-

The Consumer Financial Protection Bureau's method for detecting disparate impact discrimination can overestimate potential bias, resulting in higher payments for lenders cited by the agency, according to internal CFPB documents.

September 23 -

Benjamin Solomon, Deutsche Bank AG's former global head of securitized-product trading, accused the company in a lawsuit of firing him on frivolous and unjust grounds amid an industry focus on supervisors responsibilities.

September 23 -

The Securities and Exchange Commission has settled with Thomas Lund, the former head of Fannie Mae's single-family lending unit, for $10,000, according to news reports.

September 23 -

Although new HMDA data shows no negative effects from CFPB mortgage rules that went into effect last year, industry representatives argue it isn't showing the full picture.

September 22 -

While Congress has been unable to pass housing finance reform, Fannie Mae and Freddie Mac have done a good job of adhering to some of the spirit of recent bipartisan legislation, according to Mark Zandi, chief economist at Moody's Analytics.

September 22 -

Ginnie Mae may soon raise its liquidity and cash requirements for independent mortgage banking firms since it seems almost certain that Congress won't increase the agency's budget for fiscal year 2016.

September 22 -

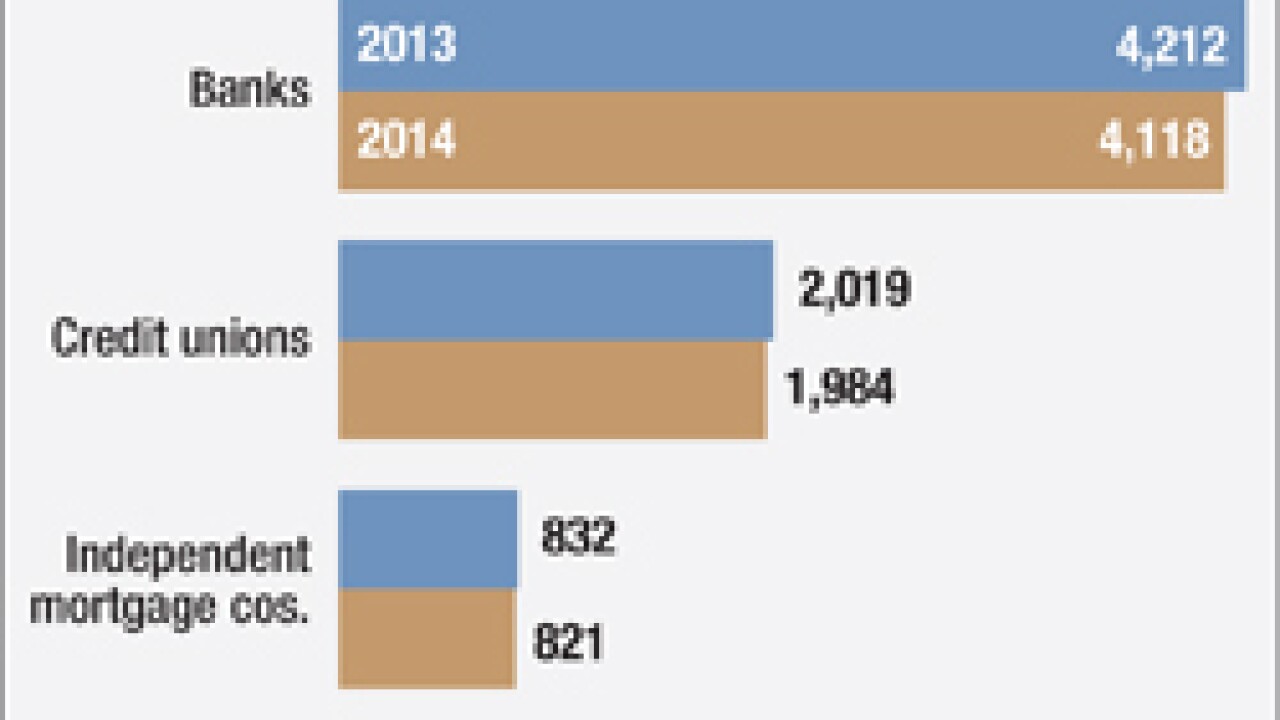

The number of mortgage originations dropped 31% to 6 million in 2014 due largely to a decline in refinancing as interest rates increased, according to a report issued Tuesday by the Federal Financial Institutions Examination Council.

September 22 -

Despite pledges last year to move aggressively to implement new credit scoring models at the government-sponsored enterprises, the Federal Housing Finance Agencys effort appears to have stalled.

September 21 -

Lenders and vendors found no bad surprises in the Truth in Lending Act/Real Estate Settlement Procedures Act integrated disclosure exam guidance, but it didn't clarify much industry confusion either.

September 18 -

Treasuries rallied with U.S. stocks, while the dollar tumbled to a three-week low after the Federal Reserve decided against curtailing stimulus that has helped propel the third-longest bull market since World War II.

September 17 -

Wells Fargo is raising minimum credit score requirements on Federal Housing Administration loans, part of the ongoing jockeying by large banks to limit lawsuits by the Justice Department for defective FHA loans.

September 17 -

Equifax has agreed to provide Fannie Mae with anonymous, loan-level FICO credit scores as part of its monthly disclosure program.

September 16 -

A report to examine the conditions surrounding last years unrest in Ferguson, Mo., is calling for officials to strengthen poor minority communities access to banking services and restrict the prevalence of predatory lending to reduce crime and poverty.

September 16 -

Loan performance has improved since the housing crisis. But credit challenges persist, while higher housing costs combined with a plateau in wages have put increased strain on some borrowers' finances.

September 15 -

Freddie Mac is making plans for its first risk-sharing transaction tied to actual losses on mortgages with higher loan-to-value ratios in the 80% to 95% range.

September 14 -

Sen. Elizabeth Warren is withdrawing her support for a Republican bill that had been on the fast track to bar the Treasury Department from selling Fannie Mae and Freddie Mac preferred shares, according to a person familiar with the matter.

September 14 -

Mission Capital Advisors in New York has merged its mortgage services business with Global Financial Review Inc. in Englewood, Colo.

September 14 -

In the wake of an unprecedented U.S. housing bust that evolved into a global financial crisis, the business of bundling home loans that aren't backed by the American government into bonds that can be sold to investors has all but disappeared.

September 11 -

The Justice Department's announcement that it would target individual executives at banks and other companies that are being investigated for wrongdoing has sparked a debate about whether the move is actually substantive or instead just designed to boost the agency's public image.

September 10 -

The rising costs to service mortgages reflects a market where there are not only downsides to being too small, but hurdles to being too large raising the question of whether there's a middle ground where servicers are not too big, not too small, but just right.

September 10