-

Creditors of a Dallas-based special servicer and mortgage services firm that filed Chapter 7 bankruptcy this week include technology providers, financial institutions and property management companies.

July 16 -

The Cleveland company, which this spring said it had decided to start originating its own mortgage loans again, shared more details on the start date of this new effort and the rationale behind it.

July 16 -

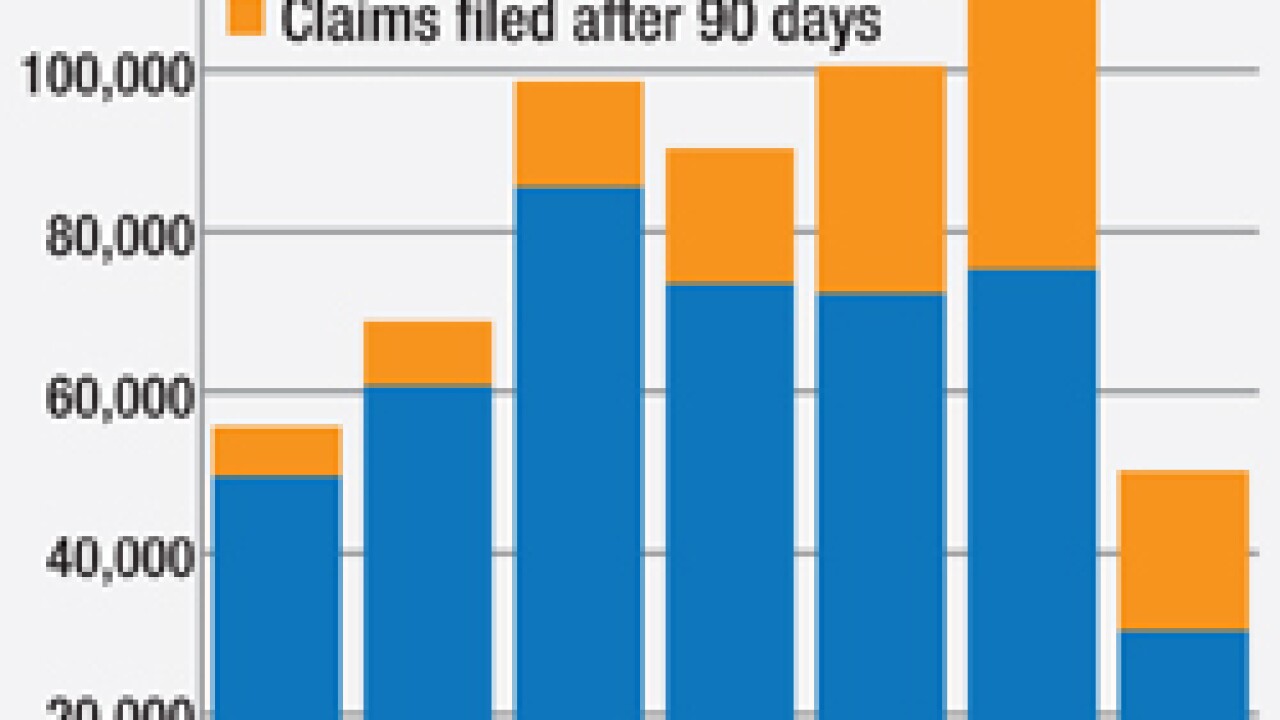

The Federal Housing Administration wants to set a hard deadline for servicers to file claims on soured mortgages. Industry executives say it should be manageable unless foreclosures surge again.

July 7 -

Bank of America will close a back-office facility in a Sacramento, Calif., suburb and outsource some of the office's employees.

June 4 -

LenderLive in Denver has acquired Walz Group, a provider of certified mailing services.

June 1 -

Online real estate marketplace Hubzu is offering consumers looking to bid on real estate owned properties a financing contingency option.

May 18 -

PHH Corp. reported a strong jump in income due to favorable adjustments to mortgage servicing rights and increased mortgage application volume.

May 7 -

Wholesale lenders and their brokers are finding preparing for the new mortgage disclosures that take effect in August especially tricky.

May 5 -

Flagstar Bancorp beat expectations as it reported stronger mortgage volume in the first quarter.

April 28 -

Regulators recently penalized a mortgage firm for keeping a file of licensing-test questions to prep exam takers, the first public challenge to what is believed to be a hushed, but longtime, industry practice.

April 23 -

Forty-one percent of mortgage lenders feel they are not ready for the August 2015 Truth in Lending Act and Real Estate Settlement Procedures Act Integrated Disclosure Rule, according to a study by Capsilon Corp.

April 14 -

Altisource Portfolio Solutions has raised the curtain on Residential Investor One, a new cooperative aimed at providing savings and services for real estate investors.

April 14 -

Holders of servicing rights will soon demand more than the basics from these third-party providers. Subservicers may be expected to help promote an institution's nonmortgage products or provide portfolio analytics.

April 6 -

Fountainhead Commercial Capital has created a program designed to allow banks and credit unions to outsource Small Business Administration 504 loans.

March 26 -

KeyCorp has been getting back into full-scale residential lending as part of a broader strategy to deepen client relationships. The market's shift toward purchase activity and defined mortgage rules also played a role.

March 10 -

JPMorgan Chase has agreed to a $50.4 million settlement with the Justice Department for robo-signing documents sent to homeowners in bankruptcy and for related abuses.

March 3 -

Real estate services provider Accurate Group has unveiled a new suite of products designed to facilitate title and lien clearance.

February 26 -

Walter Investment Management Corp. has emerged as the favorite of investors following a year of investigations of the top three nonbank mortgage servicers.

February 25 -

The Qualified Mortgage rule, as well as increased scrutiny and more frequent auditing by regulatory agencies, has required lenders to embrace quality control to a far greater degree.

February 11 ACES Risk Management Corp.

ACES Risk Management Corp. -

The relationship a loan officer took several months to cultivate can be destroyed by your servicing area in just 10 minutes, affecting potential referrals or future business. Here are a few ways you can avoid that.

February 6