-

But it is still looking to conserve capital to cover future delinquencies and will likely halt dividends to the parent company.

May 6 -

But Black Knight and Arch Capital's mortgage insurance business aren't as affected, at least so far.

May 5 -

Net income grew by nearly 1,990% year-over-year as its core mortgage services businesses gained scale.

May 1 -

The first-quarter loss ended a two-quarter profitability streak the company hoped to maintain.

April 30 -

Refinancing drove a 75% year-over-year increase in mortgage banking revenue during the first quarter at Flagstar Bancorp as it shored up its operations to avoid other negative repercussions from the coronavirus.

April 28 -

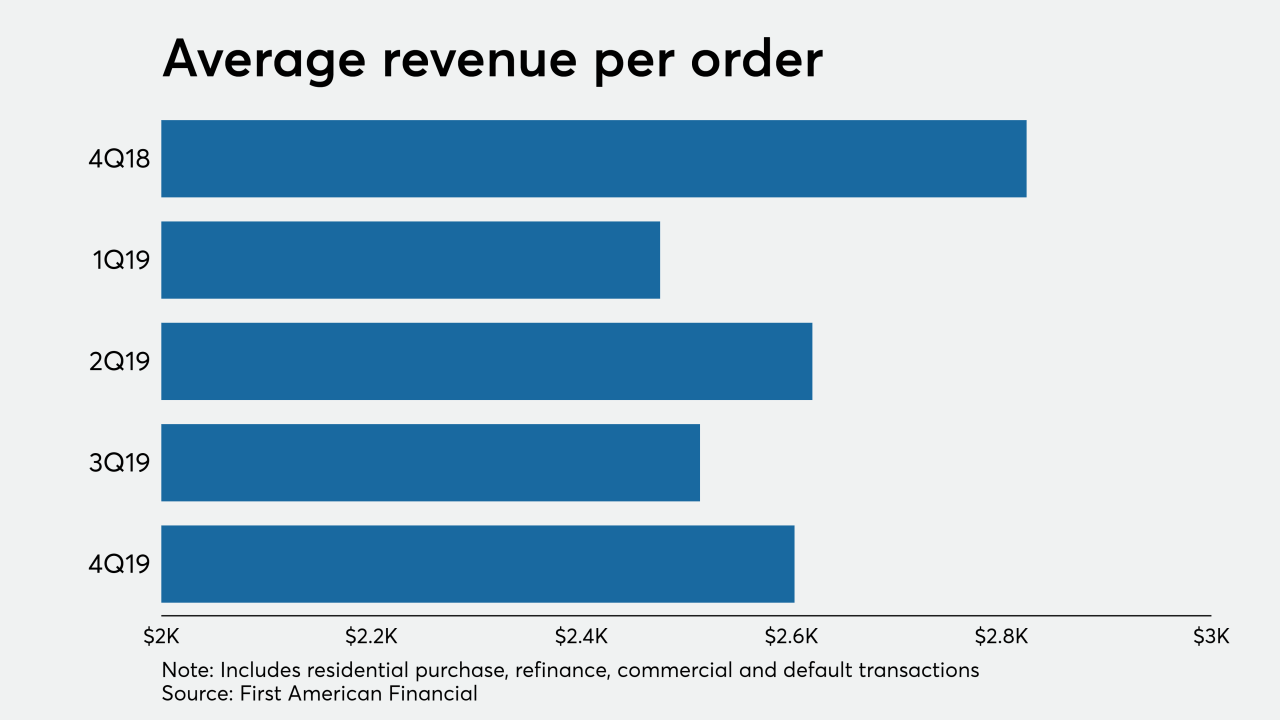

Low mortgage rates increased new orders, but fallout from the pandemic hurt investment income.

April 23 -

Declines in mortgage servicing rights valuations at JPMorgan Chase and Wells Fargo point to the resurgence of a dilemma that came up during the last downturn.

April 15 -

The coronavirus relief legislation could result in private mortgage insurers having to hold more capital, a B. Riley FBR analyst report said.

April 6 -

Two Harbors, a real estate investment trust, sold the bulk of its nonagency mortgage-backed securities portfolio to head off margin calls and refocus on its more favorable agency-MBS investments.

March 26 -

Mortgage real estate investment trusts are taking stock of their financial ability to respond to market shocks and other concerns stemming from the coronavirus.

