-

Contracts to purchase previously owned homes unexpectedly decreased in November on a sudden pickup in mortgage rates and limited inventory, according to figures released Wednesday by the National Association of Realtors.

December 28 -

Rising interest rates typically squelch demand for refinancing, leaving lenders to compete for homebuyers' business. But plain-vanilla purchase loans aren't the only saleable products in this rising-rate environment. Here are five other products likely to find demand.

December 27 -

A consumer's ability to afford to purchase a home during the fourth quarter was at its lowest level in eight years due to rapid price appreciation, moderate wage growth and the post-election increase in interest rates.

December 22 -

Mortgage rates continued their climb, with the 30-year reaching its highest level since April 2014, after the Federal Reserve increased its benchmark lending rate.

December 22 -

Refinance activity in November was even compared with the prior month, though the data suggested that the market is prepping for higher rates to cut into this segment, according to Ellie Mae.

December 21 -

Sales of previously owned U.S. homes unexpectedly increased in November to the strongest level since early 2007, ahead of a jump in borrowing costs, National Association of Realtors data showed.

December 21 -

Loans originated in the third quarter were among the highest in credit quality since 2000, according to CoreLogic.

December 20 -

While depository mortgage lenders should exercise some caution before welcoming trended data and alternative credit scoring into their process, they must become inclusive or face losing market share to newer industry players like SoFi.

December 16 Sapient Global Markets

Sapient Global Markets -

A regulatory 2017 scorecard for Fannie Mae and Freddie Mac calls on the firms to transfer a significant portion of credit risk to third-party private investors on at least 90% of unpaid principal balance of newly acquired single-family mortgages.

December 15 -

BOK Financial will take a roughly $17 million earnings hit due to a change in the fair value of its mortgage servicing rights and a corresponding hedge.

December 14 -

Mortgage application volume decreased 4% from one week earlier as interest rates on 30-year loans continued to rise, according to the Mortgage Bankers Association.

December 14 -

SoFi Lending Corp.'s securitization of its student loan refis for high net worth individuals is now a model for its recent expansion into super prime jumbo mortgages.

December 13 -

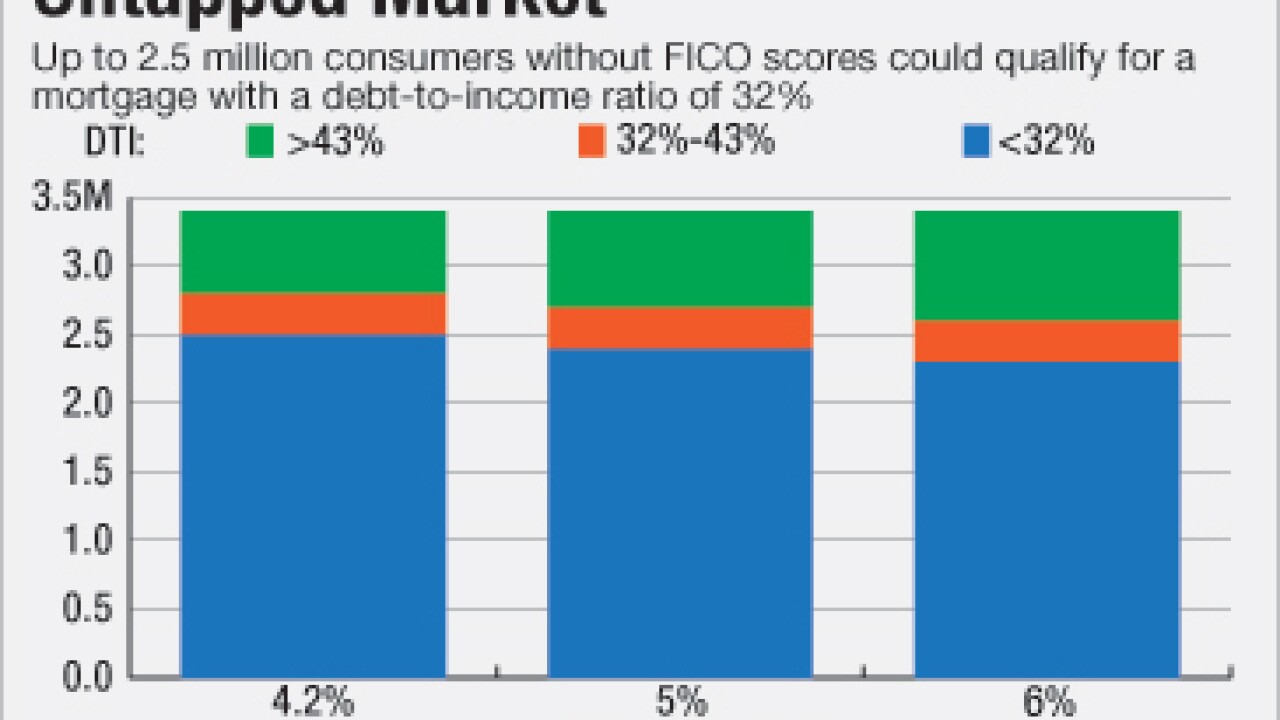

Many consumers without traditional credit scores have nearly identical risk profiles to those who can be assessed the conventional way, representing an untapped market, according to a report by VantageScore.

December 12 -

A group of traders in JPMorgan's investment bank has expanded from selling commercial mortgage-backed securities to underwriting loans that are unsuitable for bonds, such as those for big construction projects.

December 12 -

Data aggregation and analytics platform provider Envestnet-Yodlee has created a new automated mortgage asset verification product.

December 9 -

Affordable housing advocates are seizing on President-elect Donald Trump's call for tax reform, hoping that a new tax credit program to revitalize run-down homes in distressed neighborhoods will be attractive to the incoming administration.

December 8 -

Mortgage rates moved higher for the sixth consecutive week, according to Freddie Mac, even though yields on the 10-year Treasury are down from their post-election peak.

December 8 -

Conforming mortgage rates are at their highest level this year after increasing 51 basis points since Election Day, according to Freddie Mac.

December 1 -

Treasury Secretary-designate Steven Mnuchin's plan to remove Fannie Mae and Freddie Mac from government control could mean increased competition for lenders' loans. But it could also prompt a rise in mortgage rates.

November 30 -

While President-elect Donald Trump already faces numerous potential conflicts-of-interest between his businesses and the presidency, his real estate ties and campaign promises raise serious questions about his approach to the housing industry.

November 29 First Community Mortgage

First Community Mortgage