-

Nonbank mortgage company Cornerstone Home Lending has launched a new mortgage company as a joint venture with homebuilder Oakwood Homes.

February 10 -

Quicken Loans has named a new CEO to replace Bill Emerson, who is transitioning to a role with the Detroit lender's parent company, Rock Holdings.

February 10 -

The Urban Institute's Housing Finance Policy Center has created a new initiative aimed at addressing skyrocketing mortgage servicing costs.

February 8 -

The Trump administration was set to release an executive order Friday calling for a review of the Dodd-Frank Act, but the immediate questions about the order focused on what authority the White House has to enact real change.

February 3 -

PennyMac Financial Services reported higher income, reflecting larger net gains on mortgage loans held for sale.

February 3 -

Companies whose financials have taken hits due to their holdings of mortgage servicing rights are in for a treat, according to Moody's Investors Service.

February 2 -

New Residential Investment Corp. has priced the public offering of more than 49.2 million shares of its stock that it plans to use to pay for its purchase of mortgage servicing rights from CitiMortgage.

January 31 -

Citigroup's decision to exit mortgage servicing by the end of 2018 is part of a long-term strategy to increase returns and sharpen the bank's focus on its core retail customers.

January 31 -

CIT Group's exit from its commercial air and reverse-mortgage-servicing businesses cost it heavily in the fourth quarter.

January 31 -

Citigroup's plans to sell a $97 billion mortgage servicing portfolio and subservice its remaining accounts highlights the growing prevalence of nondepository servicers and raises questions about how much capacity exists for these institutions to absorb more large deals.

January 30 -

New Residential Investment Corp. is planning a public offering of more than 49.2 million shares of its stock to pay for its purchase of mortgage servicing rights from CitiMortgage.

January 30 -

Citigroup plans to exit the mortgage-servicing business by the end of 2018 to focus on making new loans.

January 30 -

Despite claims that digitizing the mortgage process will require less human capital, consumer desires for people on the other end of the phone or computer will keep mortgage loan officers in demand for the foreseeable future.

January 25 1st Mariner Mortgage

1st Mariner Mortgage -

In order to address lenders' issues with mortgage servicing rights financing, the industry needs to reconsider its typical securitization structures.

January 20 Alston & Bird LLP

Alston & Bird LLP -

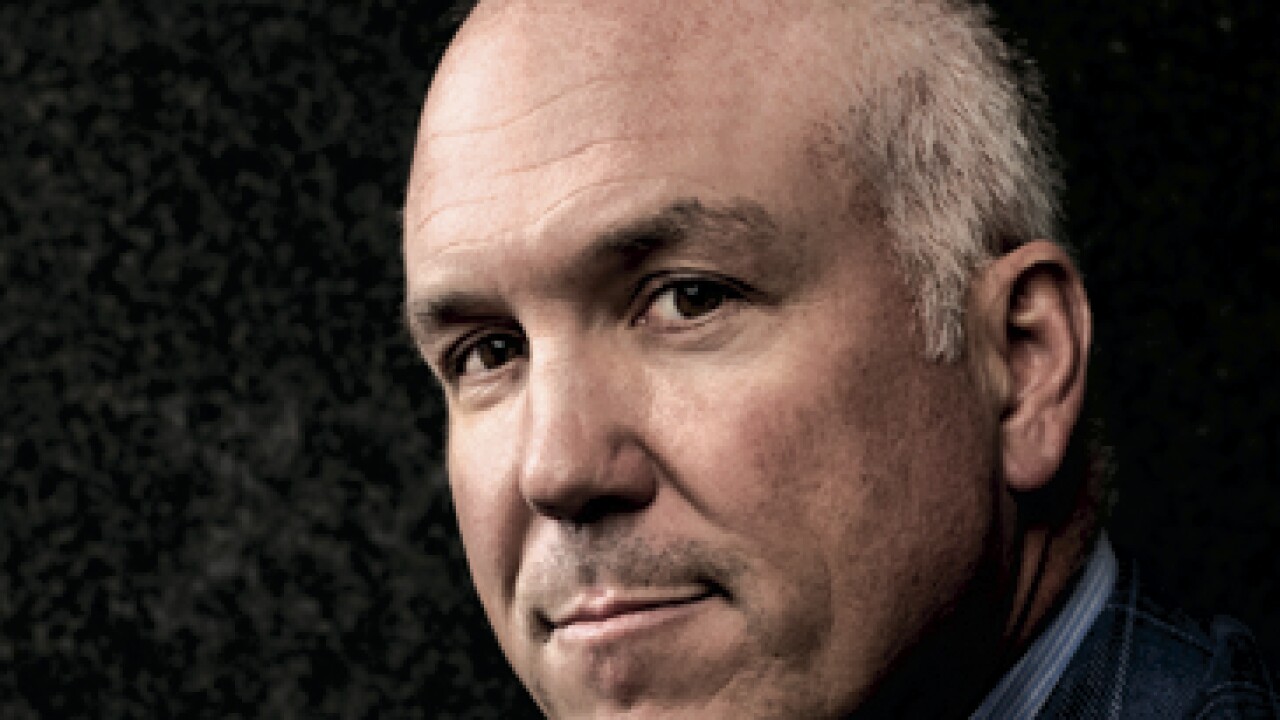

In a candid, in-depth exit interview, Ted Tozer discusses Ginnie Mae's growth during his seven years at the agency's helm, the need for comprehensive housing finance reform, big banks' retreat from mortgages, counterparty risk management and more.

January 18 -

While precise definitions vary, the term generally describes a smooth customer experience that may not even require a phone call or branch visit.

January 18 -

The startup, known for refinancing millennials' student loans, is now writing more than $100 million of home mortgages a month, and expects this to be its fastest-growing product. Here's why.

January 17 -

A unit of M&T Bank in Buffalo, N.Y., has bought certain operations of Philadelphia mortgage firm Carey, Kramer, Pettit, Panichelli & Associates.

January 10 -

Through Motto Mortgage, Remax is looking to give its smaller franchisees the same ability to offer one-stop shopping to homebuyers as larger operators, in a way that will not raise red flags for regulators.

January 10 -

Mortgage brokers and their wholesale partners have seen a slow increase in their market share since the start of the housing recovery. Remax's Motto Mortgage franchise business could accelerate growth faster than the channel's advocates hope for.

January 10