-

If GSE reform leads to the 30-year mortgage's demise, homebuyers' monthly payments could soar by $400, according to a recent Zillow estimate. But lenders aren't convinced this housing finance staple is in any danger of being replaced.

March 12 -

Today's mortgage broker is tech savvy, sophisticated and better equipped to thrive in a wholesale channel that's far more competitive than in the past.

March 8 -

Mortgage lenders are embracing the broker-wholesale channel as a low-cost way to extend their reach and maintain volume in the face of rising home prices and interest rates that are putting a damper on origination activity.

March 8 -

Tight margins, regulatory clarity and a renewed appetite to expand have made mortgage brokers and the wholesale channel attractive again, at least to the small and medium mortgage lenders.

March 8 -

Ocwen Financial Corp. fired Otto Kumbar, executive vice president of lending, as the company significantly reduces its origination business.

February 13 -

When a $40 million round of venture funding fell through at the last minute, digital mortgage broker Sindeo all but shut down this summer. Now recapitalized and rejuvenated, founder and CEO Nick Stamos explains why Sindeo is ready to grow again.

November 21 -

Mid America Mortgage's deal to acquire the assets of two Oklahoma City-based lenders will double the Addison, Texas, company's loan volume.

November 15 -

Walter Investment Management Corp. is looking to file for bankruptcy protection by Nov. 30, after lining up $1.9 billion of debtor-in-possession warehouse financing.

November 10 -

Impac Mortgage Holdings' nonqualified mortgage origination volume increased 248% year-over-year in the third quarter as the company accumulates loans for a planned securitization next year.

November 9 -

From Secretary Carson easing lending concerns to Fannie Mae announcing its expansion of Day 1 Certainty, here's a look at seven things we learned at the 2017 MBA Annual.

November 3 -

Ocwen Financial Corp. lost $6.1 million in the third quarter, as pretax losses from its origination business outweighed any profits generated from the servicing side.

November 2 -

A joint venture between loanDepot and OfferPad will broker loans for consumers who need financing to bridge gaps between the sale of one property and the purchase of another.

November 2 -

Walter Investment Management Corp. was supposed to prosper by snapping up mortgage cast-offs from big banks at fire-sale prices. Instead, Walter is belatedly joining the list of companies burned by the U.S. housing crisis.

October 25 -

From recruitment strategies to leveraging technology without losing the personal touch, here's a look at four challenges and opportunities for the resurgent mortgage broker channel.

October 12 -

Quicken Loans Mortgage Services and Calyx Software developed a version of the Point loan origination system that's preconfigured with tools for small mortgage firms to work with the Detroit lender's TPO division.

October 11 -

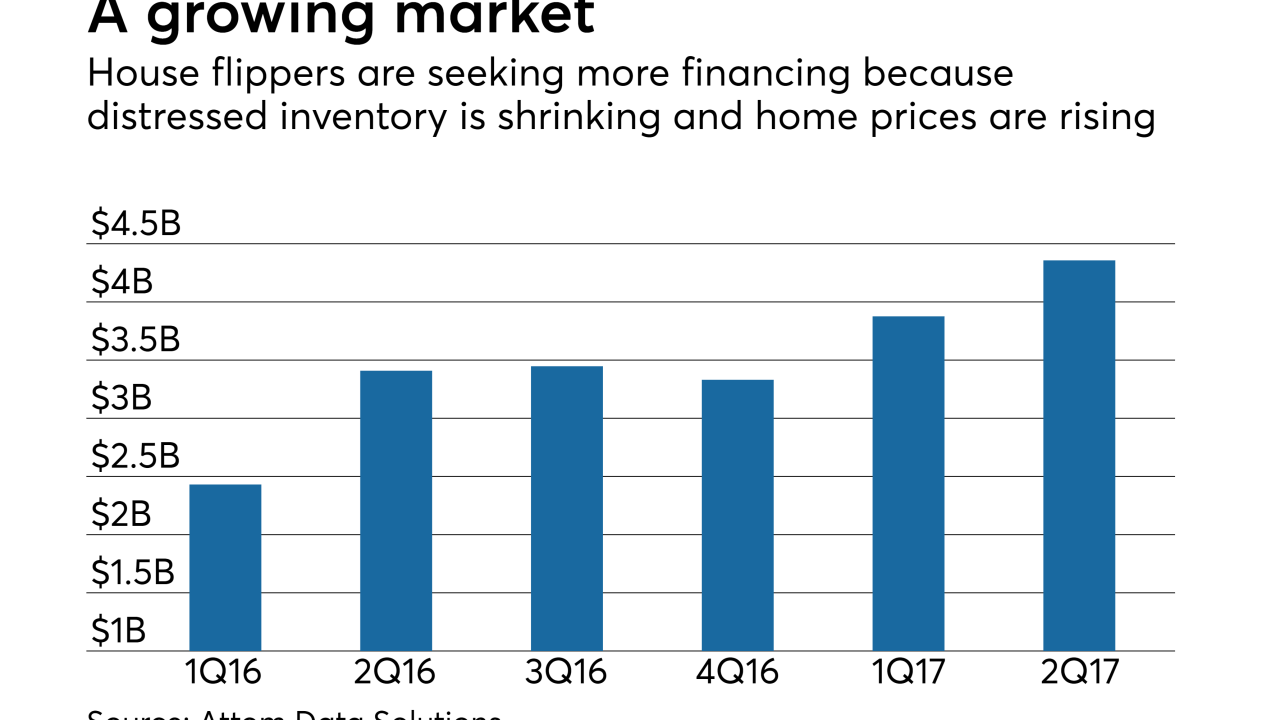

A new wholesale loan channel at CoreVest will work with mortgage brokers who are starting to source loans to house flippers for the first time.

September 28 -

The shift to a purchase market and an increase in wholesale mortgage originations contributed to a nearly 17% year-over-year rise in fraud risk during the second quarter, according to CoreLogic.

September 19 -

Walter Investment Management Corp. is in danger of having its stock delisted from the New York Stock Exchange as its average market capitalization remains below required minimums.

August 17 -

Western Bancorp, a wholesale mortgage originator, was acquired by Eli Global, a privately held investment company. Terms of the deal were not disclosed.

August 16 -

There is substantial doubt about Walter Investment Management Corp.'s ability to continue as a going concern if a restructuring plan is not approved and it needed to file a prepackaged bankruptcy plan.

August 10