-

American International Group posted its fourth loss in six quarters, burned again by higher-than-expected claims costs as Chief Executive Officer Peter Hancock struggles to sustain profitability.

February 14 -

Changes in the housing market are creating new opportunities and challenges for credit unions, including how they market themselves to potential borrowers.

February 14 -

Federal Reserve Chair Janet Yellen appeared Tuesday before an uncommonly collegial hearing of the Senate Banking Committee, but the lack of outward drama masked the fact that lawmakers from both parties were using her testimony to lay the groundwork for a broader battle over the future of regulatory reform.

February 14 -

Fairly or not, the millennial generation has a reputation as footloose and fancy-free. Or, to put it less kindly, slow to launch slower to get married, buy a house, and have kids than the young people of previous generations.

February 14 -

Federal Reserve Chair Janet Yellen said more interest-rate increases will be appropriate if the economy meets the central bank's outlook of gradually rising inflation and tightening labor markets.

February 14 -

While Arch Capital had a slight increase in year-over-year net income to $64 million, the total was affected by $25 million of costs related to the purchase of United Guaranty.

February 13 -

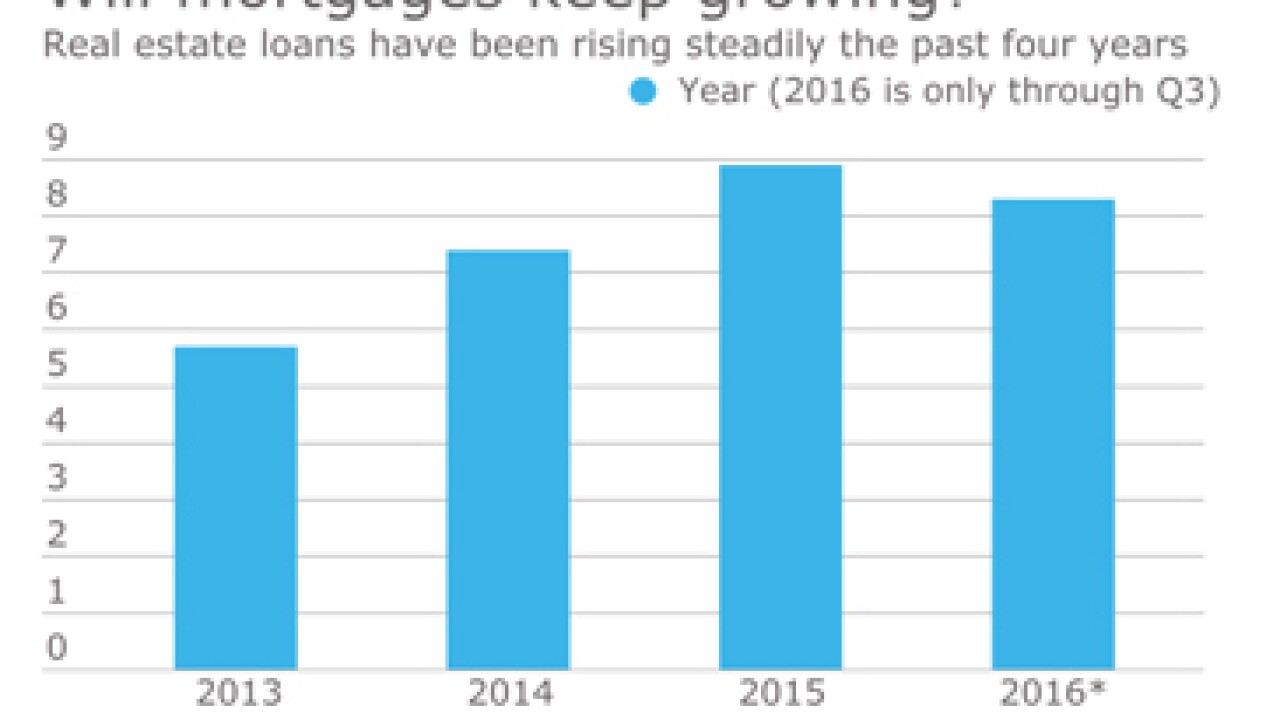

Real estate loans have been growing over the last few years despite a number of headwinds, but can credit unions build on that trend as interest rates rise?

February 13 -

JPMorgan Chase is known to eschew selling conforming mortgage loans to Fannie Mae and Freddie Mac, preferring to securitize them in the private-label market.

