-

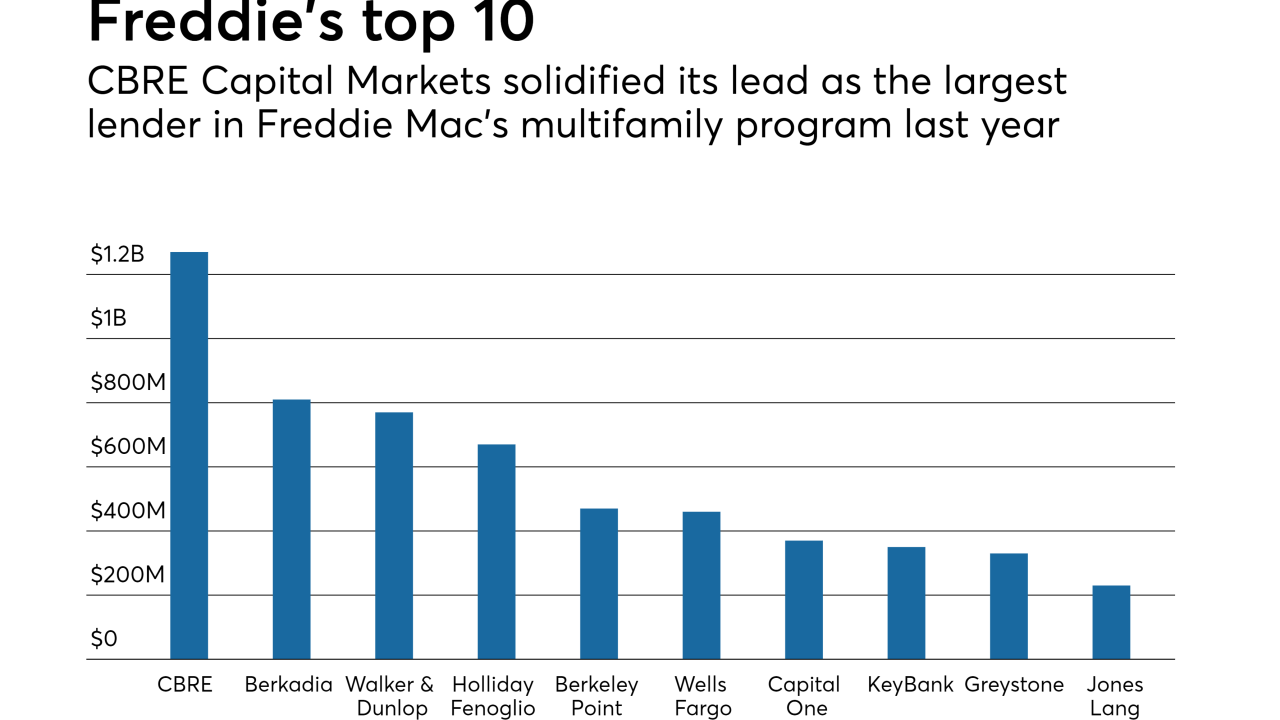

The top five Freddie Mac multifamily lenders remained stable year-to-year, in contrast to the shakeup in competitor Fannie Mae's rankings.

February 2 -

Fannie Mae's multifamily volume hit another record high of $67 billion in 2017 as former top producer Wells Fargo nearly halved its volume and nonbank competitors increased their market share.

January 26 -

With rents rising and homeownership rates still low, here's a look at eight reasons why more renters may want to become homeowners.

January 18 -

Though multifamily housing starts are projected to slightly moderate this year and next, production levels are expected to remain in a steady range considered normal, according to the National Association of Home Builders.

January 12 -

Pittsburgh rents on the listing site Abodo dropped an average of 1.7% a month in 2017, the fourth-largest decrease in the nation.

January 11 -

The new cap on the mortgage interest deduction should help the first time home buyer market by forcing sellers to lower prices, at least in the near term.

January 10 -

The $280 million securitization is also expected to boost capital levels and lower Dime's loan-to-deposit ratio.

December 19 -

Fannie Mae and Freddie Mac's final Duty to Serve plans are moving ahead with expanded support for manufactured housing through both single-family and multifamily programs, including controversial personal property loans.

December 18 -

Freddie Mac is broadening its capital markets vehicles with its first offering of participation certificate securities backed by multifamily tax exempt loans.

December 13 -

The $1.5 billion FREMF 2017-K1 has a in-trust stressed loan-to-value ratio of 120%, as measured by Kroll; that's projected to fall to 108.7% when the deal matures.

