-

National Mortgage News takes a look back at some of the major or unique transactions which went on, or in some cases didn't happen, in the past 12 months.

December 29 -

The announcement follows Realpha's two previous mergers with mortgage brokerages, as well as its purchases of AI firms and title businesses.

December 23 -

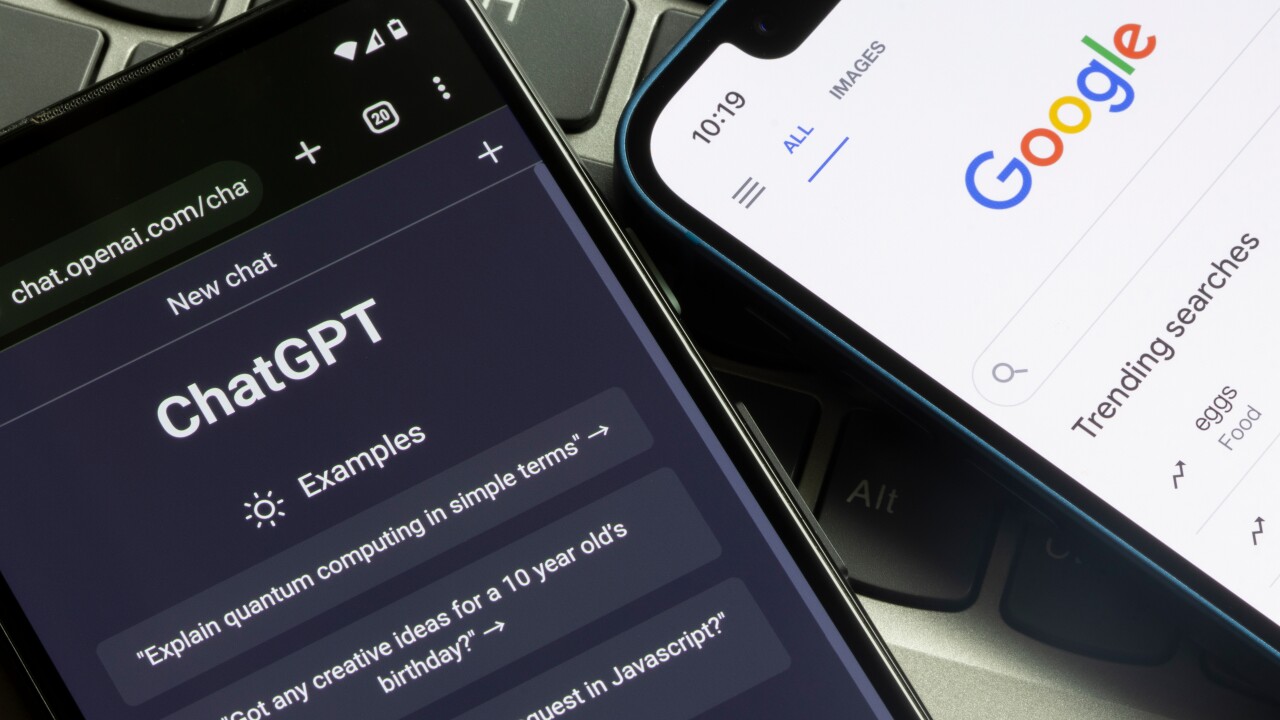

AI tools like ChatGPT are reshaping mortgage marketing, forcing lenders to rethink SEO, brand authority and how they show up as consumers turn to generative search for answers.

December 23 -

Overall satisfaction is highest when customers receive status updates from mobile apps, according to the J.D. Power's 2025 U.S. Claims Digital Experience Study.

December 22 -

Our experts expect a mortgage market reset in 2026 with an uptick in originations, but warn lenders not to skimp on compliance even as the reins loosen.

December 22 -

Hart, who came over from Ellie Mae, starts in the position of Jan. 1, as Tim Bowler moves to a new role within ICE's Fixed Income and Data Services division.

December 16 -

The executive order described state legislation on artificial intelligence as a cumbersome patchwork, and pledged to develop a national framework.

December 12 -

ETHZilla partnered with Zippy to bring manufactured home chattel loans on-chain as tokenized real-world assets.

December 11 -

The rent reporting platform says it's helped tenants raise their credit scores by double digits and unlocked $30 billion more in mortgage lending.

December 11 -

A former employee cited a ransomware gang's claim in October that it stole 20 terabytes of sensitive customer information from the industry vendor.

December 10