February 13 -

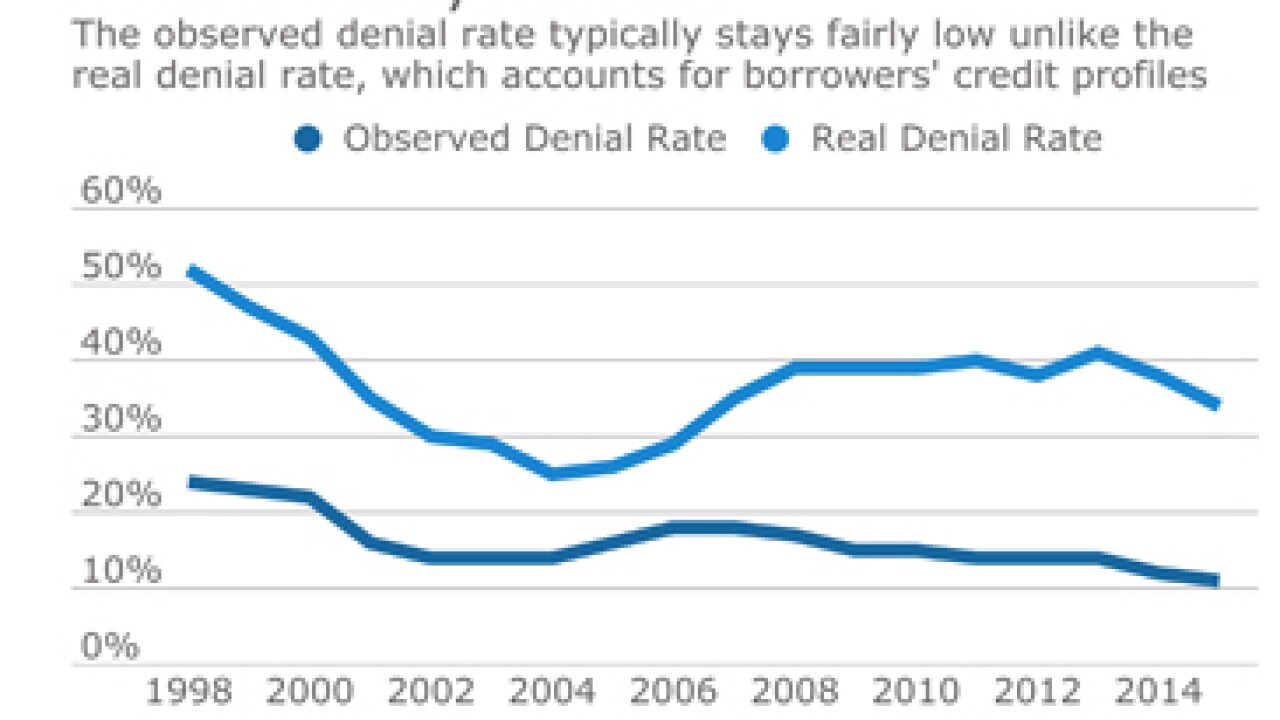

The denial rate traditionally used by the mortgage industry is hiding the fact that fewer borrowers with lower credit are applying for loans, according to the Urban Institute.

February 13 -

Mortgage lenders afraid to enter into any kind of marketing services agreement should look not to what the Consumer Financial Protection Bureau has laid as guidance, but what it has left unsaid.

February 13 Offit | Kurman

Offit | Kurman -

Nonbank mortgage company Cornerstone Home Lending has launched a new mortgage company as a joint venture with homebuilder Oakwood Homes.

February 10 -

Invictus Capital Partners, a nonprime mortgage lender based in Washington, D.C., is making its debut in the securitization market.

February 10 -

Mortgage industry hiring and new job appointments for the week ending Feb. 10.

February 10 -

Quicken Loans has named a new CEO to replace Bill Emerson, who is transitioning to a role with the Detroit lender's parent company, Rock Holdings.

February 10 -

Mortgage insurer Essent Group reported higher net income for the fourth quarter, as premium growth offset a modest uptick in expenses.

February 10 -

Mortgage software provider Ellie Mae reported a 126% increase in net income during the fourth quarter, driven by an increase in users and loan volume.

February 9 -

The rise in home values is good news for homeowners looking to tap the equity in their homes to pay down debt or make big purchases, but some consumer groups fear it could lead to a new wave of loan defaults.

February 9 -

Stringent regulations put in place after the recession have been unevenly enforced across the industry, to the detriment of small financial institutions. Here's hoping that changes with the new administration.

February 9 Members Mortgage Co.

Members Mortgage Co. -

Net income rose sharply from a year earlier during the fourth quarter at Stewart Information Services Corp., while it held steady at First American Financial Corp.

February 9 -

Federal Reserve Bank of St. Louis President James Bullard said the central bank ought not rush to raising interest rates next month because uncertainty over the fiscal policies of the Trump administration clouds the U.S. economic outlook.

February 9