Regulation and compliance

Regulation and compliance

-

The Consumer Financial Protection Bureau issued guidance late Friday that will shield some new mortgage data from the public that lenders are required to report.

December 21 -

The House Financial Services Committee held a hearing to examine the outgoing committee chairman's bipartisan GSE reform bill, but lawmakers were already looking ahead.

December 21 -

The process to confirm Mark Calabria as FHFA director could be lengthy, forcing the White House to consider how it will proceed with housing finance reform under Joseph Otting as acting head of the agency.

December 21 -

Maria Vullo is stepping down as head of New York's banking and insurance regulator after three years in which she created a national model for cybersecurity regulations at banks and fought back against federal attempts to chip away at payday-lending rules.

December 19 -

Kathy Kraninger's first official action as head of the Consumer Financial Protection Bureau is to reverse course on acting chief Mick Mulvaney's effort to rename it the Bureau of Consumer Financial Protection, which consumer groups and others had sharply criticized as confusing and costly.

December 19 -

A Flora Vista, N.M., man accused of five felony charges for forging a signature on real estate paperwork then ordering an employee to dispose of property from the victim's residence has agreed to a plea agreement.

December 19 -

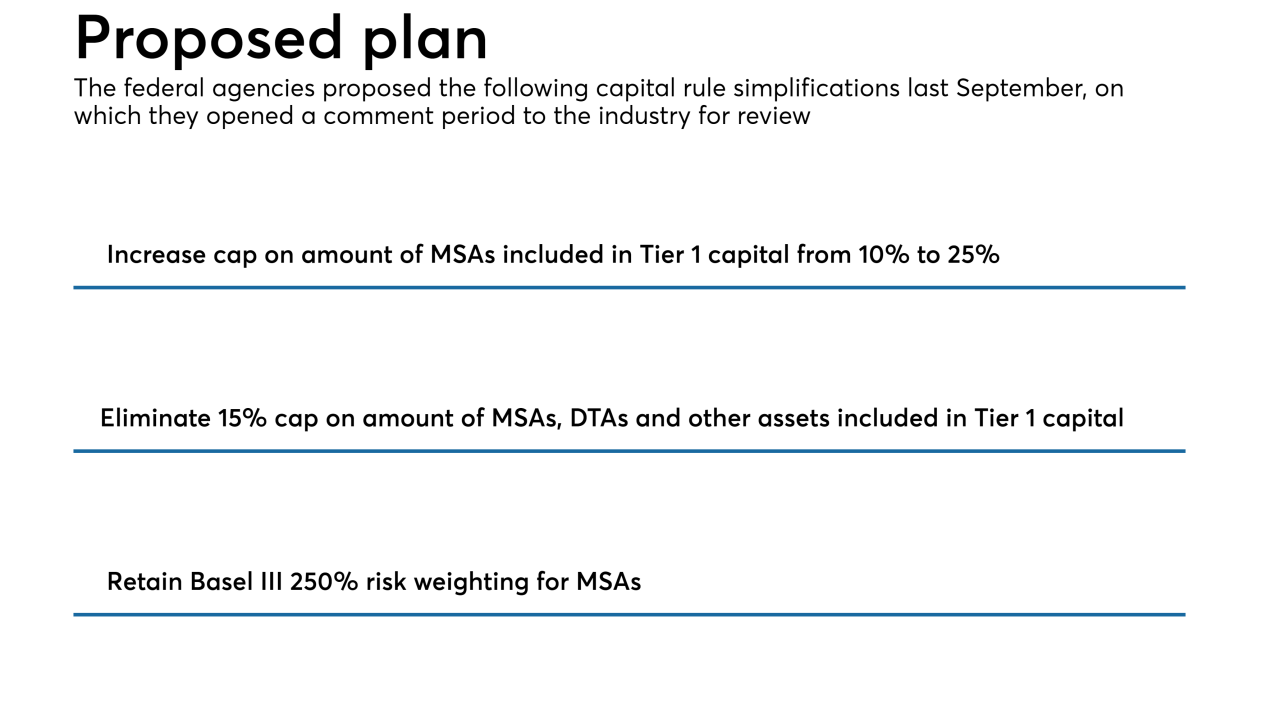

A proposal issued over a year ago by federal banking agencies to simplify risk-based capital rules and ease compliance burdens for community banks has still not been finalized, and mortgage brokers and bankers are calling on them to do just that.

December 18 -

A proposal allowing more lenders to skip outside appraisals could remove a hurdle to quick closings, but appraisers say they could be collateral damage.

December 17 -

Five Florida Keys men ripped off the federal government and received thousands of dollars in recovery money after Hurricane Irma struck last year, the Monroe County State Attorney's Office said.