March 17 -

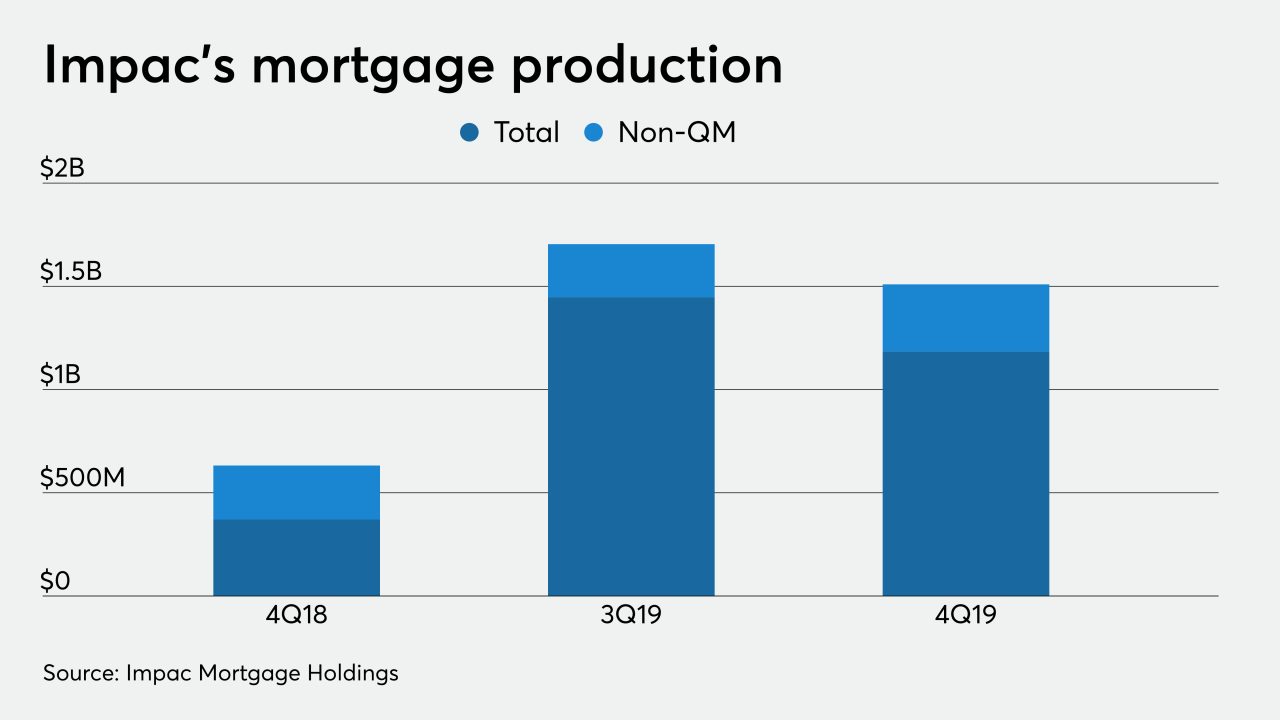

Impac Mortgage Holdings decided a year ago to emphasize its non-qualified mortgage lending operations and placed the company in position to succeed when the housing market returns to normal.

March 13 -

Bank of America cut its ratings and price targets on several homebuilders and building products companies as the firm is bracing for the "inevitable" coronavirus impact on the U.S. housing market.

March 12 -

The 10-year Treasury yield fell below 0.5% and the 30-year yield dropped under 0.9%, taking the whole U.S. yield curve below 1% for the first time in history.

March 9 -

Altisource Portfolio Solutions lost nearly the same amount of money as it did for the whole year while it continued the business transition started in 2018.

March 6 -

CoreLogic's fourth-quarter earnings reflect the success of the transformation to an appraisal management company business model accelerated in the prior-year period.

February 27 -

The cancellation by New Residential of a money-losing subservicing agreement should benefit Ocwen's financial results going forward, the company said.

February 26 -

Mr. Cooper Group reported fourth-quarter net income of $461 million, aided by the recovery of its deferred tax asset and a positive mark-to-market on its servicing portfolio.

February 25 -

Fidelity and Essent reported higher year-over-year profits in the last three months of 2019 as refinancing increased business volume, but Black Knight took a hit on its Dun & Bradstreet investment.

February 14 -

First American Financial, a title insurance underwriter and settlement services provider, is acquiring mortgage document firm Docutech for $350 million in cash.

February 13 -

NMI Holdings saw its insurance-in-force grow 38% over the past year as 90% of its clients used its black box pricing module during the fourth quarter.

February 12