-

Treasuries fell after the US government signaled that larger auction sizes are on the horizon, while signs of economic resilience hurt the odds a Federal Reserve interest-rate cut in December.

November 5 -

Southern states' government-sponsored enterprise share lags outside of a small number of metros, the Center for Mortgage Access' analysis of HMDA data shows.

November 5 -

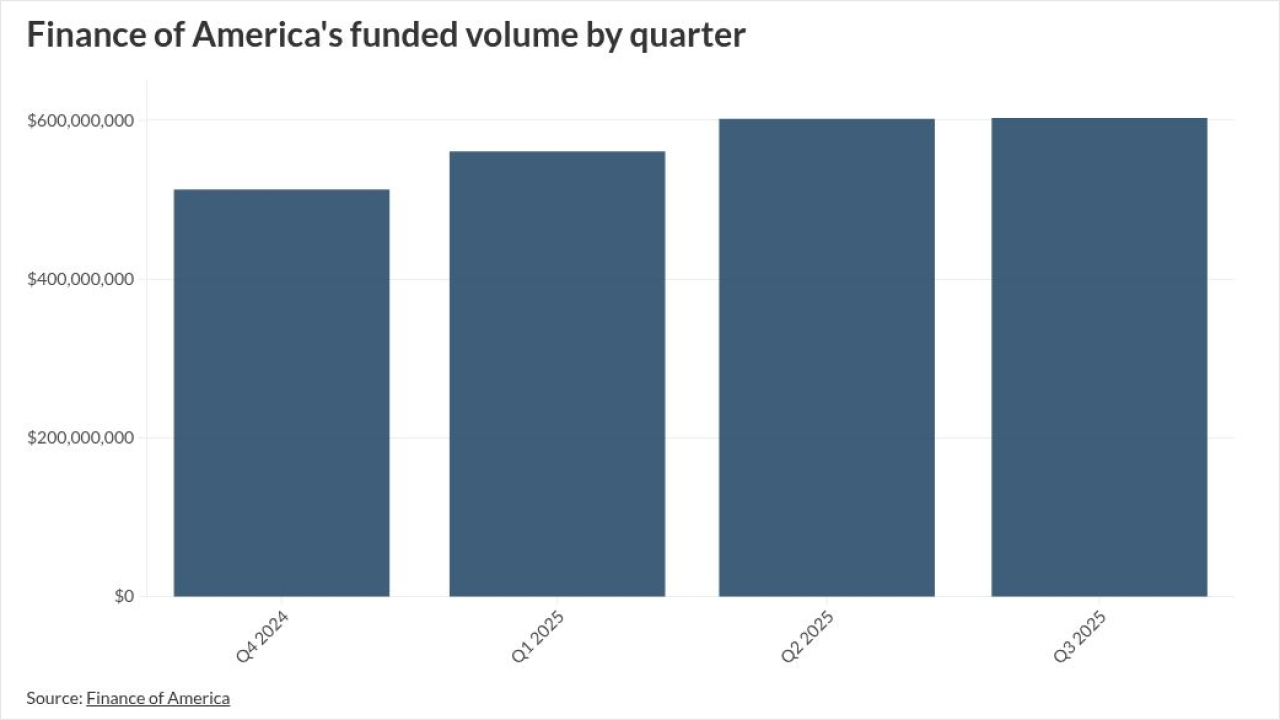

Home price modeling changes hurt FOA's third-quarter interim results but it was in the black between January and September on a continuing operations basis.

November 4 -

While FHFA reduced most of the single-family low-income goals, the MBA wants the refinance target for Fannie Mae and Freddie Mac cut as well, its letter said.

November 4 -

The latest case comes after at least three other zombie lawsuits in the past year, with the owner of the loan in question claiming $173,000 in past-due interest.

November 4 -

Newer automation that can serve as a wraparound to existing technology can cut servicing costs in a competitive industry, according to fintech executives.

November 4 -

The age at which people purchase their first home has climbed rapidly since 2021, when the median was 33, according to a National Association of Realtors survey of transactions from July 2024 through June.

November 4 -

Now that quantitative tightening is ending, the debate on who should be the MBS buyer of last resort, Fannie Mae and Freddie Mac, or the Fed, is taking hold

November 3 -

Refinancing pushed mortgage originations higher as rates eased, and home equity lending kept growing, but rising delinquencies signal mounting borrower stress.

November 3 -

Financial literacy advocate John Hope Bryant has joined with a Los Angeles-based developer in an effort to raise up to $300 million from banks to preserve and construct low-income housing around the country.

November 3 -

Wall Street dealers expect Bessent to signal as soon as Wednesday, when his department releases a quarterly statement on debt sales, that issuance in the $30 trillion Treasury market will keep shifting in that direction.

November 3 -

A successful summer pilot led to wider rollout of a program, whereby Robinhood Gold subscribers will be able to find discounted rates and closing costs.

November 3 -

Vic Lombardo, new head of mortgage services, has identified growth ideas and new revenue streams for Motto Mortgage and Wemlo, Remax CEO Erik Carlson said.

October 31 -

Three Federal Reserve officials said they did not support the US central bank's decision to cut interest rates this week, citing inflation that remains too high.

October 31 -

The acquisition complements existing lending channels at Carrington and also adds Reliance's full servicing portfolio to its platform, the company said.

October 31 -

Zillow Home Loans originated 57% more purchase mortgages versus the third quarter of 2024, with production and segment revenue growth beating estimates.

October 31 -

Rocket Companies lost $124 million on a GAAP basis, but its management celebrated milestones regarding its Redfin and Mr. Cooper acquisitions.

October 30 -

Uncover how high-speed internet access drives property valuations, creates lending opportunities, and transforms mortgage markets nationwide.

October 30 -

Instances of miscommunication between servicers and borrowers have declined, but some warn that CFPB stepping back from enforcement could create oversight gaps.

October 30 -

Until August, Bell was the executive director for loan guaranty service at the Department of Veterans Affairs, where he was credited with growing the program.

October 30