-

The financial services regulator believes Mr. Cooper is violating the Fair Debt Collection Practices Act due to its $25 fee for payoff quote statements.

August 12 -

Democrats Ritchie Torres and Gregory Meeks called on the New York Home Loan bank to follow the lead of its peers and use alternative credit scoring models for collateral to improve consumers' access to homeownership.

August 9 -

The move aims to end a conflict between service-related disability benefits and rental assistance. HUD and the Treasury also are looking at tax credit impacts.

August 8 -

The Federal Housing Finance Agency wants to update the dual mission of the Federal Home Loan Banks. Members of the private bank cooperative say their regulator has no authority to redefine the mission.

August 8 -

Vice President Kamala Harris recruited Minnesota's governor to join the Democratic presidential ticket. He's been a longtime advocate for affordable housing and rental protections.

August 7 -

Appraisal appeal rules announced by Fannie Mae, Freddie Mac and FHA set to go into effect in three weeks, will now be required starting on Oct. 31.

August 7 -

Gary Quinzel, vice president of portfolio consulting at Wealth Enhancement Group, gives his views about monetary policy and offers his opinion on the FOMC statement and Fed Chair Jerome Powell's press conference.

-

President Joe Biden's administration and Senate Democrats are ramping up pressure on the Federal Home Loan Bank system to pump more money into solving the nation's housing crisis.

August 6 -

High borrowing costs led to fewer mortgage originations in the second quarter, according to the Federal Reserve Bank of New York's Quarterly Report on Household Debt and Credit released Tuesday.

August 6 -

Inflation and housing affordability are the two top election-year issues among home buying consumers, according to a new report from Veterans United Home Loans.

August 2 -

The Federal Reserve chair said Fed researchers continue to explore central bank digital currencies to stay current on international payments developments, but emphatically denied that the central bank is considering creating one of its own.

July 31 -

But the industry-backed proposal differs by $13 million from the House version of the appropriation bill and it is not likely to get resolved until after the November election.

July 29 -

Catch up on the housing and mortgage industry issues pushing to the forefront of the 2024 election — and how each campaign is responding.

July 29 -

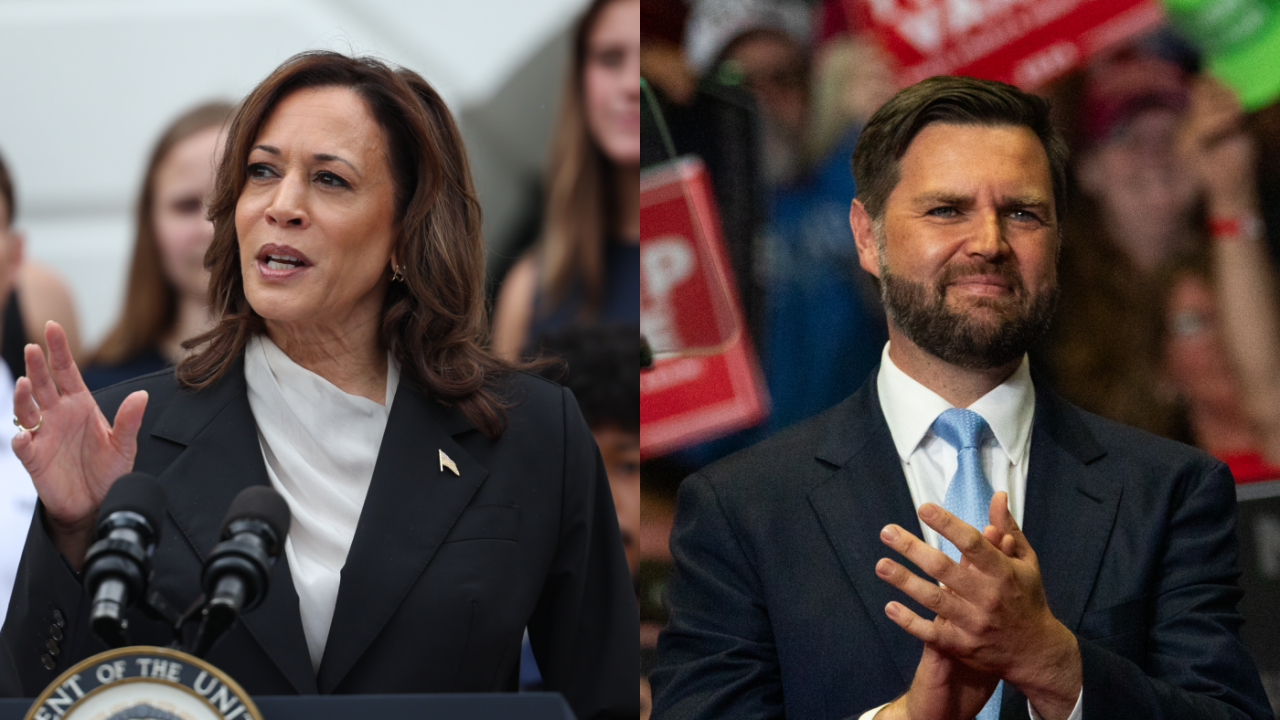

As the vice president gathers support from the Democratic party in hopes of securing the nomination, attention has turned to her policies, some of which aim to boost affordable supply.

July 26 -

Despite being a top concern for a wide swath of voters, housing affordability has largely been absent from presidential politics.

July 26 -

A group of 14 state attorneys general, led by Tennessee, joined the chorus of opposition to the Fannie Mae pilot to not require title insurance on certain refinances

July 25 -

Vice President Harris' surprise elevation to the top of the Democratic ticket and the ascent of Ohio Sen. J.D. Vance to be the Republican vice presidential pick brings renewed vigor to each party's economic vision.

July 22 -

The former president's running mate pick has garnered national attention, partially for his controversial suggestion to deport 20 million people as a solution to the lack of housing inventory.

July 21 -

Vice President Kamala Harris, the most likely choice to replace President Joe Biden on top of the Democratic presidential ticket in November, has a long and complicated history with the banking industry.

July 21 -

Investors are set to start the week scrambling to decide if President Joe Biden's decision to end his reelection campaign and endorse Vice President Kamala Harris increases or decreases Donald Trump's chances of regaining power.

July 21