I often wonder if the Treasury Department—which owns Fannie Mae—has actually tried to call (on the telephone) Seterus, the servicing division of IBM that the GSE is apparently using to handle its lousy loans. As reported by the National Mortgage News website on Friday, it appears that Seterus was awarded a chunk of the $73 billion MSR package that Fannie bought from B of A. Of course, we don't really know if Fannie bought it, but that's a different matter. (See the full story at

Meanwhile, disgruntled mortgagors are already taking their complaints about Seterus to the web. One poster on a website called 'Scam Informer' posted this: “Seterus won't take payments unless I pay late charges. They took over my loan and did not inform me.” Some of the grammar was cleaned up by me, but you get the picture. But does Fannie know? Does the U.S. Treasury? I would love to hear from management about what exactly IBM is doing in the mortgage space, but I'm not holding my breath…

IN THE GOP WE TRUST: It appears that mortgage interest deduction is safe. How do I know this? Answer: House Speaker John Boehner late this week affirmed GOP opposition to any tax increases to solve then nation's debt crisis. In the Republican playbook eliminating a tax deduction (like mortgage interest payments) is the same thing as a tax hike…

Meanwhile, here's a theoretical economic question to ponder: Can a nation start growing again if all we do is cut spending? If you were running a business (and many of you are) would spending cuts put you in the black for good? Maybe they would—over the short term. But over the long haul?...

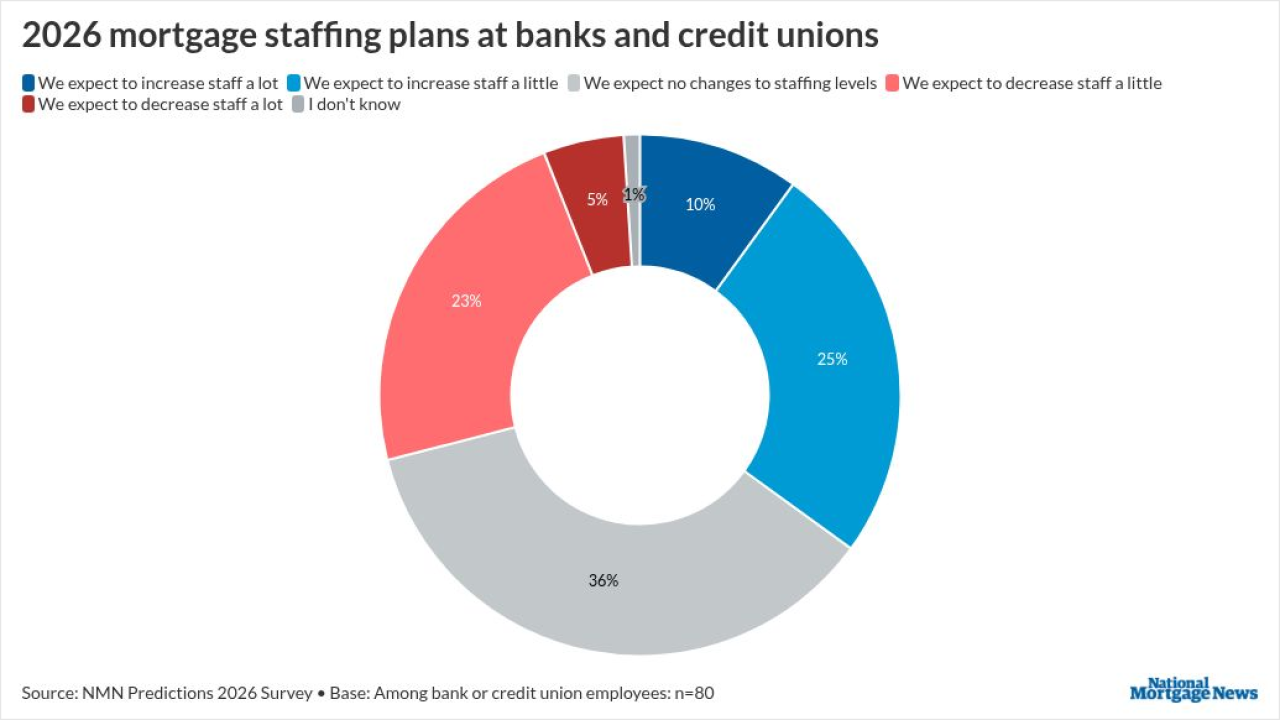

As for the mortgage job market, on Monday NMN will be printing a feature about who's hiring, and who is not. (Obviously, Bank of America is not.)

Don't subscribe? Call 800-221-1809. A subscription gets you access to all the premium content on our website…

A GRAND EXPERIMENT IS ABOUT TO BEGIN: It looks as though the GSE loan limit of $729,750 will expire, as scheduled, on Sept. 30. Will the jumbo conduits come out of the woodwork and fill the void? Redwood Trust, start your engines…

REO BEAT: The Federal Housing Administration is selling 11,000 to 13,000 foreclosed homes a month after re-engineering the way it manages and markets REO.

JUST A LITTLE LOW: Faulty mortgages and foreclosure abuses have cost the nation's five biggest home lenders at least $65.7 billion, according to a tally by Bloomberg News. That's it? Bloomie may want to revisit the blackboard. That number is what it will wind up costing just Bank of America and HSBC. Remember Household Finance?

BIG SCOOP: We understand that actor/former journalist/lawyer Ben Stein (he of “Ferris Bueller's Day Off” fame) is about to become a national spokesman for a midsized mortgage lender. Stay tuned…

It seems as though an increasing number of somewhat well-known actors (mostly men) are showing up as pitchmen for reverse mortgages. But Robert Wagner, the former star of the TV show “It Takes a Thief”? Al Monday phone home. Does Darryl Hicks know?...

WHAT'S GOING ON OVER AT ALLONHILL? Three officials—including chief operating officer Craig Wildrick—recently left the firm.

WASHINGTON NEWS: The Mortgage Bankers Association is urging the Federal Housing Administration to reopen its 203(k) program to local investors wanting to buy and renovate foreclosed properties. The Department of Housing and Urban Development slapped a moratorium on investors using the 203(k) program back in 1996 due to abuses and fraudulent activities. (Reporting by NMN's Brian Collins.)

MUST ATTEND MORTGAGE CONFERENCES: It's not too late to attend: On Sept. 19-20 NMN and SourceMedia will hold its Mortgage Regulatory Forum show at the Washington Marriott in the nation's capital. Speakers include OCC chief John Walsh, Rep. Shelley Moore Capito, R-W.Va., and Rep. Barney Frank, D-Mass. I will be roaming the hallways, too. More info visit

IMPORTANT DATA STUFF: MortgageStats.com is alive and well. This exclusive only data website has been updated to include not only full year 2010 figures but first and second quarter information as well. MortgageStats boasts the nation's top 400 lenders and servicers, including hard volume numbers and contact information. It also includes exclusive monthly analysis from me. (You can't get this information anywhere else.) For more information drop an email to

I'm

THE LAST WORD: Go see the movie “The Debt.” It's not about mortgages.