-

The California State Assembly approved legislation Monday that would expand the rights of a deceased homeowner's surviving loved ones, including widows, widowers and other heirs.

August 23 -

As the volume of maturing commercial mortgages has spiked, so has the number of loans transferred to special servicing when they fail to pay off.

August 22 -

Prepayment activity declined during July in spite of the low rates that added to the number of borrowers who could refinance, Black Knight Financial Services said in its "First Look" data release.

August 22 -

The share of homeowners who owe more than their house is worth remains above 10% nationwide, according to data from Zillow's second quarter Negative Equity Report.

August 18 -

Macy's decision to shutter another 100 of its department stores could impair some $3.64 billion of securitized commercial mortgages, according to Morningstar Credit Ratings.

August 17 -

A federal appeals court said an older version of a Nevada law that stripped lenders of their first deed of trust when a homeowners' association forecloses on a property is unconstitutional.

August 17 -

Ditech Financial will lay off nearly 80 employees in Georgia as it closes an office in the Atlanta metropolitan area.

August 17 -

LM Funding swung to a net loss from last year amidst ballooning expenses and lower interest income from delinquent association fees.

August 16 -

The delinquency rate for mortgages on residential properties during the second quarter dropped to the lowest level since 2006, the Mortgage Bankers Association reported.

August 11 -

S&P Global Ratings has raised Ocwen Loan Servicing's rankings for both its residential and commercial segments.

August 10 -

Fannie Mae has released the details of its next nonperforming loan sale, which will include its fifth "community impact" pool.

August 10 -

Nationstar is preparing its third securitization this year, and sixth overall, of nonperforming and inactive reverse mortgages under a Federal Housing Administration reverse mortgage program.

August 10 -

Morgan Stanley has completed $10.5 million in consumer relief, according to the independent monitor of the company's mortgage-backed securities settlement with New York State.

August 10 -

The foreclosure inventory at the end of June was at its lowest level since August 2007, according to data released Tuesday by CoreLogic.

August 9 -

The Inspector General of the Department of Housing and Urban Development has found a new ally in his fight to reform the down payment assistance programs run by HUD and state and local housing finance agencies.

August 8 -

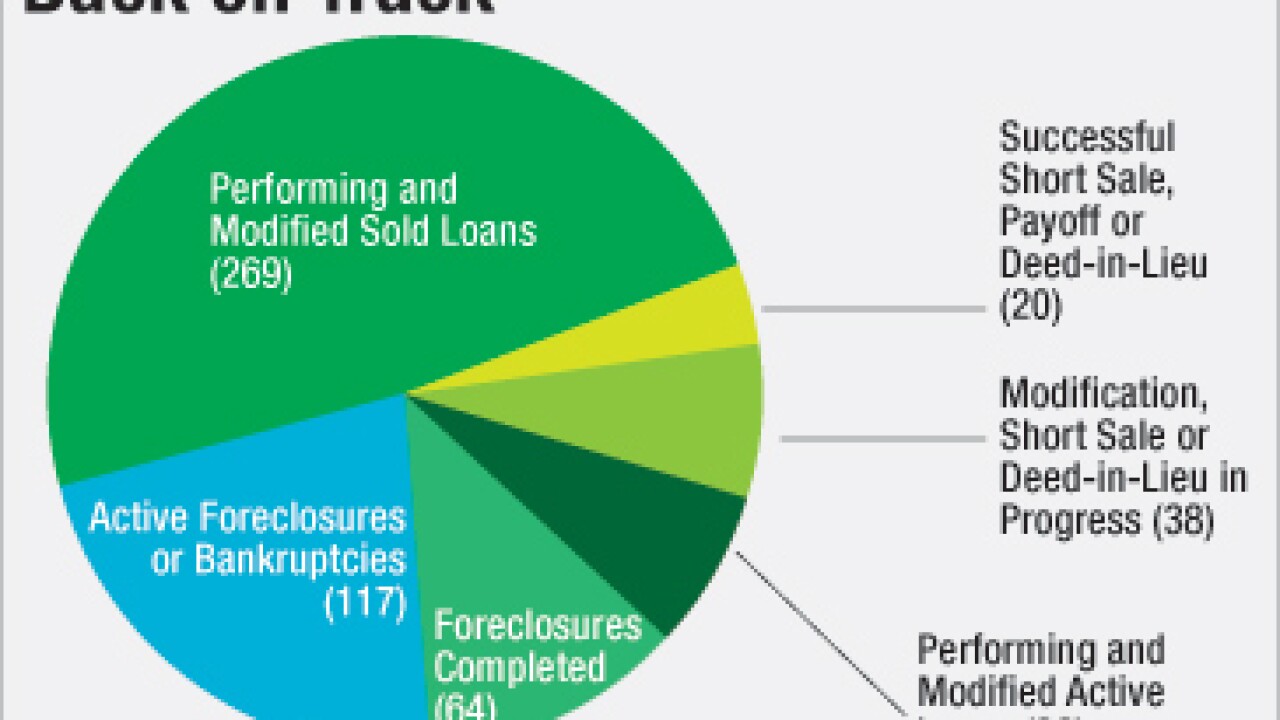

Community development entities like New Jersey Community Capital and Hogar Hispano are being guaranteed a portion of the secondary market for distressed mortgages. They are doing a good job of forestalling foreclosures, but skeptics question whether that run will last.

August 5 -

Incenter Mortgage Advisors is brokering the sale of an $8.9 billion Ginnie Mae bulk residential mortgage servicing rights portfolio.

August 4 -

The Consumer Financial Protection Bureau on Thursday finalized new requirements for mortgage servicers that provide more help to struggling borrowers and add consumer protections when loans are transferred.

August 4 -

Nationstar Mortgage Holdings is still in the red in the second quarter, as mark-to-market adjustments due to interest rate drops more than offset an increase in servicing revenue.

August 3 -

Ocwen Financial Corp. is marketing $500 million of notes backed by reimbursement rights to funds it has advanced on residential mortgages that it services.

August 3