-

But UWM says the provision is designed to protect against a broker double-locking the loan and is used by other lenders.

March 24 -

The acquired platform, while remaining stand-alone, will have integrations with Black Knight's Empower loan origination system for mortgage lenders.

March 17 -

United Wholesale Mortgage's new rule, which forbids brokers from doing deals with two competitors, has brought extra attention to its smaller rival.

March 15 -

Mortgage brokers are telling the company that they "are looking for another large source," according to President and CEO Willie Newman.

March 11 -

Rocket Pro TPO EVP Austin Niemiec calls this the start of the slippery slope, but UWM's Mat Ishbia responds he isn't being aggressive

March 9 -

But the move could have legal repercussions from a competitive standpoint.

March 4 -

The expansion of borrower data collected in the new URLA upends an industry standard and lenders are experiencing some growing pains.

March 3 -

The mortgage brokerage franchisor added 30 operating offices and had its best year yet for unit sales.

February 26 -

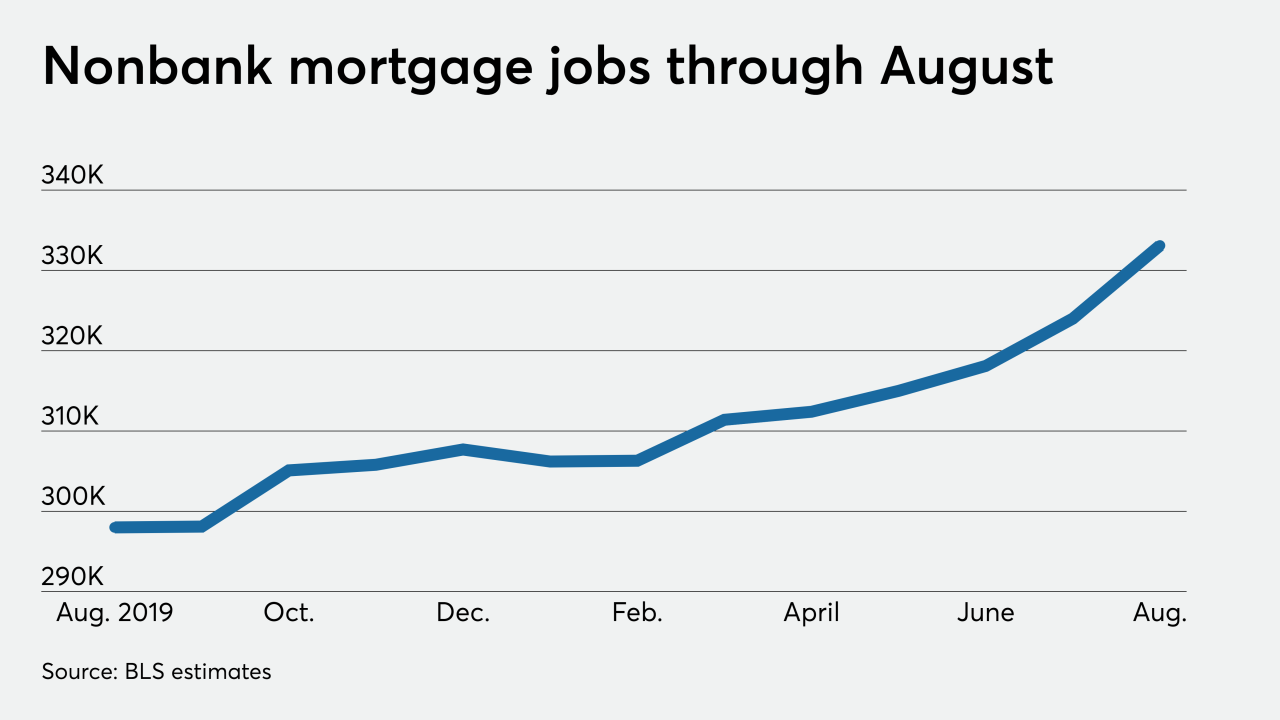

2020’s mortgage employment numbers proved to be slightly higher than previously estimated when reconciled with the Bureau of Labor Statistics’ annual business census.

February 5 -

The move to a remote work model is a long-term, technology-driven transformation, which was well underway prior to the pandemic and will continue long after the pandemic, Matthew VanFossen and Taylor Stork, members of the Community Home Lenders Association, argue.

January 15 Absolute Home Mortgage

Absolute Home Mortgage -

The estimates in the Bureau of Labor Statistics latest numbers were only marginally higher than the previous month, which may reflect more deliberate hiring and a preholiday slowdown.

January 8 -

The survey period runs through Feb. 19, so don't dally!

January 8 -

Even with a slight downward revision to September’s numbers, employment in the industry remained incredibly high through October as home-loan refinancing continued to surge.

December 4 -

The company, which earned $535 million in net income in 3Q20, has been prioritizing purchase volume and managing costs to account for a possible decline in originations next year.

November 6 -

The new record in third-party originator hiring numbers adds to indications that some lenders have been leaning harder on the wholesale channel to address capacity issues amid the origination boom.

November 6 -

Smaller lenders should consider positioning themselves for acquisition at a time when they can be making the most money.

November 4 -

Staying in compliance with the Secure and Fair Enforcement for Mortgage Licensing Act has been a difficult task for lenders while employees work from home for months on end.

November 3 Mphasis Digital Risk

Mphasis Digital Risk -

Earnings increased by 81% year-over-year as its gain-on-sale margins grew nearly 2.5 times.

October 13 -

There was an estimated total of 333,100 people on nonbank mortgage banker and broker payrolls in August, and that's the highest recorded since at least 2010.

October 2 -

This unit helps Axia increase market penetration to the more densely populated areas of the state.

October 1