The Democratic and Republican platforms adopted at this year's party conventions take a more forward-looking approach to housing issues than they did four years ago. But they have distinctly different views on the government's role in maintaining a robust mortgage industry.

A key difference between the two platforms lies in the question of whether the government should strengthen its support and enforcement of diverse and evenly-distributed lending.

Democrats seek to rely on fair lending regulation or enforcement to promote government programs that will make it easier to lend to diverse groups of borrowers.

"Over the next decade most new households will be formed by families in communities of color, which typically have less generational wealth and fewer resources to put towards a down payment," the platform says, noting that this is why steps to close "racial and wealth gaps" are important.

Meanwhile, Republicans pledge to lighten the industry's heavy regulatory burden by scaling back or removing requirements that benefit borrower groups and cutting back programs that help support broader lending.

"We will end the government mandates that required Fannie Mae, Freddie Mac, and federally-insured banks to satisfy lending quotas to specific groups," the Republican platform states.

Specific housing finance-related government entities and programs that could head in different directions depending on the party that prevails in the election include the Consumer Financial Protection Bureau, Fannie Mae and Freddie Mac, the National Housing Trust Fund, the Department of Housing and Urban Development and its insurance arm, the Federal Housing Administration.

The two parties are most clearly divided on the CFPB, which regulates not just mortgage lenders but financial services broadly.

The Democrats specifically pledge to defend the CFPB and "oppose any efforts to change the CFPB's structure," while the Republicans are critical of it, and seek to make it subject to an appropriations process

Also

The current Democratic platform does not specifically mention Fannie and Freddie but it does say it would support the National Affordable Housing Trust Fund, which some of the

Also the Democrats' support of programs aimed at more evenly distributing funds to different groups of borrowers across income levels and ethnic groups, combined with the government's current domination of the secondary mortgage market, suggests Fannie and Freddie would be used to meet this goal.

In contrast, the Republican platform seeks to "scale back the federal role in the housing market, promote responsibility on the part of borrowers and lenders, and avoid future taxpayer bailouts."

It is unclear whether the mortgage industry will support a particular party based on housing finance statements in their platforms. Platforms generally have had little bearing on voter decisions, and the party may depart from them as time goes on. Also the promises in the platforms are vague when it comes to housing.

In a recent survey commissioned by mortgage and consumer lender LoanDepot, 36% of respondents said the presidential candidates from both parties are doing a poor job of articulating their policies on housing and financial matters, and 35% said they want to hear more on these topics from the candidates.

"I think the two platforms are similar in that they both lack a level of detail in their housing plans that would really allow us to dig in to determine the costs of their plans and the impact," said Alanna McCargo, co-director of the Urban Institute Housing Finance Policy Center.

But collectively, the platforms do cover the broad issues the center sees as crucial for the mortgage industry in the next four years: the government's role in housing finance and GSE reform, housing and rental access, consumer protections for housing and their tone or general direction on regulatory reform overall, she said.

Both parties are more focused on rental housing than in the past due to the increased renter share in the market and need for more affordable housing, said McCargo, who previously worked as an executive at CoreLogic, JPMorgan Chase and Fannie Mae.

Generally, mortgage bankers and brokers are likely to see the choice between the two parties as a choice between the devil they do know and they devil they don't, said Gibran Nicholas, chairman and CEO of the CMPS Institute, which provides certification, training and technology for these groups.

"The Democratic platform is more of the same, which may be good or bad," he said.

The Democrats pledge to maintain the CFPB, which some mortgage bankers and brokers view negatively. But the Democrats promise to maintain, stabilize and possibly even expand GSE and FHA programs and these moves are viewed positively by the mortgage industry, said Nicholas.

On the other hand, mortgage companies tend to prefer the Republican platform's plans to reform or rescind the CFPB over the Democrats plan to maintain the status quo, he said.

While a full repeal of the Dodd-Frank Act and the CFPB is highly unlikely, some mortgage bankers and brokers view other Republican proposals could stabilize the bureau's rulemaking and enforcement as paving the way for them to spend less on compliance systems, and more on other types of automation, said Nicholas.

"Whenever they make an expenditure, they might think, 'Is this going to keep my customer happy?' instead of 'is this going to keep my regulator happy?"

On the other hand, the Republican platform suggests short-term uncertainty when it comes to the GSEs and the FHA.

"It may be a final resolution to the

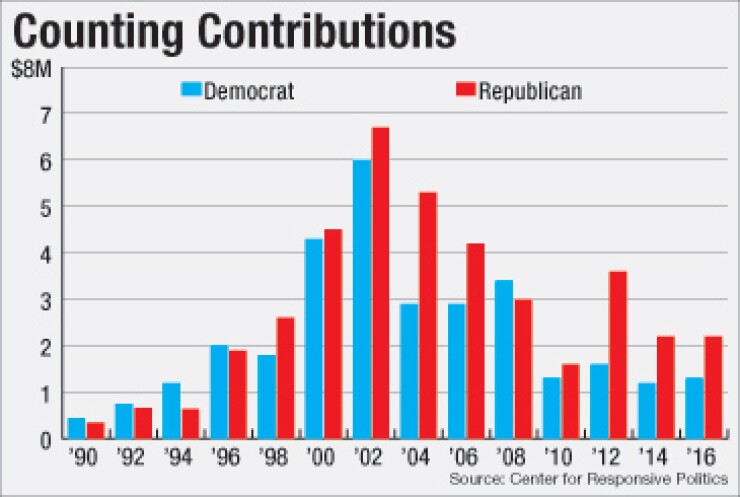

Mortgage banker and broker donations to Republicans have been higher than donations to Democrats, but the Presidential candidate that has received the most money has been Democratic nominee Hillary Clinton, according to the

While there are some distinct differences between the parties on certain issues, with Republicans generally leaning toward less government involvement and Democrats leaning toward more, there have been exceptions to this and their policies have dovetailed or run counter to expectations.

While some Republican leaders, for example, have been more associated more with plans to reduce taxpayer exposure to Fannie and Freddie by winding them down than the Democrats, their current platform mentions scaling them back instead.

But meanwhile, last year, Democratic President Barack Obama last January called for a

While the Democratic platform makes no direct mention of the GSEs, a complete wind down of both agencies seems unlikely. Clinton has been associated with a plan that proposes to

It's unclear what Republican nominee Donald Trump's position on the GSEs is as he has been largely silent on the topic.