-

Fannie Mae is offering yet another carrot to lenders that have lobbied extensively for relief from loan repurchases.

December 15 -

The new mortgage disclosures are not expected to have a large impact on origination volume, but could have a sizable effect on lenders' processes.

December 15 -

Securitizations that involve commercial mortgages are increasingly dropping loans from their pools before the final transactions close, according to Fitch Ratings.

December 11 -

Mortgage applications for new homes declined in November, although not as sharp a drop as is typical for this time of year, according to the Mortgage Bankers Association.

December 10 -

Mortgage lenders said their per-loan profits declined 19% in the third quarter compared with the previous quarter, according to the Mortgage Bankers Association.

December 10 -

The consumer lending market, including mortgages, will fully recover from the financial crisis by the end of 2016, according to a forecast by TransUnion.

December 9 -

Loan limits for the Federal Housing Administration mortgage insurance program in 2016 will rise in 188 counties across the nation where home prices increased.

December 9 -

High loan-to-value ratio lending is gaining ground, spurred by the reintroduction 12 months ago of GSE-backed products that only require a 3% down payment, according to Black Knight Financial Services.

December 8 -

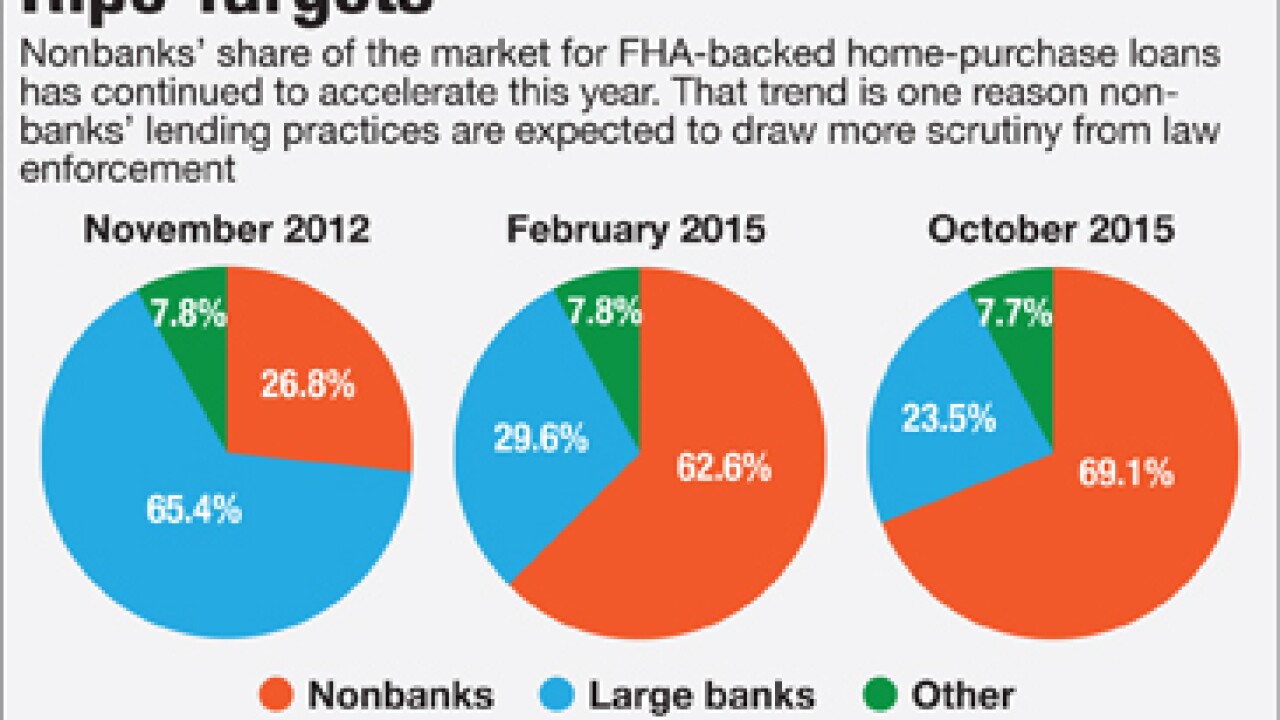

Two independent mortgage banks agreed to settlements in the past week with the Justice Department for failing to meet Federal Housing Administration guidelines. The cases are a warning to nonbank lenders that they need to beef up self-reporting of deficiencies, and they remind large banks about the legal risks associated with FHA lending.

December 7 -

Anticipation of rising interest rates has stirred more talk among mortgage lenders about the need to originate loans to borrowers with low credit scores.

November 30 -

Broadway Financial Corp. in Los Angeles has been released from an enforcement action requiring it to improve its corporate governance.

November 30 -

Jeff Patmont got his home loan on his phone. The 30-year-old marketing manager for a medical-device company said he did almost everything electronically for the mortgage on his home in the San Francisco Bay Area.

November 30 -

A plan by the government-sponsored enterprises to begin collecting the new Closing Disclosure data is designed to promote Fannie Mae and Freddie Mac's loan quality goals. But the initiative may also prompt broader use of e-signatures and paperless processing.

November 30 -

Mortgage rates remained steady during the week ending Nov. 25, according to Freddie Mac's Primary Mortgage Market Survey.

November 25 -

Commercial mortgages bundled into securities will keep seeing their underwriting standards deteriorate from this year into 2016, said JPMorgan analysts in a report Wednesday.

November 25 -

The percentage of mortgage applications with defects declined in October, according to First American Financial Corp.

November 25 -

Rising incomes and other affordability markers have tempered the impact of rising home prices in hot West Coast markets, according to Pro Teck Valuation Services.

November 24 -

There's been concern this year that commercial mortgage bonds are getting backed by loans that are increasingly risky.

November 23 -

Fannie Mae has introduced an improved online data portal, which users can customize to receive reports on loan servicing, pricing and other areas.

November 20 -

Commercial mortgage underwriting standards have already loosened dramatically this year, but it seems that some borrowers are still trying to get away with a little more.

November 20