-

Freddie Mac has released a new online tool for lenders that determines whether a borrower's income qualifies them for a low down payment mortgage on a particular property.

August 9 -

Marketplace lender Lending Club has added Fannie Mae Chief Executive and President Timothy Mayopoulos to its board of directors.

August 8 -

Fannie Mae and Freddie Mac could need as much as $126 billion in bailout money from taxpayers in a severe economic downturn, according to stress test results released by their regulator.

August 8 -

The former officers and directors for Midwest Bank & Trust have reached a $26.5 million settlement with the Federal Deposit Insurance Corp. over charges of negligence during the financial crisis.

August 8 -

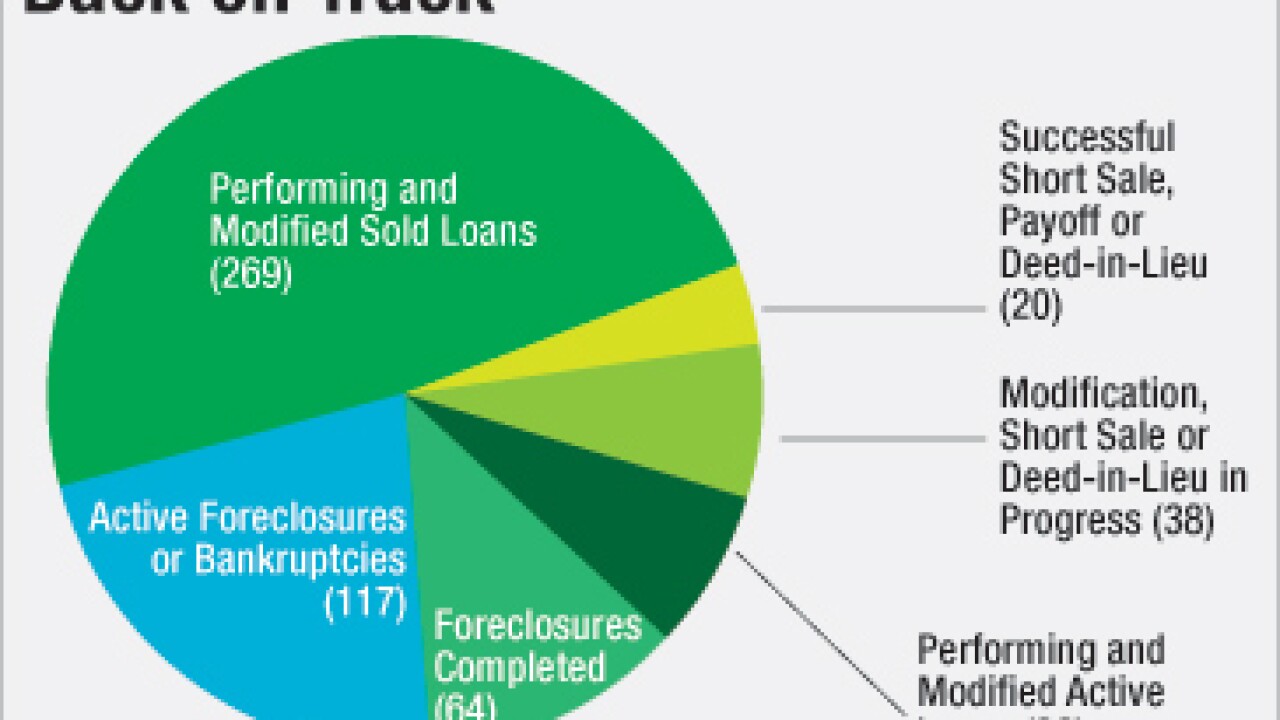

Community development entities like New Jersey Community Capital and Hogar Hispano are being guaranteed a portion of the secondary market for distressed mortgages. They are doing a good job of forestalling foreclosures, but skeptics question whether that run will last.

August 5 -

Two Harbors, which last week announced it was getting out of the private-label mortgage securitization business, is marketing one last deal.

August 5 -

Returning Fannie Mae and Freddie Mac to their status as privately owned public utilities is consistent with their mandate and makes the most policy sense.

August 4

-

Settlements related to court fights over private-label mortgage-backed securities are significantly boosting the bottom lines at a few Federal Home Loan banks.

August 4 -

Incenter Mortgage Advisors is brokering the sale of an $8.9 billion Ginnie Mae bulk residential mortgage servicing rights portfolio.

August 4 -

Essent Group reported higher net income for the second quarter of 2016 as the company wrote more insurance year-over-year.

August 4 -

Genworth Financial is looking at separating its mortgage insurance business from its life insurance line after it does the same for its long-term care insurance unit.

August 4 -

Mortgage rates declined for the first time in four weeks as the bond market reacted to the news from the Federal Reserve Board's July meeting, according to Freddie Mac.

August 4 -

NMI Holdings reported second-quarter net income of $2 million, making it the first time the company founded in 2012 has ended a period in the black.

August 3 -

Ocwen Financial Corp. is marketing $500 million of notes backed by reimbursement rights to funds it has advanced on residential mortgages that it services.

August 3 -

Benefiting from higher loan guarantee income and lower derivative losses, Freddie Mac said Tuesday it had made $993 million in the second quarter, a dramatic reversal from its $354 million loss a quarter earlier.

August 2 -

Greenlight Capital Re Ltd., the reinsurer seeking to reverse underwriting losses, is pushing into the mortgage guaranty market after being burned by fraudulent claims on property policies in Florida.

August 2 -

Mid America Mortgage in Addison, Texas, has executed its first electronic closing and e-note through its retail origination channel. The closing builds on the company's plan to expand e-closings and e-notes across all of its origination channels.

August 2 -

The average single-family guarantee fee paid to Fannie Mae and Freddie Mac only increased by two basis points in 2015 to 59 bps, according to the Federal Housing Finance Agency.

August 1 -

MGIC Investment Corp. has begun a public offering of $350 million in senior notes.

August 1 -

The Federal Housing Administration is promoting a particular kind of financing for residential energy retrofits that another regulator staunchly opposes. Mortgage lenders and investors have qualms, too, about the impact on their standing in collateral claims.

July 29