-

New-home construction cooled by more than expected in February on a reversal in the volatile multifamily category, while building remained on pace to contribute to economic growth this quarter.

March 16 -

The security that was incorporated into the index is backed exclusively by loans on green building certified properties; the GSE is still working on acceptance of financing for green upgrades.

March 15 -

The Trump administration's new tariffs on imported steel and aluminum may raise prices on a variety of consumer and commercial products, but will only put minimal strain on the housing industry.

March 9 -

Commercial and multifamily fourth-quarter mortgage delinquency rates improved for most investor types compared to one year prior as the U.S. economy continued its recovery.

March 6 -

Net apartment leasing totaled almost 14,000 units in Houston in the final months of 2017 as residents flooded out of their homes by Hurricane Harvey sought higher ground in rental units.

March 5 -

A $300 rent hike threw Noemi Hernandez' finances into a tizzy in 2016, forcing the part-time cashier to apply for food stamps and curtail spending on other things. A year later, her rent went up another $160.

February 22 -

New-home construction rose in January to the highest level since October 2016, helped by a surge in apartment building, as momentum in the housing market continues into 2018.

February 16 -

Freddie Mac posted a fourth-quarter net loss of $3.3 billion and will request $312 million from the Treasury after recent tax reform legislation forced it to write down the value of deferred tax assets.

February 15 -

The Charlotte region added about 25,000 jobs last year, and Mecklenburg County is expected to grow to about 1.4 million people by 2030, a nearly 40% increase.

February 5 -

Rising rents across the country suggest the homebuyer pool could get even bigger at a time when demand in the housing market is already far outpacing supply. Here's a look at 12 cities where that trend is strongest.

February 5 -

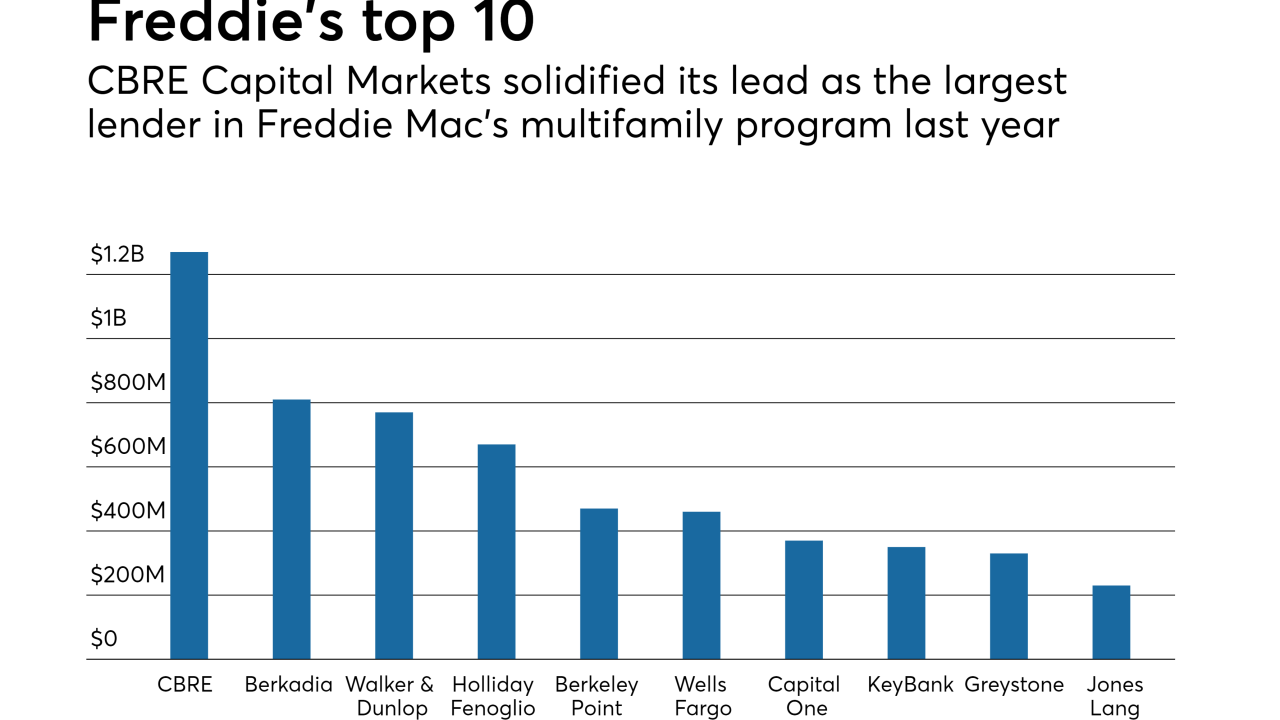

The top five Freddie Mac multifamily lenders remained stable year-to-year, in contrast to the shakeup in competitor Fannie Mae's rankings.

February 2 -

Fannie Mae's multifamily volume hit another record high of $67 billion in 2017 as former top producer Wells Fargo nearly halved its volume and nonbank competitors increased their market share.

January 26 -

With rents rising and homeownership rates still low, here's a look at eight reasons why more renters may want to become homeowners.

January 18 -

Though multifamily housing starts are projected to slightly moderate this year and next, production levels are expected to remain in a steady range considered normal, according to the National Association of Home Builders.

January 12 -

Pittsburgh rents on the listing site Abodo dropped an average of 1.7% a month in 2017, the fourth-largest decrease in the nation.

January 11 -

The new cap on the mortgage interest deduction should help the first time home buyer market by forcing sellers to lower prices, at least in the near term.

January 10 -

The $280 million securitization is also expected to boost capital levels and lower Dime's loan-to-deposit ratio.

December 19 -

Fannie Mae and Freddie Mac's final Duty to Serve plans are moving ahead with expanded support for manufactured housing through both single-family and multifamily programs, including controversial personal property loans.

December 18 -

Freddie Mac is broadening its capital markets vehicles with its first offering of participation certificate securities backed by multifamily tax exempt loans.

December 13 -

The $1.5 billion FREMF 2017-K1 has a in-trust stressed loan-to-value ratio of 120%, as measured by Kroll; that's projected to fall to 108.7% when the deal matures.

December 12