-

Years after the great American housing bust, mortgages akin to the so-called liar loans which were made without verifying peoples finances are creeping back into the market.

September 8 -

Guaranteed Rate has added 75 former Discover Home Loans employees as well as the Irvine, Calif., call center facility that they worked at.

September 4 -

Non-bank originators add 3,200 new employees in July.

September 4 -

After his son was born with a number of serious medical conditions, Atlantic Coast Mortgage's Thad Musser has made it a personal mission to show gratitude to the hospital responsible for his treatment. Little did he know these gestures would help him bond with customers who have faced similar experiences.

September 2 -

The resignation of Stonegate Mortgage founder and CEO Jim Cutillo will likely result in either the quick hiring of a replacement CEO to execute Stonegate's business plan or the company being acquired, according to analysts at FBR Capital Markets.

August 31 -

Residential mortgage servicers are once again tapping the securitization market to fund advances to bondholders for the first time since April 2014.

August 28 -

Walter Investment Management has received approval from Freddie Mac to hold the mortgage servicing rights on $3.3 billion in residential mortgage loans.

August 27 -

Blackstone Group has acquired a majority stake in the parent company of nonbank mortgage lender Stearns Lending.

August 24 -

Banks have ramped up foreclosure activity in the past five months, with default notices, scheduled auctions and bank repossessions at their highest levels in two years. It's a positive sign that banks are finally clearing out all the distressed loans still lingering from the housing crisis. Meanwhile, banks remain cautious about new lending, partly because of regulatory actions.

August 20 -

Sabal Financial Group has put a $541 million portfolio of real estate loans up for sale.

August 19 -

In 1979, mortgage bankers worried that they could be undercut by "sleeping giants" like Merrill Lynch, Sears Roebuck and what was then called Master Charge.

August 14 RealtyTrac

RealtyTrac -

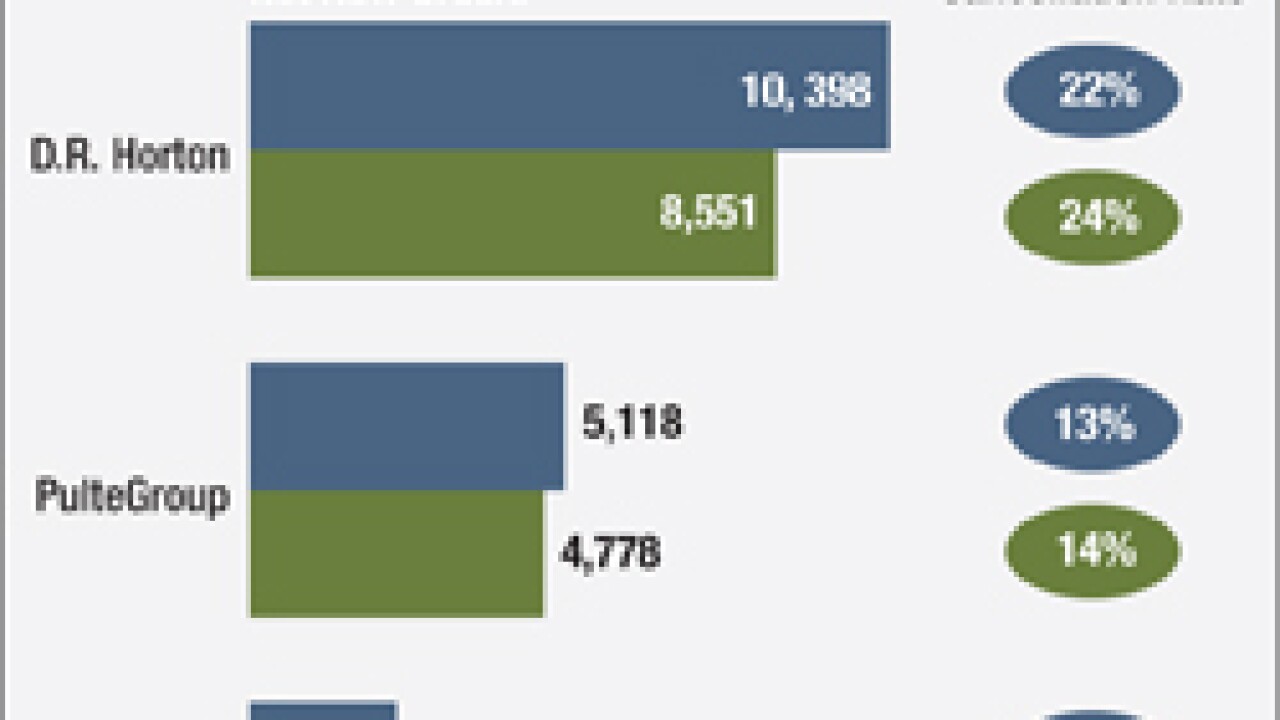

Consumers' growing confidence about their ability to qualify for a mortgage is generating more foot traffic, sales orders and loan volume for some of the nation's largest homebuilders.

August 12 -

New Residential Investment Corp., real estate investment trusts, residential mortgage bonds, mortgage servicing rights

August 11 -

Walter Investment Management in Tampa, Fla., said its second-quarter loss widened, as it recorded a goodwill impairment charge in its reverse mortgage division.

August 10 -

PennyMac Mortgage Financial Services reported a rise in income on higher servicing and origination revenue.

August 7 -

PHH Corp. reported losses of $62 million for the second quarter, driven by major increases in operating expenses and a $46 million loss in the servicing segment.

August 7 -

M&T Bank's disclosure that it is in settlement talks with the Justice Department for not complying with underwriting guidelines on FHA loans has renewed fears that more lenders will be targeted.

August 7 -

United Wholesale Mortgage has introduced software to help brokers and correspondents close loans faster.

August 7 -

Employment in the mortgage banking and broker sector has grown 5.8% since June 2014.

August 7 -

Competition among lenders has been good for homebuyers.

August 7