Upcoming risk retention requirements may be the proverbial straw that breaks the back of the commercial mortgage-backed securities market.

Lenders already beset by several issues, including economic and political uncertainty and regulatory pressure to pull back from the commercial real estate market, will be required to retain at least 5% of the credit risk under new rules to take effect Dec. 24.

"A lot of the industry feels the regulators have overshot," said Christina Zausner, vice president for industry and policy analysis at the Commercial Real Estate Finance Council. "The combined effects of the regulations have made the markets much thinner."

Buyers of commercial properties can still get a loan from a bank, "but it is really hard for the investment banks to hold CMBS inventory for market-making reasons, even if it is a highly rated bond," Zausner added. "What that means is there is not a lot of liquidity, pricing or discovery. People feel less sure about the market."

Industry representatives said they are concerned.

The "final rule does have some problematic components, which I think could have a significant impact on the CMBS market," said Tom Kim, senior vice president at the Mortgage Bankers Association. "And it could go into effect at a time when there is a lot of volatility in the capital markets."

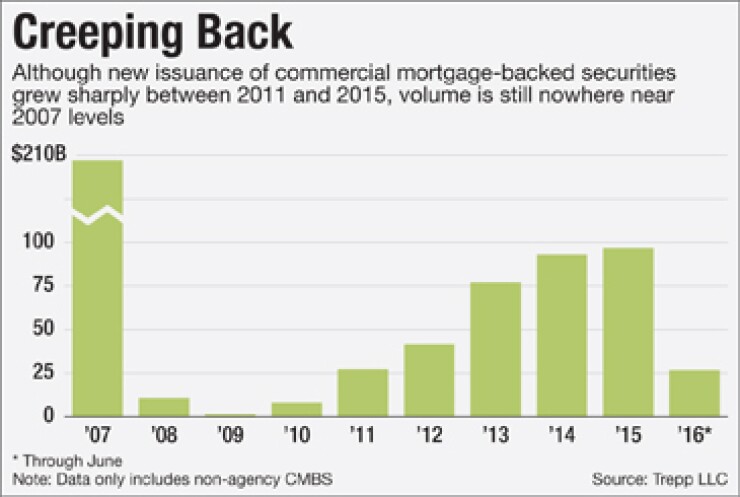

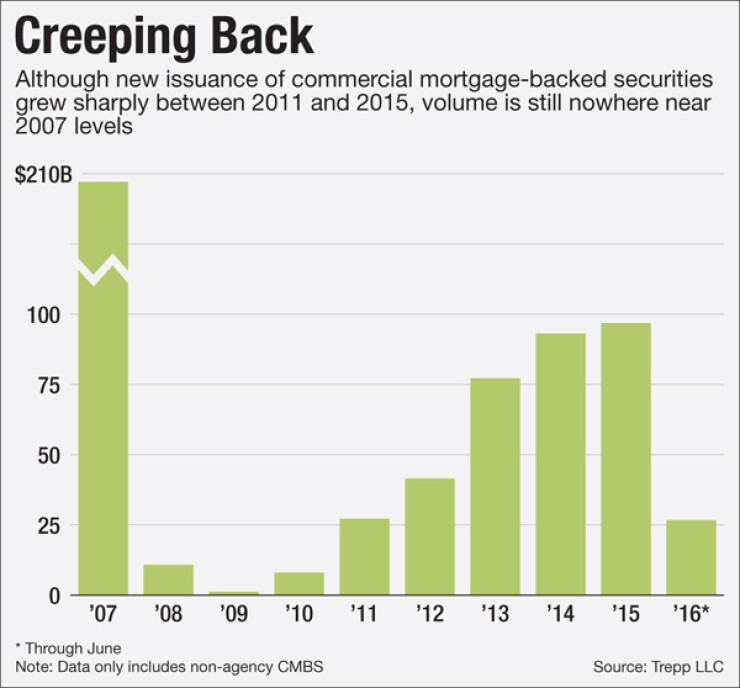

Industry estimates commercial mortgage back securities issuance will total $50 billion to $60 billion this year — less than the $97 billion in issuance last year. Economists at Wells Fargo Securities recently reported that issuance in the market has fallen to the lowest levels since 2009.

While there are fears that risk retention could worsen an already dire situation, the first deal could also provide relief when it is priced.

One such deal was sold in June as kind of a dry run for what risk retention will look like going forward, according to Manus Clancy, a managing director at Trepp LLC.

The $596 million JPMorgan CMBS deal issued June 7 had a 5% risk retention piece. It was designed to show the Securities and Exchange Committee what the industry is thinking in terms of meeting the risk retention requirements.

"We are hearing other banks are playing around with different structures that would accomplish the same thing," said Clancy in an interview. "At this point, investors and issuers think this is a surmountable problem. I don't think anyone is in a panic mode.

The retained credit risk (or B-piece) can be kept by the issuer or sold to a third-party investor. But starting in December, the B-piece owners will have to hold the retained risk for 10 years.

There are still ongoing negotiations between B-piece buyers and the banks on who is going to hold that particular portion of the credit risk, according to one source who did not want to be identified. It is also possible for the CMBS issuer to split the risk retention requirement with the investor.

"Over the past six months, we have seen more B-piece investors stepping forward, raising dedicated funds and saying they will be the holder of that risk going forward, "Clancy said.

One school of thought is the loans will be sold to the B-piece buyer the day before the issuance of the bonds, according to Clancy.

"The banks will continue to make loans and have permanent partners with the B-piece buyers, who understand the quality of the loans the bank is making," he said. "The bank no longer retains the risk and serves mainly as an originator and placement agent."

The final risk retention rule issued in 2014 allows for an "L-shaped structure" where the issuer and third-party investors each hold a portion of the required risk retention interest, according to industry representatives.

Meanwhile, the quality of CMBS deals that are getting done currently is high. "Deals getting through are vastly improved from deals issued last year," Zausner said.

However, the biggest concern is that risk retention deals will drive up borrowing costs for commercial property owners.

Well Fargo Securities economists argue the rule could increase the cost of capital for securitized products and increase the strain on banks.

"These regulations also come at a time when refinancing activity is picking up, with about $40 billion of CMBS loans maturing this year and $85 billion in 2017," according to a May 23 report.

Zausner said that "in general, there is still capital available to fund commercial real estate loans, but it is coming from different sources and seeking higher returns."

Some industry representatives are pursuing a legislative fix. The MBA backs a bill authored by Rep. French Hill, R-Ark., that would soften the 5% risk retention requirement. The bill provides an exemption for single-asset, single-borrower transactions and would allow investors to split the retained risk horizontally and in line with the structure of the bonds, or pari-passu, as currently required by the final rule, according to the Commercial Real Estate Finance Council, which also supports the legislation.

The bill has been approved by the House Financial Services Committee, but it has gained little traction in the Senate.

"We support the bill along with other coalition organization members," said Kim, who said it was a common sense reform that would enable the securitization market to continue financing CRE properties. "We continue to press Congress to make progress on that piece of legislation."