-

Mortgage industry hiring and new job appointments for the week ending Jan. 6.

January 6 -

The Senate Banking Committee is scheduled to hold a hearing Jan. 12 on the nomination of Dr. Ben Carson as Secretary of the Department of Housing and Urban Development.

January 5 -

The lending arm of U.S. Department of Agriculture guaranteed 3,439 single-family construction loans in the first quarter of fiscal year 2017, which ended Dec. 31, but just nine of those loans involved its new single-close construction-to-permanent financing option.

January 5 -

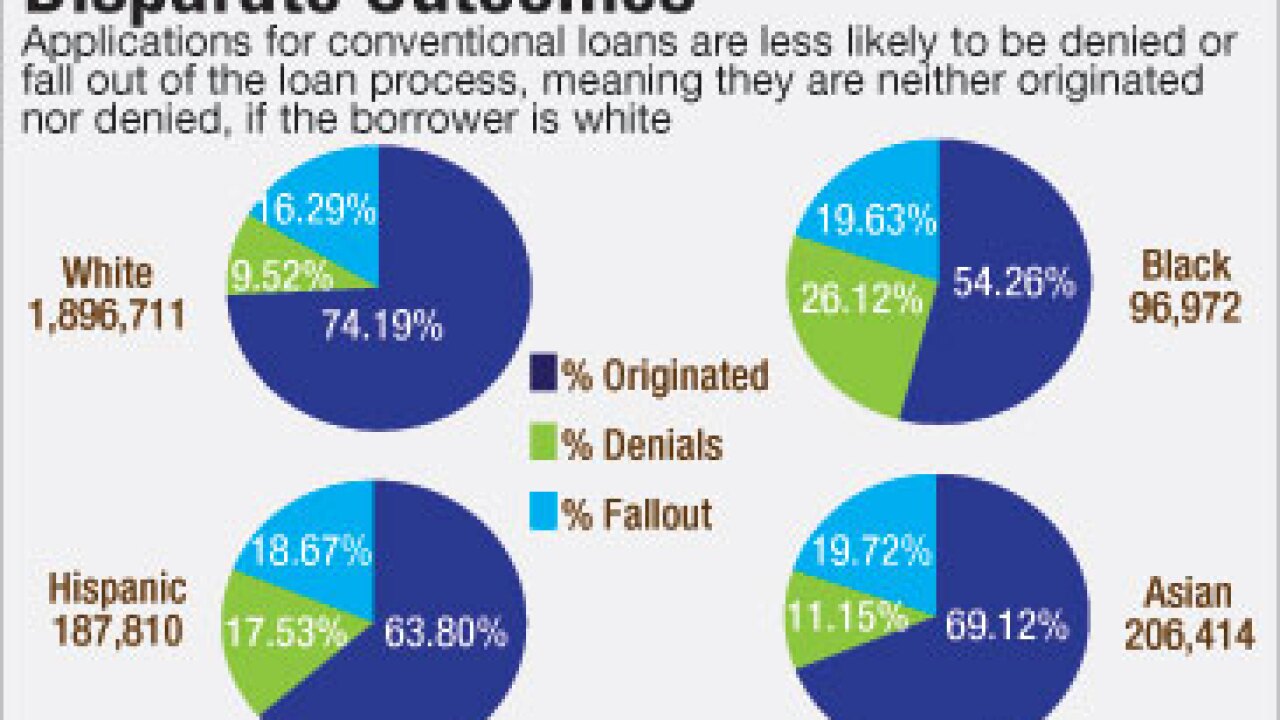

Demographics are shifting, creating more prospective minority homebuyers than ever before. But predominant underwriting processes and these would-be borrowers' financial backgrounds are holding them back.

January 5 -

Mortgage credit availability grew for the fourth consecutive month in December, the Mortgage Bankers Association reported.

January 5 -

Mortgage interest rates dropped for the first time since the presidential election in the first week of the new year, Freddie Mac reported.

January 5 -

Now that it has completed the purchase of its rival private mortgage insurer United Guaranty from AIG, Arch Capital Group plans to trim the sales force while avoiding service disruptions.

January 4 -

Donald Trump's election sent interest rates higher, and the mortgage industry is waiting to see what other effects he will have. Here's a look at how the housing market performed during the first years of recent presidencies.

January 4 -

Origin Bank in Addison, Texas, has begun offering warehouse financing for electronic mortgages.

January 4 -

President-elect Donald Trump's choice of well-known Wall Street lawyer Jay Clayton to head the Securities and Exchange Commission was a relatively safe move that suggests his other financial appointments may be equally conservative, industry observers said.

January 4 -

Walter Investment Management Corp. has agreed to sell Green Tree Insurance Agency to a wholly owned subsidiary of insurance company Assurant.

January 4 -

F&M Bank Corp. in Timberville, Va., has acquired Valley Southern Title in Harrisonburg, Va.

January 4 -

Residential loan application activity continued its post-election slump, declining for the sixth time in the eight weeks, according to the Mortgage Bankers Association.

January 4 -

The Senate Banking Committee will have six fresh faces in the new Congress as Republicans grapple with a slimmer majority.

January 3 -

In an enforcement action totaling more than $23 million in fines and restitution, the Consumer Financial Protection Bureau found that TransUnion and Equifax two of the largest consumer credit reporting agencies had misled consumers on the value of the data they marketed.

January 3 -

The Office of the Comptroller of the Currencys decision to offer a special-purpose charter for fintech firms may entice more players than expected, including mortgage lenders.

January 3 -

National Mortgage News is now accepting submissions for the 2017 Top Producers, our annual ranking of mortgage loan officer and broker origination volume.

January 3 -

Home values continued to climb in November, but in 2017 price appreciation is likely to slow due to rising interest rates, according to CoreLogic.

January 3 -

The new year is shaping up to be the one in which sizable changes to the Dodd-Frank Act are finally enacted, thanks to Republican victories in the White House, Senate and House.

January 3 -

Kenneth Mahon, the new CEO of Dime Community Bank, wants to reduce the 152-year-old institution's multifamily exposure by diversifying into other asset classes. But finding new business amid already fierce competition could be an immense challenge for Dime and other community banks in 2017.

December 30