-

Fannie Mae plans to sell a pool of 3,600 loans with $806 million in unpaid principal balance.

October 11 -

Companies in the path of the storm have battened down the hatches, as others have prepared for the impact the hurricane could have on home sales and loan servicing in the weeks to come.

October 7 -

It's been a tough year for farmers, and lenders are looking for ways to help those borrowers offset sagging income.

October 7 -

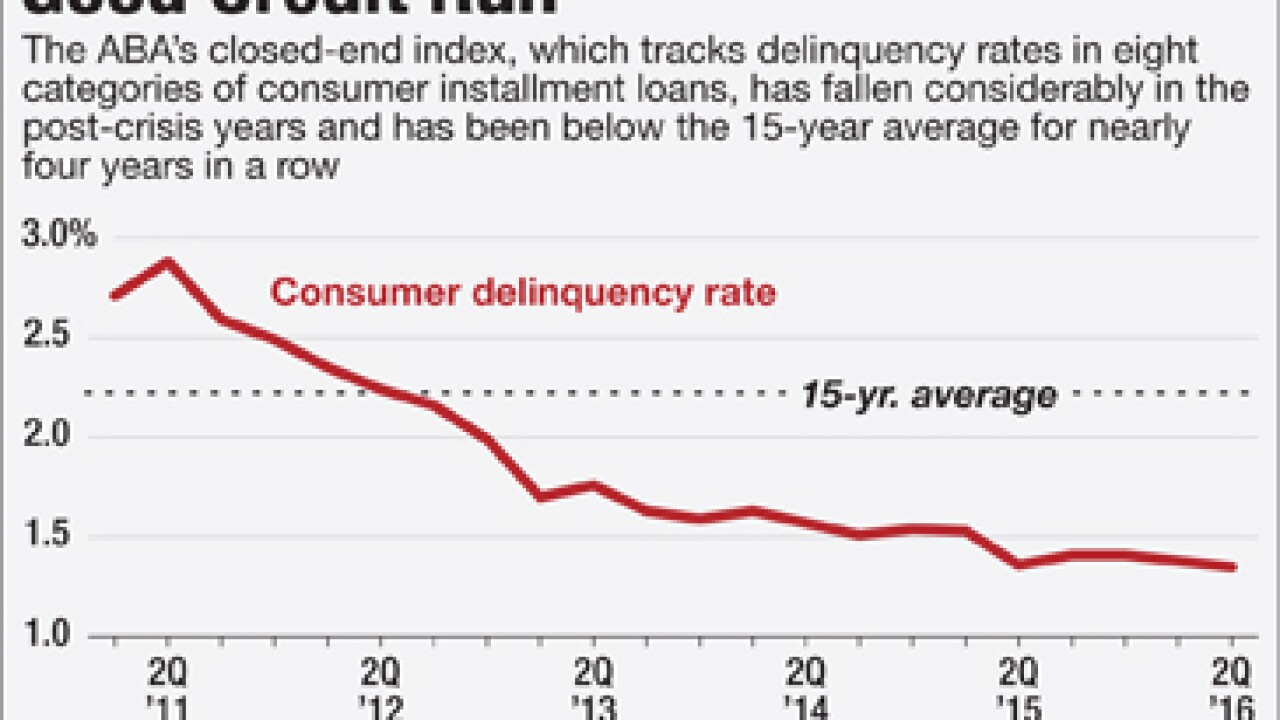

The 1.35% delinquency rate was the lowest since at least 2001, and it marked nearly four years of delinquencies below the 15-year average of 2.21%.

October 6 -

With the myriad home price indices available to the mortgage industry, it's difficult to determine which offers the most cost-effective insights about a particular market. Granularity is a key selling point, but not a one-size-fits-all solution.

October 6 -

More than $200 billion of the most poorly underwritten commercial mortgages originated before the financial crisis come due this year and next, many of them still underwater.

October 4 -

U.S. Bancorp has agreed to settle a lawsuit that claimed it neglected to maintain foreclosed properties in Southern California after the 2008 financial crisis.

October 4 -

Late payments on securitized commercial mortgages reversed course in September and resumed a climb that began in March, according to Trepp.

October 3 -

Walter Investment Management Corp. subsidiary Ditech Financial has paid $1.4 million as part of an agreement to settle claims of alleged abusive debt collection practices in Massachusetts.

October 3 -

Bank mortgage servicers are slashing their staff in the wake of improved loan performance and decreased portfolio, according to Fitch Ratings.

October 3 -

Fannie Mae has awarded its latest "community impact" pool of nonperforming loans to an affiliate of the nonprofit New Jersey Community Capital.

September 27 -

The Mortgage Bankers Association has detailed the features of a proposal to succeed the soon-to-be-defunct Home Affordable Mortgage Program.

September 23 -

Towd Point Mortgage Trust is adding more "dirty" pool assets into its fourth reperforming mortgage securitization of 2016.

September 23 -

The average sales price of a new mobile home was $67,800 in April, compared with an average sales price of $380,000 for a site-built home.

September 23 -

Banks are dumping their mortgage servicing rights because low rates and new rules make it hard to earn a profit. SunTrust, Flagstar and First South Bancorp in North Carolina are taking the opposite view.

September 22 -

The June Brexit vote continues to have implications for the mortgage industry, as prepayment rates jumped even higher.

September 22 -

Americans are carrying higher levels of debt as they head into retirement, raising the specter of financial headaches in their old age, according to Prudential Financial.

September 20 -

More than 9 million consumers would have difficulty paying all of their monthly debt obligations, including their mortgage, if the Federal Open Markets Committee raises short-term rates by 25 basis points, a TransUnion study found.

September 19 -

Activity under the Making Home Affordable program increased in the second quarter thanks to the introduction of the Streamline Home Affordable Mortgage Program, according to a performance report from the Treasury Department.

September 16 -

Loan modification activity fell again on a monthly basis, but there are still several states where borrowers need assistance, according to the Hope Now alliance.

September 15