-

Today's mortgage broker is tech savvy, sophisticated and better equipped to thrive in a wholesale channel that's far more competitive than in the past.

March 8 -

Mortgage lenders are embracing the broker-wholesale channel as a low-cost way to extend their reach and maintain volume in the face of rising home prices and interest rates that are putting a damper on origination activity.

March 8 -

Tight margins, regulatory clarity and a renewed appetite to expand have made mortgage brokers and the wholesale channel attractive again, at least to the small and medium mortgage lenders.

March 8 -

Ocwen Financial Corp. fired Otto Kumbar, executive vice president of lending, as the company significantly reduces its origination business.

February 13 -

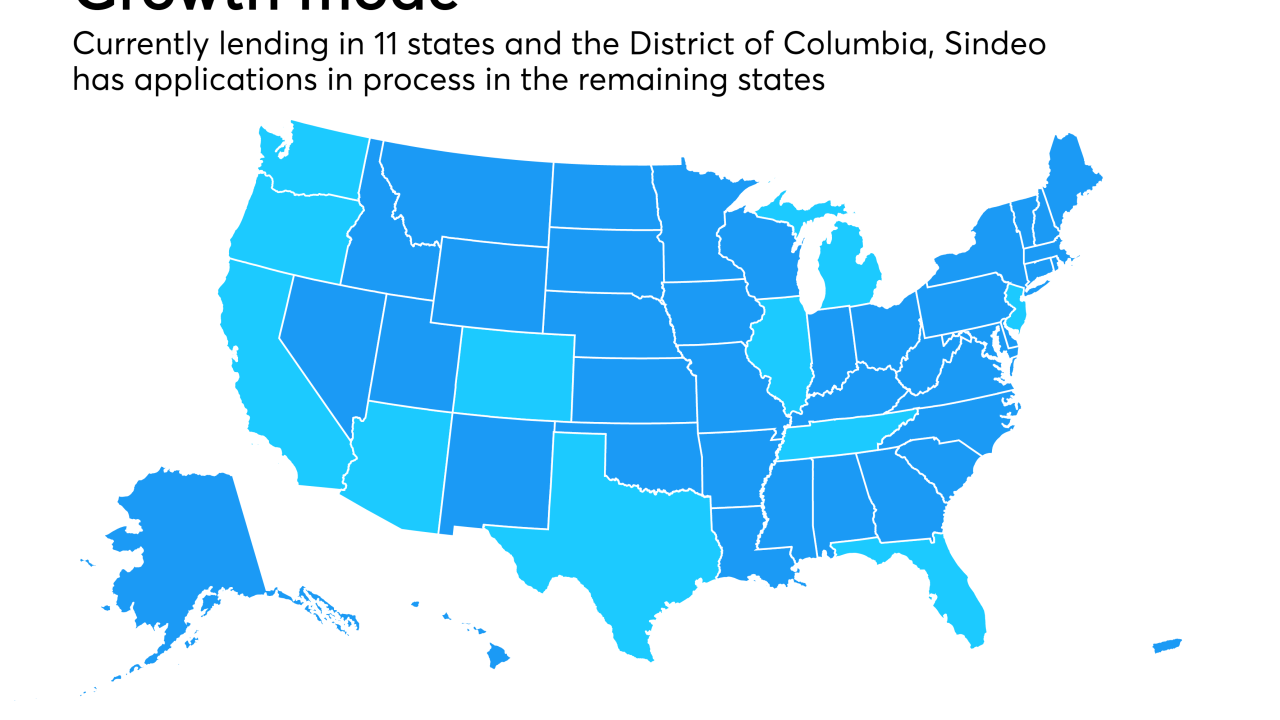

When a $40 million round of venture funding fell through at the last minute, digital mortgage broker Sindeo all but shut down this summer. Now recapitalized and rejuvenated, founder and CEO Nick Stamos explains why Sindeo is ready to grow again.

November 21 -

Mid America Mortgage's deal to acquire the assets of two Oklahoma City-based lenders will double the Addison, Texas, company's loan volume.

November 15 -

Walter Investment Management Corp. is looking to file for bankruptcy protection by Nov. 30, after lining up $1.9 billion of debtor-in-possession warehouse financing.

November 10 -

Impac Mortgage Holdings' nonqualified mortgage origination volume increased 248% year-over-year in the third quarter as the company accumulates loans for a planned securitization next year.

November 9 -

From Secretary Carson easing lending concerns to Fannie Mae announcing its expansion of Day 1 Certainty, here's a look at seven things we learned at the 2017 MBA Annual.

November 3 -

Ocwen Financial Corp. lost $6.1 million in the third quarter, as pretax losses from its origination business outweighed any profits generated from the servicing side.

November 2