December 14 -

The newly sworn-in director’s first public remarks seemed to contrast with the approach of her predecessor, Mick Mulvaney, who at times questioned the role of the agency.

December 11 -

The Trump appointee officially took over for Mick Mulvaney as head of the agency following her Senate confirmation last week.

December 11 -

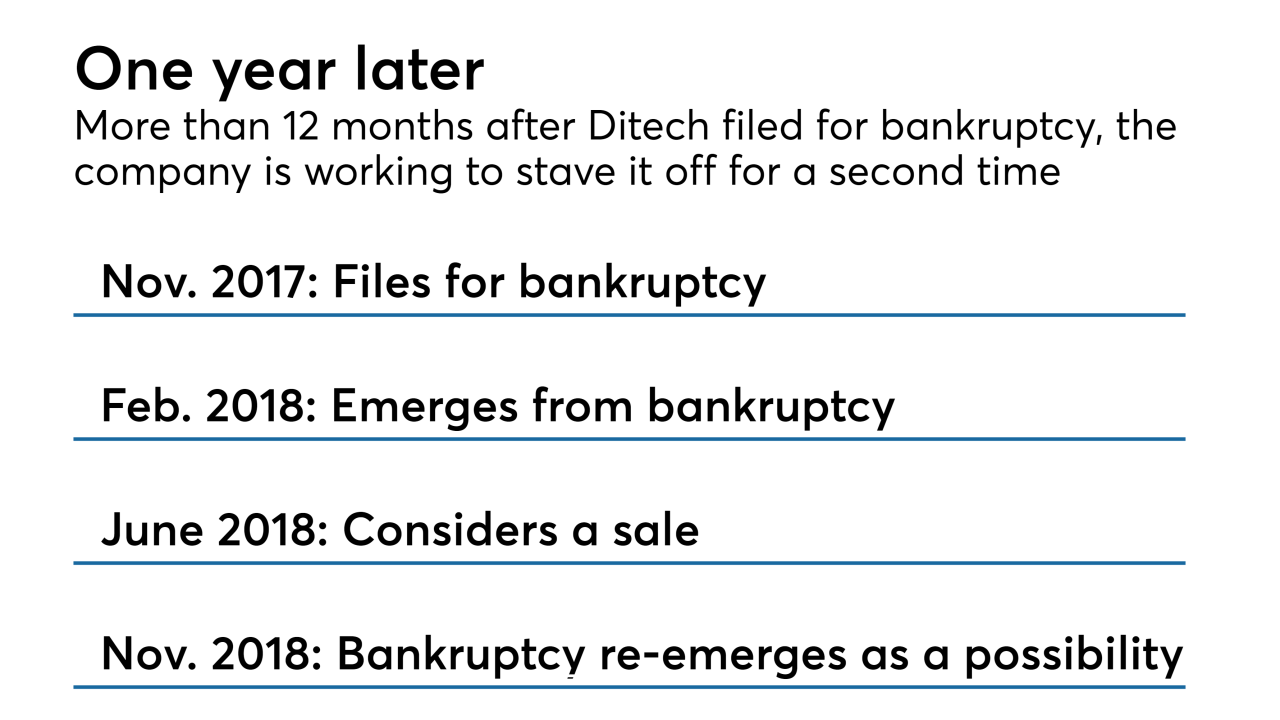

Ditech Holding Corp. is proposing to pay $257,000 and improve governance to settle a stockholder lawsuit alleging that a lack of oversight allowed improprieties to occur in several mortgage-related business lines.

December 10 -

Executives urged the consumer bureau at a public meeting to keep a closer eye on artificial intelligence innovations developed by fintech firms that are subject to less regulation.

December 6 -

Kraninger's nomination was lauded by industry groups, but vigorously opposed by consumer groups and Democratic lawmakers.

December 6 -

The CFPB ordered Village Capital & Investment in Henderson, Nev., to issue refunds and pay a penalty for allegedly misrepresenting the cost savings in a refi product.

December 6 -

Democrats on the House Financial Services Committee are expected to shine a spotlight on Trump-appointed regulators, but that light might shine brightest on one agency in particular.

December 5 -

Reps. Lacy Clay and Emanuel Cleaver, both from Missouri, have shown interest in running the panel that could be a focal point in efforts to reform Fannie Mae and Freddie Mac.

December 5 -

The Democrat, who will likely head the Financial Services Committee, has signaled she'll make expanded housing opportunities for lower-income consumers a top priority.

December 3 -

Orlando real estate broker Geo Geovanni, 49, was found guilty in federal court of one count of conspiracy to commit bank fraud and three counts of bank fraud, the U.S. Attorney's office announced.

December 3 -

A motion to limit debate on the nominee to run the consumer bureau passed along strictly party lines, setting the stage for her to be confirmed as early as next week.

November 29