate Mortgage founder and CEO Jim Cutillo will likely result in either the quick hiring of a replacement CEO to execute Stonegate's business plan or the company being acquired, according to analysts at FBR Capital Markets.

August 31 -

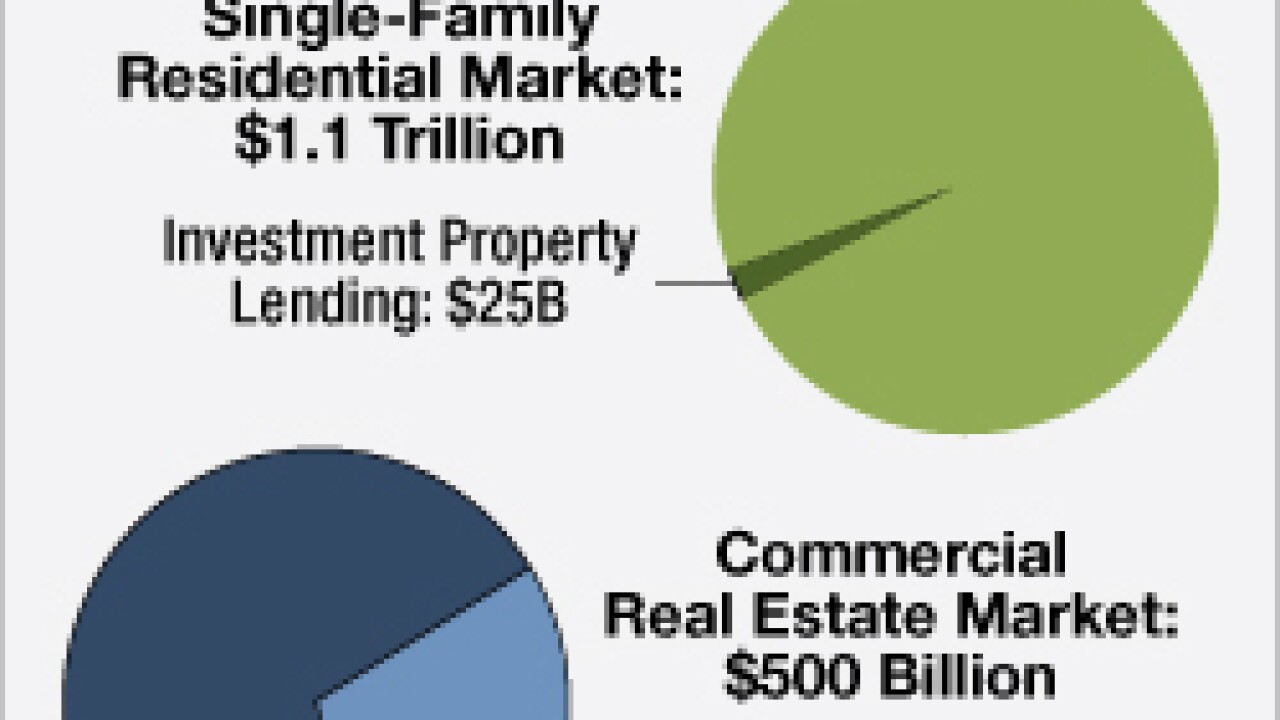

Marketplace lenders seek to disrupt traditional financial services with online platforms that connect borrowers to investors. But in real estate, this burgeoning sector has taken an approach that seeks to co-exist with, rather than supplant, the traditional mortgage market.

August 31