-

Mortgage application volume decreased 4% from one week earlier as interest rates on 30-year loans continued to rise, according to the Mortgage Bankers Association.

December 14 -

SoFi Lending Corp.'s securitization of its student loan refis for high net worth individuals is now a model for its recent expansion into super prime jumbo mortgages.

December 13 -

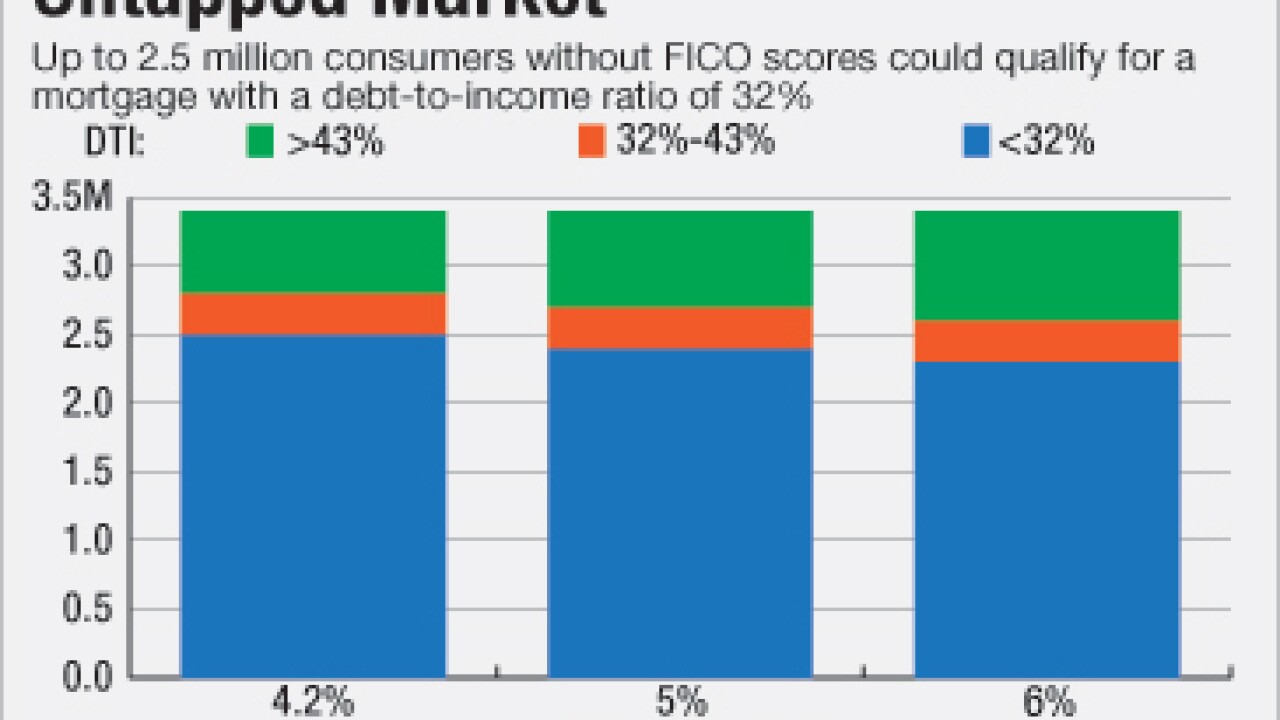

Many consumers without traditional credit scores have nearly identical risk profiles to those who can be assessed the conventional way, representing an untapped market, according to a report by VantageScore.

December 12 -

A group of traders in JPMorgan's investment bank has expanded from selling commercial mortgage-backed securities to underwriting loans that are unsuitable for bonds, such as those for big construction projects.

December 12 -

Data aggregation and analytics platform provider Envestnet-Yodlee has created a new automated mortgage asset verification product.

December 9 -

Affordable housing advocates are seizing on President-elect Donald Trump's call for tax reform, hoping that a new tax credit program to revitalize run-down homes in distressed neighborhoods will be attractive to the incoming administration.

December 8 -

Mortgage rates moved higher for the sixth consecutive week, according to Freddie Mac, even though yields on the 10-year Treasury are down from their post-election peak.

December 8 -

Conforming mortgage rates are at their highest level this year after increasing 51 basis points since Election Day, according to Freddie Mac.

December 1 -

Treasury Secretary-designate Steven Mnuchin's plan to remove Fannie Mae and Freddie Mac from government control could mean increased competition for lenders' loans. But it could also prompt a rise in mortgage rates.

November 30 -

While President-elect Donald Trump already faces numerous potential conflicts-of-interest between his businesses and the presidency, his real estate ties and campaign promises raise serious questions about his approach to the housing industry.

November 29 First Community Mortgage

First Community Mortgage -

The average for the 30-year fixed-rate mortgage this week topped 4% for the first time since 2015 as 10-year Treasury yields continued their post-election climb, according to Freddie Mac.

November 23 -

First Community Mortgage has added six loan products to its menu, each targeted to borrowers who are not eligible for a conforming or government mortgage.

November 22 -

While nonbank servicers are expected to continue to gain greater market share in 2017, much of that growth will come from their own loan origination activity rather than mortgage servicing rights purchases and subservicing, according to a report from Fitch Ratings.

November 21 -

Banks already have a difficult time collecting data on mortgage lending to minorities. New data requirements scheduled to take effect in early 2018 could lead to even more mistakes and financial penalties not to mention higher compliance costs and longer delays in closing loans.

November 17 -

Mortgage rates for 30-year loans skyrocketed to a 10-month high as investors reacted to Donald Trump's presidential election win by pulling money out of the bond market, driving up yields that guide home loans.

November 17 -

As the Justice Department winds down its Mortgage Fraud Task Force and a new administration prepares to enter the White House, the number of False Claims Act cases brought against Federal Housing Administration lenders is expected to dwindle.

November 16 -

Commercial mortgage lenders, and investors in their bonds, have been more eager than the residential market to embrace Property Assessed Clean Energy loans even though those loans hold a superior-lien position. Heres why.

November 16 -

Five credit unions in three states have partnered with myCUmortgage, a provider of outsourced origination and servicing programs.

November 16 -

The spike in borrowing costs in response to President-elect Donald Trump's pro-growth agenda is causing some heartburn in America's housing industry.

November 15 -

Experian, like fellow credit bureaus TransUnion and Equifax, is now offering trended credit reports to lenders that originate single-family loans.

November 14