-

Mortgage rates moved higher for the seventh consecutive week, a sign that the markets are still in flux after the presidential election, Freddie Mac said.

December 15 -

When Barack Obama leaves office on Jan. 20, Democratic appointees across the government are expected to follow him out the door, to be replaced by officials chosen by Donald Trump. Not Mel Watt he isn't planning to go anywhere.

December 15 -

Fannie Mae and Freddie Mac will replace the expiring Home Affordable Mortgage Program with a new loss mitigation option called the Flex Modification.

December 14 -

The surge in mortgage rates since the November election is expected to offset the increase to lenders' short-term funding costs following the Federal Open Markets Committee's 25-basis-point increase to the federal funds rate.

December 14 -

Credit Suisse Group must face New York Attorney General Eric Schneiderman's $10 billion lawsuit accusing the bank of fraud in the sale of mortgage-backed securities prior to the 2008 financial crisis, a state appeals court ruled Tuesday in a split decision.

December 14 -

It is going take some time before it comes to fruition, but the Federal Housing Finance Agency got the ball rolling Tuesday on pushing Fannie Mae and Freddie Mac to begin purchasing manufactured housing loans.

December 13 -

Stanford Kurland will step down from his role as CEO of PennyMac Financial Services and its affiliate PennyMac Mortgage Investment Trust and assume the role of executive chairman of both as part of a broader executive reorganization.

December 13 -

One step the government can take to strengthening housing is to create a unified office dedicated to housing finance and policy, streamlining and making more efficient existing agencies and programs.

December 13 The Collingwood Group

The Collingwood Group -

The Federal Housing Finance Agency finalized a rule Tuesday that will create a "duty to serve" for Fannie Mae and Freddie Mac to help low- and moderate- income consumers, including encouraging a secondary market for manufactured housing loans.

December 13 -

SoFi Lending Corp.'s securitization of its student loan refis for high net worth individuals is now a model for its recent expansion into super prime jumbo mortgages.

December 13 -

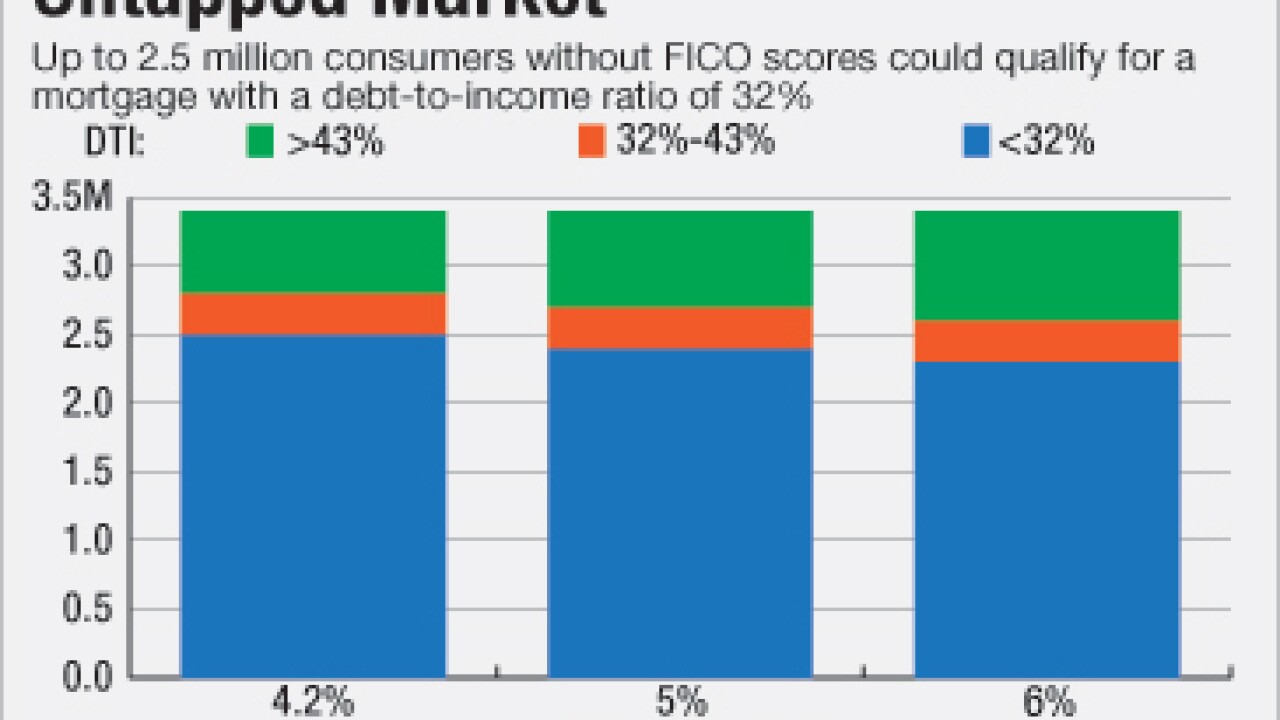

Many consumers without traditional credit scores have nearly identical risk profiles to those who can be assessed the conventional way, representing an untapped market, according to a report by VantageScore.

December 12 -

Rising mortgage interest rates affect the volume of refinance and purchase originations, but don't necessarily spell bad news for home prices, explains Fannie Mae Chief Economist Doug Duncan.

December 12 -

Fannie Mae and Freddie Mac will again halt evictions nationwide for foreclosed properties during the holiday season.

December 12 -

A group of traders in JPMorgan's investment bank has expanded from selling commercial mortgage-backed securities to underwriting loans that are unsuitable for bonds, such as those for big construction projects.

December 12 -

A former Cantor Fitzgerald & Co. trader was charged with defrauding customers by lying about prices of mortgage-backed securities, becoming the latest target of a U.S. crackdown on deceptive practices in the bond market.

December 12 -

Manufactured housing advocates are "guardedly optimistic" that the Federal Housing Finance Agency will soon issue a long-awaited final rule that they hope will expand the secondary market for mobile homes.

December 12 -

One of latest proposals for reviving the private-label residential mortgage market involves improving communications between issuers and investors.

December 9 -

The Mortgage Industry Standards Maintenance Organization is proposing a standard for the maintenance and sharing of commercial and multifamily real estate rent-roll information.

December 9 -

A bipartisan duo of House lawmakers introduced a bill Thursday that would push Fannie Mae and Freddie Mac to engage in more credit risk-sharing transactions.

December 8 -

Digital mortgages are not an idea for the future; they are here to stay, and the mortgage industry must put aside its misplaced fear of technology and change and embrace them.

December 8 Pavaso

Pavaso