-

Fannie Mae sees growth in refinance activity pushing volumes upward, but flattening purchases will temper lender momentum, according to its December report.

December 24 -

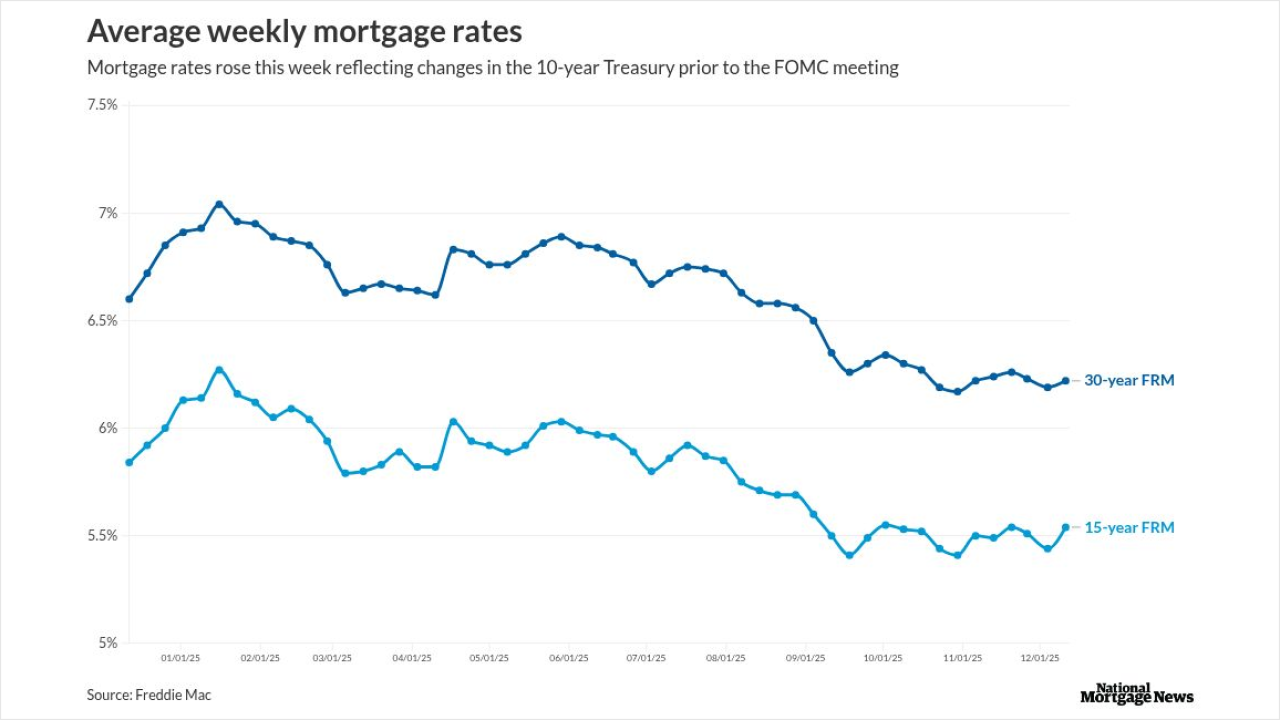

The 30-year fixed rate mortgage dropped 3 basis points this week, its lowest level since October and just over its 52-week bottom, Freddie Mac reported.

December 24 -

The regulator lowered benchmarks for acquisitions of certain single-family loans including low-income refinances, and left multifamily targets intact.

December 23 -

The announcement follows Realpha's two previous mergers with mortgage brokerages, as well as its purchases of AI firms and title businesses.

December 23 -

The inventory slowdown came as properties sold for 1.6% below asking prices, with some sellers opting to remove their listings altogether, according to Redfin.

December 22 -

Our experts expect a mortgage market reset in 2026 with an uptick in originations, but warn lenders not to skimp on compliance even as the reins loosen.

December 22 -

Existing-home sales in the US barely rose in November, as a recent moderation in price growth and mortgage rates motivated buyers at the margin.

December 19 -

More than 80% of mortgage brokers expect business to grow in 2026, mainly through the strengthening of referral networks and the expansion of non-QM offerings.

