-

Less than 45% of mortgage residential properties in the United States were equity-rich last quarter, a 1.5-percentage-point drop from the third quarter.

February 3 -

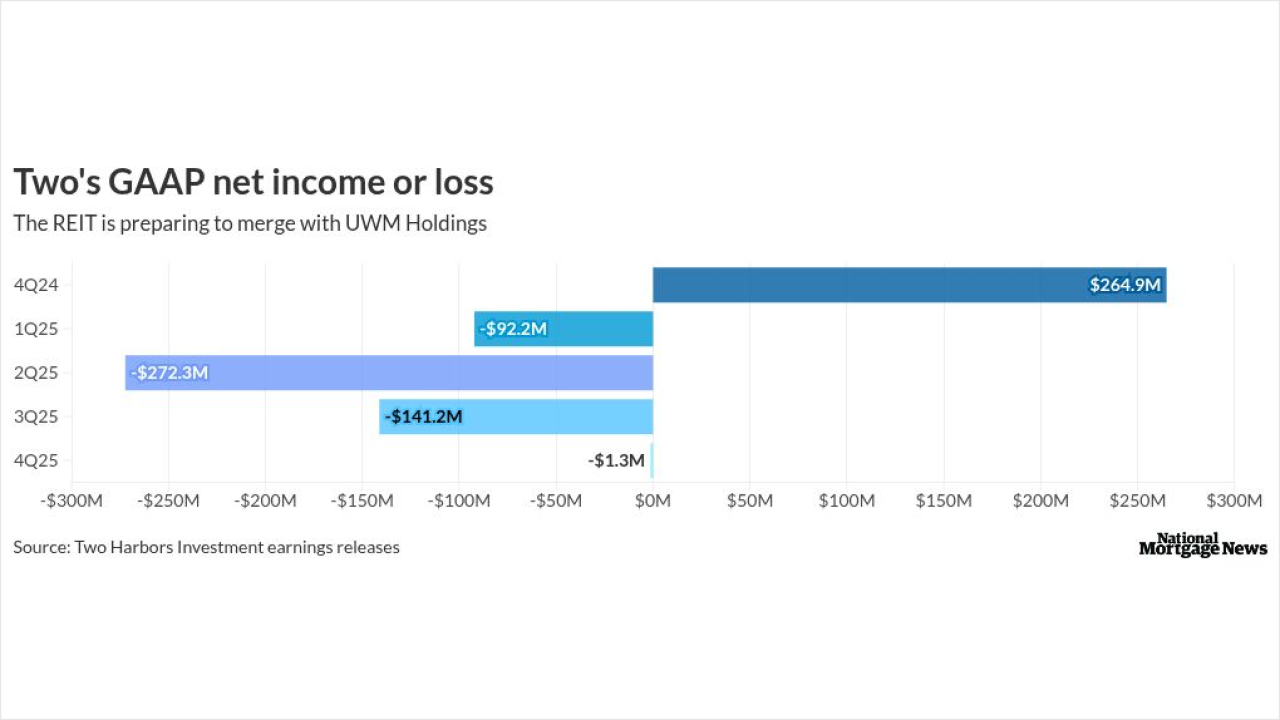

As measured by earnings available for distribution at the REIT, Two posted a profit of $0.26 per share but this was well below the consensus estimate of $0.37.

February 3 -

-

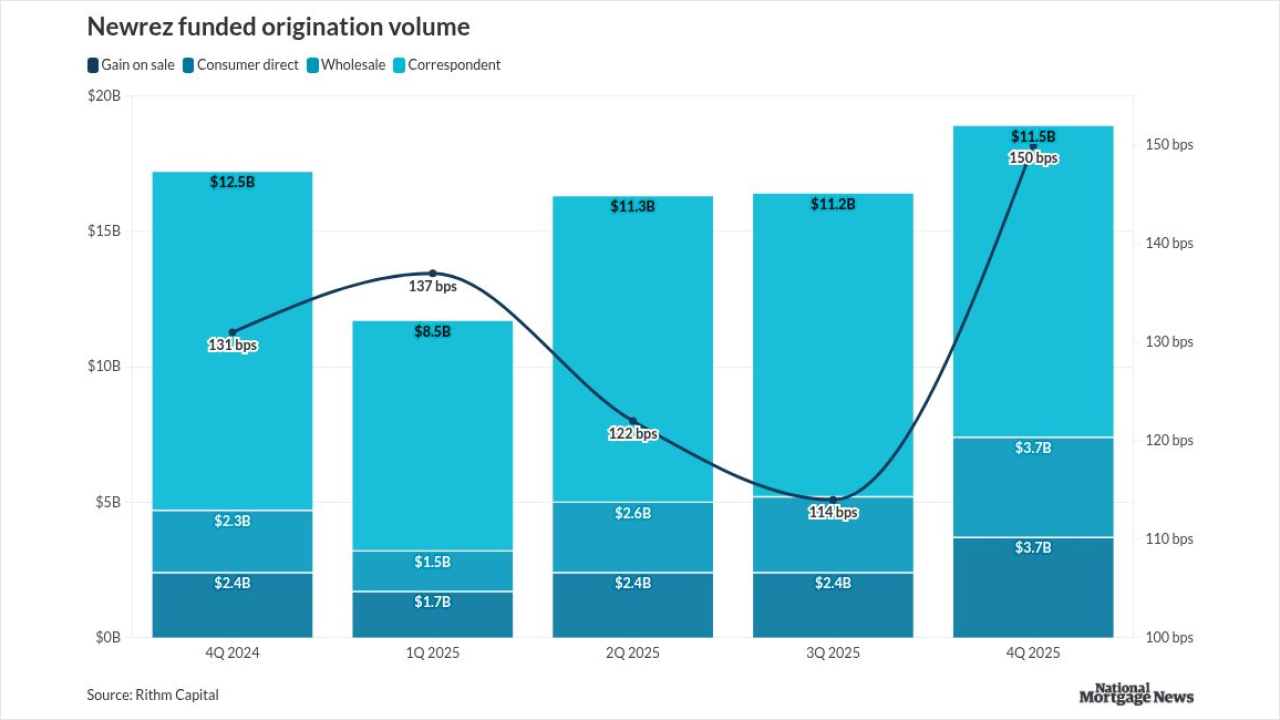

Mortgage rate trends in late 2025 led the lender into the red in the fourth quarter, even as Newrez originations picked up from the prior quarter and year.

February 3 -

Mortgage subsidiary Newrez expects to begin moving borrowers onto the platform by 2027, with the deal marking its second major tech investment this year.

February 2 -

Preemption would hurt affordability for many, the Conference of State Banking Supervisors and the American Association of Residential Mortgage Regulators said.

January 30 -

The high court, without comment, refused Emigrant Mortgage's appeal of a verdict holding it liable for no income, no asset verification loans to minorities.

January 30 -

The reverse mortgage companies squeezed thousands of dollars out of aging homeowners through various illegal fees, according to a new class action suit.

January 30 -

Competition that impacted margins and prepayments in excess of expectations were challenges during the period, but executives report first quarter improvement.

January 29 -

VA- and FHA-backed mortgages helped drive the increase in property volume, but sales did not maintain the same pace, according to Auction.com.

January 29