-

Home prices rose 6.9% in July compared to a year ago, according to CoreLogic.

September 1 -

Real estate owned managers can differentiate themselves and earn more business by bringing focus back to distressed property rehabilitation.

August 31 Fay Servicing

Fay Servicing -

Home prices rose 0.9% from May to June, according to Black Knight Financial Services' Home Price Index. Prices rose 5.1% compared to a year ago.

August 24 -

BlackRock Inc. is the latest company planning to finance investors who buy single-family homes, capitalizing on soaring rental demand as the homeownership rate sits at a five-decade low.

August 24 -

Banks have ramped up foreclosure activity in the past five months, with default notices, scheduled auctions and bank repossessions at their highest levels in two years. It's a positive sign that banks are finally clearing out all the distressed loans still lingering from the housing crisis. Meanwhile, banks remain cautious about new lending, partly because of regulatory actions.

August 20 -

Bank repossessions of distressed homes hit a 30-month high in July, as financial institutions continue to work through the backlog of bubble-era loans.

August 20 -

Mortgage Contracting Services will close the Utah office of its MCS Valuations subsidiary and consolidate its operations into three offices nationwide.

August 19 -

Home prices across the United States spiked 6.5% year-over-year in June 2015, including distressed sales, according to proprietary analytics provider CoreLogic.

August 5 -

Green River Capital has rolled out a new surveillance service for single-family rental properties called Retail Asset Management & Performance.

July 29 -

The Conference of State Bank Supervisors recently challenged college students to examine how community banks survived the financial crisis, and the contest highlighted innovative strategies used by Main Street banks such as Bank of American Fork in Utah.

July 28 -

The bankruptcy of Wingspan Portfolio Advisors epitomizes the existential crisis facing default servicing. This once-thriving sector of the mortgage industry now finds itself declining in lockstep with the drop in loan delinquencies and foreclosures.

July 24 -

F.N.B. in Pittsburgh reported higher second-quarter profit as it booked more commercial real estate and business loans.

July 24 -

Creditors of a Dallas-based special servicer and mortgage services firm that filed Chapter 7 bankruptcy this week include technology providers, financial institutions and property management companies.

July 16 -

Foreclosure volume was down 3% for the first six months of 2015 compared with the same time span last year, a new report from analytics firm RealtyTrac found.

July 16 -

The national foreclosure rate in May fell to its lowest level since December 2007 as the housing market showed continued signs of improvement, according to CoreLogic.

July 14 -

Blackstone Group's Invitation Homes, after spending more than $9 billion in a U.S. property-buying spree, is starting to sell some houses as it shifts focus from rapid expansion to fine-tuning its holdings.

July 13 -

Two mortgage servicers have agreed to join a group of peer institutions in following a series of guidelines to address zombie properties in New York State, Gov. Andrew Cuomo announced Thursday.

July 9 -

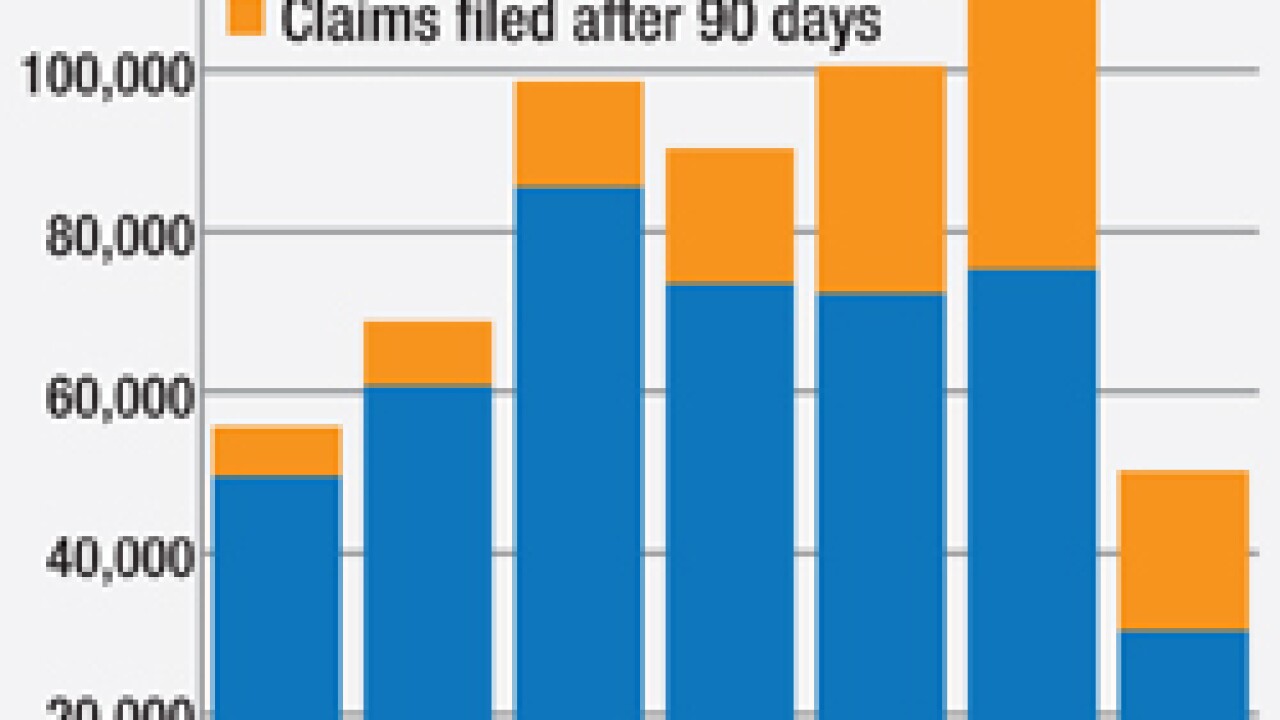

The Federal Housing Administration wants to set a hard deadline for servicers to file claims on soured mortgages. Industry executives say it should be manageable unless foreclosures surge again.

July 7 -

The share of U.S. home purchases made with cash has fallen to a five-year low as investors pull back from a property market that's rebounding without them.

July 2 -

CV Holdings agreed to a new financing arrangement with Tricadia Capital Management to expand its business of acquiring and servicing nonperforming loans.

June 30