December 19 -

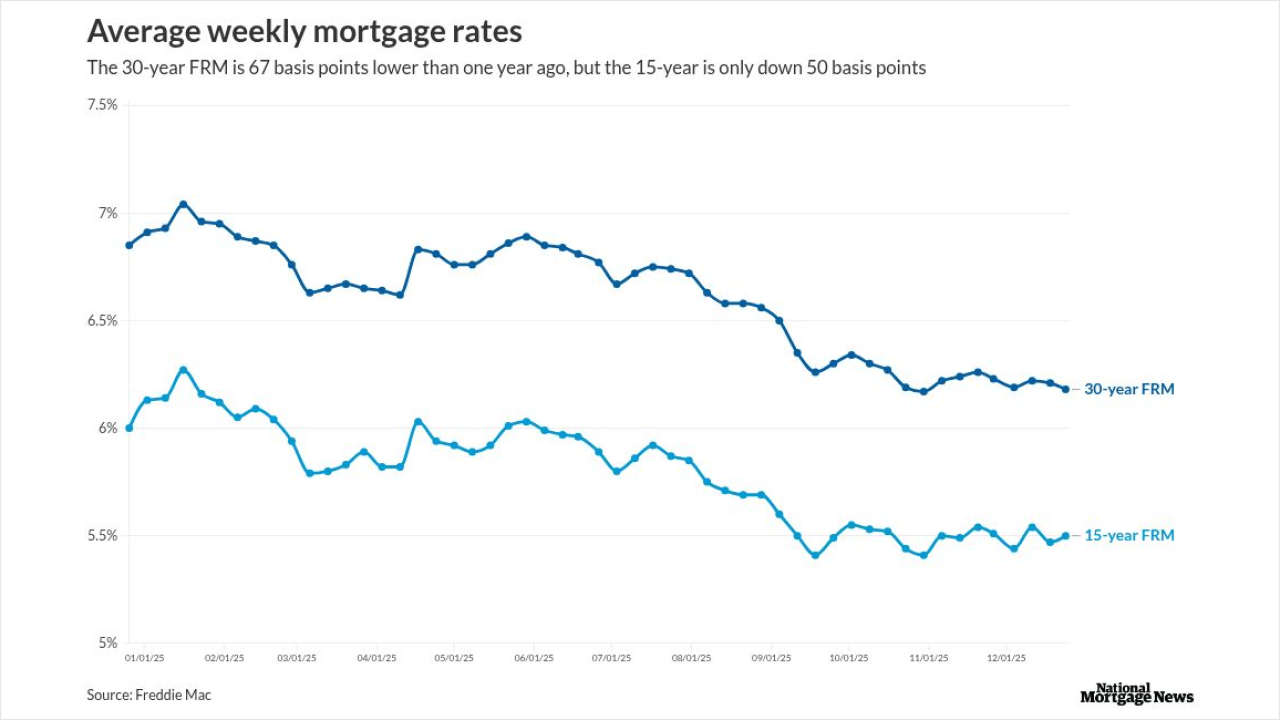

While the 30-year average has hovered near the same level for weeks, the past year brought with it promising trends that may ease affordability in 2026.

December 18 -

Mortgage activity fell 3.8% from one week prior for the week ending Dec. 12, led by a 4% drop in refinance applications, the Mortgage Bankers Association said.

December 17 -

The trade group's letter to FHFA Director Bill Pulte pointed out that lenders were facing credit report price hikes for four straight years.

December 16 -

New-home purchase activity rose 3.1% year over year, but dropped 7% from October, the Mortgage Bankers Association said.

December 16 -

Remote work helped fuel migration and erased the loss of rural residents that occurred in the decade prior to the arrival of Covid, Harvard researchers found.

December 15 -

The threshold regards loans where the annual percentage rate is at least 1.5 percentage points higher than the average prime offer rate on first liens.

December 15 -

The partnership also includes a $50 million equity investment in Finance of America, securing long-term alignment between the companies.

December 15 -

The Department of Housing and Urban Development announced the FHA-insured loan caps for low- and high-cost areas, which are set based on conforming loan limits.

December 12 -

ETHZilla partnered with Zippy to bring manufactured home chattel loans on-chain as tokenized real-world assets.

December 11 -

Approximately 70% of home purchasers do not get more than one quote in the mortgage process, doing so could reduce their rate by 50 basis points, Zillow said.

December 11 -

The lowest-priced properties purchased by investors typically left them in the red when sold, according to the latest home flipping report from Attom.

December 11 -

The investor markets already set mortgage rates to include the 25 basis point reduction the FOMC announced, and it is too early to see the longer-term effect.

December 11