Regulation and compliance

Regulation and compliance

-

Ocwen Financial Corp.'s acquisition of PHH Corp. will help the nonbank servicer rebuild scale that's been diminished by years of regulatory restrictions and the decline in distressed mortgage volume brought about by improvements in the overall housing market.

February 28 -

From accelerating its subservicing transformation to overcoming regulatory obstacles, here's a look at three reasons behind Ocwen Financial Corp.'s $360 million acquisition of PHH Corp.

February 27 -

Banking Committee Chairman Mike Crapo said he is hopeful that a bipartisan deal to roll back certain Dodd-Frank Act regulations will soon have a vote on the Senate floor.

February 27 -

Acting CFPB Director Mick Mulvaney dismissed concerns by Sen. Elizabeth Warren, D-Mass., about his leadership of the consumer agency while supporting a lighter regulatory touch for credit unions.

February 27 -

Shares of the Providence, R.I., company plunged Monday after a news report that it faces possible legal risks from the latest charges filed against Paul Manafort, the former campaign manager for President Trump.

February 26 -

Credit union executives talked up a pending regulatory relief effort while endorsing a radical shift in direction by the Consumer Financial Protection Bureau during a meeting with President Trump and other top White House officials on Monday.

February 26 -

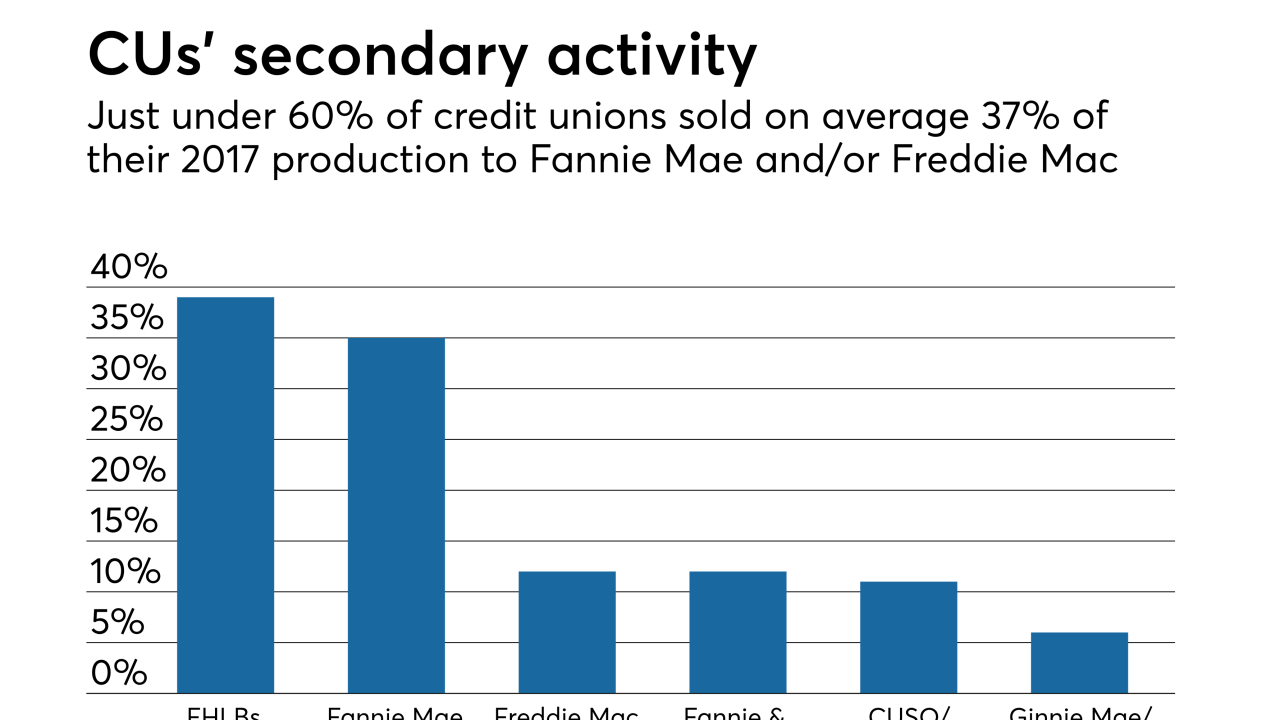

Credit unions favor housing finance reforms that would keep the government-sponsored enterprises or something similar in place, but add an explicit government guarantee to their mortgage-backed securities, according to a recent survey.

February 26 -

House Chief Deputy Whip Patrick McHenry, R-N.C., said House lawmakers are having discussions with the Senate about ways to go further on rolling back Dodd-Frank before the Senate is expected to hold a floor vote.

February 26 -

As a bipartisan regulatory relief bill approaches the finish line in the Senate, the House has mostly stood on the sidelines. But no one expects the lower chamber to just rubber-stamp the deal.

February 23 -

The war of words between acting Consumer Financial Protection Bureau Director Mick Mulvaney and Sen. Elizabeth Warren, D-Mass., the agency's architect, is escalating.

February 23 -

Commenting on the consumer bureau’s enforcement practices as part of a CFPB review could help shape regulatory reforms, but it could also draw attention to a firm’s run-in with the agency.

February 22 -

The Consumer Financial Protection Bureau is seeking comment on how to engage the public in field hearings and town hall meetings as part of a broad review of all of the bureau's processes.

February 21 -

Nearly 50 years after the federal Fair Housing Act was signed into law, banning racial discrimination in lending, black prospective homebuyers in the St. Louis area continue to be denied conventional mortgage loans at a much higher rate than whites.

February 21 -

The Supreme Court dealt hedge funds and other big investors a blow Tuesday by refusing to revive core parts of lawsuits that challenged the federal government’s capture of billions of dollars in profits generated by Fannie Mae and Freddie Mac.

February 20 -

Recent tax cuts could negatively affect home prices over the long run, according to a survey of economists and other housing market experts.

February 20 -

As the debate over housing reform heats up, policymakers should give careful consideration to a plan that recapitalizes the government-sponsored enterprises.

February 16 -

Democratic lawmakers are objecting to acting CFPB Director Mick Mulvaney's decision to strip the fair-lending office of enforcement powers.

February 16 -

Almost two years after settling mortgage securitization allegations with the Department of Justice and a group of states, Goldman Sachs has fulfilled more than half of its consumer relief commitment.

February 16 -

National MI set a record for new insurance written in the fourth quarter, but its parent company reported a net loss for the period due to tax reform.

February 16 -

Freddie Mac posted a fourth-quarter net loss of $3.3 billion and will request $312 million from the Treasury after recent tax reform legislation forced it to write down the value of deferred tax assets.

February 15