-

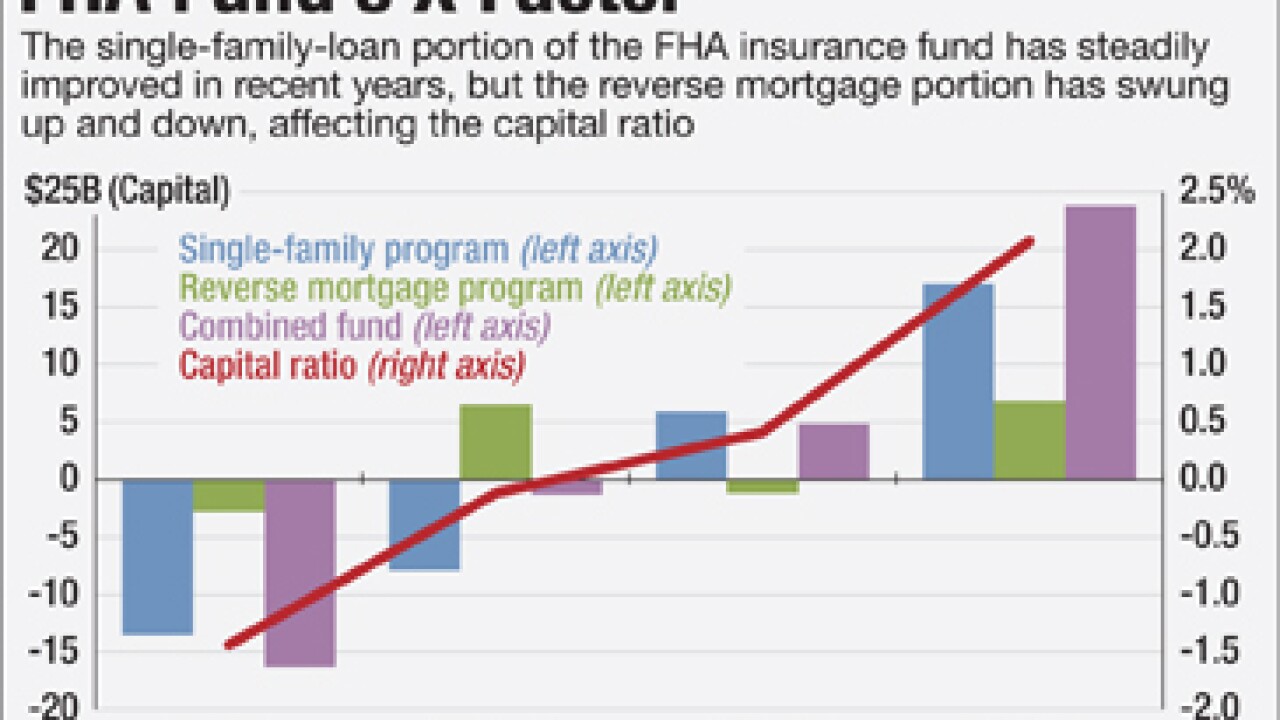

The Federal Housing Administration's annual financial report demonstrates the outsized influence of reverse mortgages on the performance of its insurance fund, fueling a debate about whether those loans belong there.

November 23 -

The Federal Housing Administration's unexpected windfall is already generating industry talk about another premium cut by the agency but FHA officials insist such discussion is premature.

November 16 -

The report from independent auditors will likely show that FHA remains below its 2% statutory minimum capital ratio, but HUD officials and outside observers still expect it to show major improvement over last year.

October 29 -

The CFPBs expanded data requirements for the Home Mortgage Disclosure Act will create a powerful tool for analyzing fair lending compliance. But some say the initiative is a massive overreach that could compromise borrower privacy.

October 23 -

Walter Investment Management has promoted its vice chairman to CEO, after Mark O'Brien said he will retire from that position.

October 5 -

Senior home equity rose by $117 billion in the second quarter, compared to the previous quarter, according to the National Reverse Mortgage Lenders Association.

September 23 -

American Advisors Group has begun marketing a jumbo reverse mortgage loan over a year after it first planned to issue them.

September 11 -

Walter Investment Management has reached a settlement with federal authorities over reverse-mortgage practices at a business unit.

September 8 -

Home Equity Conversion Mortgages have gotten a bad rap, but they're often a better alternative to home equity lines of credit for both borrowers and lenders.

September 4 Wendover Consulting

Wendover Consulting -

The Department of Housing and Urban Development's policies governing the Home Equity Conversion Mortgage program failed to detect instances where borrowers failed to comply with residency requirements, according to a report.

August 27 -

Walter Investment Management in Tampa, Fla., said its second-quarter loss widened, as it recorded a goodwill impairment charge in its reverse mortgage division.

August 10 -

A new Department of Housing and Urban Development policy will make it easier for servicers to transfer certain reverse mortgages back to HUD instead of foreclosing on widowed nonborrower spouses.

June 12 -

The Consumer Financial Protection Bureau issued a consumer advisory on Thursday warning older consumers about misleading advertisements promoting reverse mortgages.

June 4 -

Walter Investment Management Corp. dropped to a $31 million net loss on decreasing net servicing fees and a significant fair value charge to mortgage servicing rights.

May 7 -

The Department of Housing and Urban Development has rescinded a policy designed to help certain widowed spouses of reverse mortgage borrowers avoid foreclosure.

May 1 -

A new federal lawsuit is an early warning that a recent federal policy letter designed to address litigation over Home Equity Conversion Mortgage spouses' rights doesn't go far enough.

April 24

-

Freddie Mac's latest sale of risk-sharing bonds, its biggest yet, was structured in a way that will help reduce the earnings volatility that's added to concerns that the mortgage giant may again need to tap taxpayer funds.

April 23 -

The new financial assessment requirements pose a challenge, but they are necessary to the sustainability of the reverse mortgage industry.

April 15

-

NewDay Financial found itself embroiled in another regulatory order, this time stemming from allegations of rampant cheating on mortgage licensing examinations by company employees, including its chief operating officer.

April 13 -

ReverseVision has created an operations team within its company to improve its capacity management about a month after its RV Express system's last reported outage.

April 2