-

Genworth Financial agreed to sell a European mortgage insurance operation to AmTrust Financial Services Inc. as CEO Tom McInerney divests assets to bolster capital amid tighter regulation on companies that back home loans in the U.S.

October 27 -

The rising costs to service mortgages reflects a market where there are not only downsides to being too small, but hurdles to being too large raising the question of whether there's a middle ground where servicers are not too big, not too small, but just right.

September 10 -

In the world of property valuations, there's no such thing as the "perfect" comparable sale. From design and architecture styles to energy efficiency, here's a look at 10 home features most frequently adjusted in appraisals.

August 26 -

The new supplemental performance metric should encourage lenders to serve lower credit score borrowers.

August 17 -

The Federal Housing Administration's Neighborhood Watch website is back online after crashing about three weeks ago.

August 17 -

Neighborhood Watch, the Federal Housing Administration's "early warning system" for monitoring mortgage defaults and lender performance, crashed more than two weeks ago and it's unclear when the service will be restored.

August 13 -

Fidelity National Financial has recapitalized ServiceLink Holdings, increasing its ownership in the transaction services company.

July 31 -

Fidelity National Information Services Inc., the payment-services provider, is in exclusive talks to buy SunGard Data Systems Inc. in a deal with an enterprise value of more than $8.3 billion, people familiar with the matter said.

July 31 -

Green River Capital has rolled out a new surveillance service for single-family rental properties called Retail Asset Management & Performance.

July 29 -

The bankruptcy of Wingspan Portfolio Advisors epitomizes the existential crisis facing default servicing. This once-thriving sector of the mortgage industry now finds itself declining in lockstep with the drop in loan delinquencies and foreclosures.

July 24 -

Creditors of a Dallas-based special servicer and mortgage services firm that filed Chapter 7 bankruptcy this week include technology providers, financial institutions and property management companies.

July 16 -

The Cleveland company, which this spring said it had decided to start originating its own mortgage loans again, shared more details on the start date of this new effort and the rationale behind it.

July 16 -

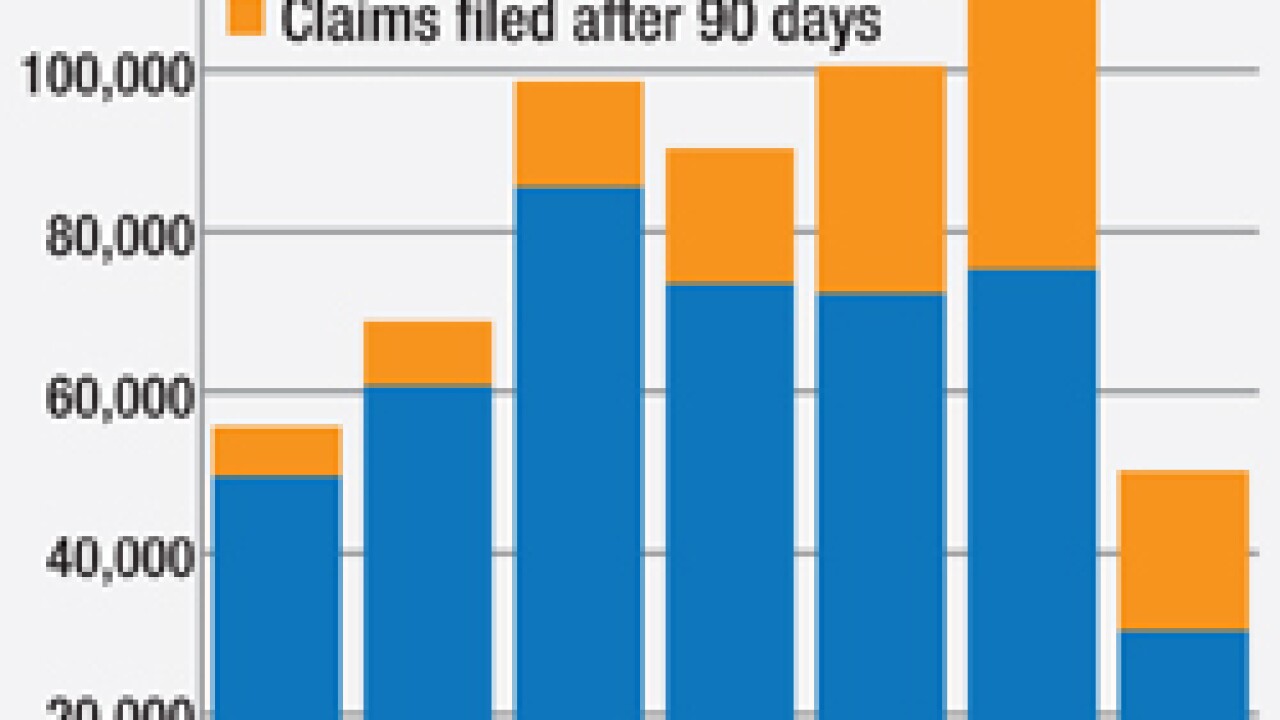

The Federal Housing Administration wants to set a hard deadline for servicers to file claims on soured mortgages. Industry executives say it should be manageable unless foreclosures surge again.

July 7 -

Bank of America will close a back-office facility in a Sacramento, Calif., suburb and outsource some of the office's employees.

June 4 -

LenderLive in Denver has acquired Walz Group, a provider of certified mailing services.

June 1 -

Online real estate marketplace Hubzu is offering consumers looking to bid on real estate owned properties a financing contingency option.

May 18 -

PHH Corp. reported a strong jump in income due to favorable adjustments to mortgage servicing rights and increased mortgage application volume.

May 7 -

Wholesale lenders and their brokers are finding preparing for the new mortgage disclosures that take effect in August especially tricky.

May 5 -

Flagstar Bancorp beat expectations as it reported stronger mortgage volume in the first quarter.

April 28 -

Regulators recently penalized a mortgage firm for keeping a file of licensing-test questions to prep exam takers, the first public challenge to what is believed to be a hushed, but longtime, industry practice.

April 23