-

Arch Mortgage Insurance introduced a new pricing program to better aligns a policy's risk with the amount of the premium. But analysts have expressed concerns about pricing competition.

December 23 -

The recovery in the housing market will slow dramatically over the next 10 months, according to Weiss Analytics.

December 21 -

American Mortgage Consultants has bought JCIII & Associates, in a combination of providers of mortgage due diligence and consulting.

December 21 -

The Connecticut Housing Finance Authority issued more than $400 million of bonds in 2015 to finance mortgages at below-market interest rates for low- to moderate-income first-time homebuyers, according to authority officials.

December 21 -

Lenders continued to ease loan standards across all types of mortgage products in the fourth quarter and they expect the trend to continue, according to Fannie Mae.

December 17 -

KeyCorp will keep and expand First Niagara Financial Group's Buffalo, N.Y.-based mortgage operations to spur along its return to being a player in residential lending.

December 17 -

There could be more willingness among lenders to roll back self-imposed requirements for agency loans in 2016, but secondary-market conditions will be mixed for mortgage sellers while rates and costs are poised to rise.

December 17 -

Real estate finance services provider Chronos Solutions in Frisco, Texas, has acquired San Diego-based mortgage technology company Cogent Road.

December 16 -

Credit scores on closed loans have declined for six consecutive months, according to the latest Ellie Mae Origination Insight report.

December 16 -

Default rates on various types of consumer loans improved in November, according to Standard & Poor's and Experian.

December 16 -

Fannie Mae is offering yet another carrot to lenders that have lobbied extensively for relief from loan repurchases.

December 15 -

The new mortgage disclosures are not expected to have a large impact on origination volume, but could have a sizable effect on lenders' processes.

December 15 -

Securitizations that involve commercial mortgages are increasingly dropping loans from their pools before the final transactions close, according to Fitch Ratings.

December 11 -

Mortgage applications for new homes declined in November, although not as sharp a drop as is typical for this time of year, according to the Mortgage Bankers Association.

December 10 -

Mortgage lenders said their per-loan profits declined 19% in the third quarter compared with the previous quarter, according to the Mortgage Bankers Association.

December 10 -

The consumer lending market, including mortgages, will fully recover from the financial crisis by the end of 2016, according to a forecast by TransUnion.

December 9 -

Loan limits for the Federal Housing Administration mortgage insurance program in 2016 will rise in 188 counties across the nation where home prices increased.

December 9 -

High loan-to-value ratio lending is gaining ground, spurred by the reintroduction 12 months ago of GSE-backed products that only require a 3% down payment, according to Black Knight Financial Services.

December 8 -

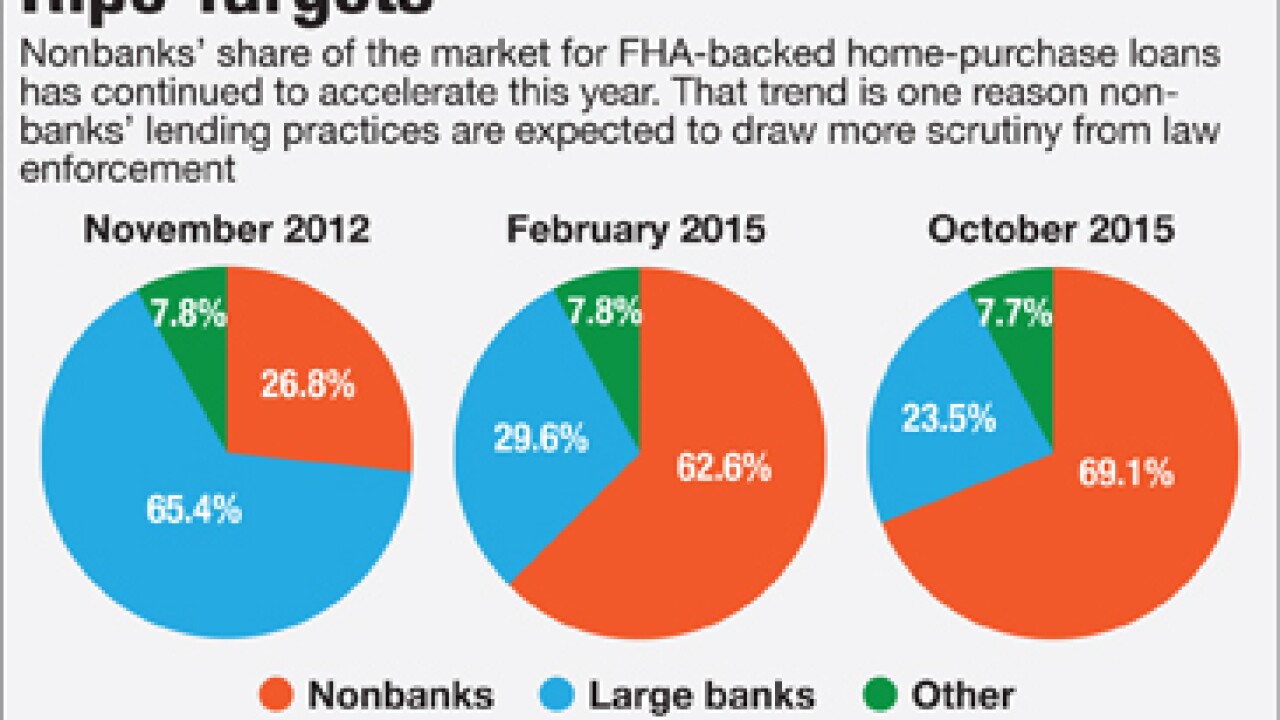

Two independent mortgage banks agreed to settlements in the past week with the Justice Department for failing to meet Federal Housing Administration guidelines. The cases are a warning to nonbank lenders that they need to beef up self-reporting of deficiencies, and they remind large banks about the legal risks associated with FHA lending.

December 7 -

Anticipation of rising interest rates has stirred more talk among mortgage lenders about the need to originate loans to borrowers with low credit scores.

November 30