December 12 -

Freddie Mac on Thursday priced the first transaction to result from its pilot in the single-family rental market.

December 7 -

A $92 million portion of $194.4 million mortgage on a portfolio of 36 ExtraSpace Self Storage locations is the largest of 42 loans backed backing MSC 2017-HR2.

December 7 -

A provision in the tax bill passed by the House of Representatives would only intensify the housing crunch by crippling affordable housing construction, developers and local government officials say.

December 1 -

Nonprofit agencies looking to purchase unsubsidized affordable housing properties can use a new impact gap financing program from Freddie Mac to fund the acquisition.

November 28 -

Developer confidence in multifamily production weakened in the third quarter to its lowest reading since 2011, according to the National Association of Home Builders.

November 27 -

Faster apartment building was instrumental in pulling the U.S. housing market out of its slump a decade ago. Now, that engine is starting to throttle back.

November 20 -

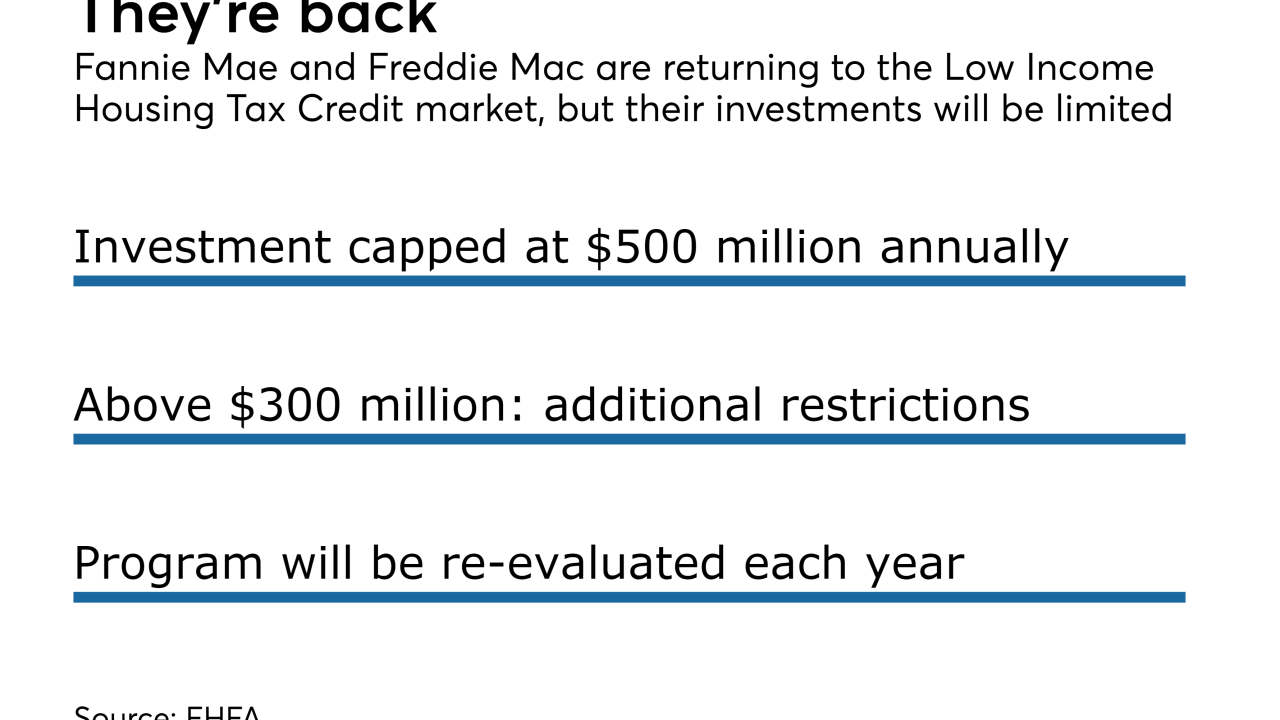

The FHFA is allowing Fannie Mae and Freddie Mac to invest in the credits for the first time since they entered conservatorship. Its purpose is to promote affordable housing in underserved markets.

November 16 -

Benefit Street Partners is securitizing 20 short-term commercial real estate loans it originated or acquired for transitional properties currently with unstable cash flow.

November 15 -

The supply-demand outlook in commercial real estate markets took a slight dip nationwide for the first time since early 2016 and financing for some CRE property types is getting more difficult to arrange.

November 10 -

Commercial and multifamily originations are projected to surpass the 2007 market peak this year, according to the Mortgage Bankers Association.

October 27