-

Leverage is moderate in Saluda Grade's pool, yet the junior liens carry slightly more LTV and DTI risk, on a weighted average (WA) basis.

February 4 -

After four years, the senior note classes will either pay a 100 basis-point increase to the fixed coupon or the net weighted average coupon (WAC) rate, whichever is lower.

February 4 -

Property inspection waivers were granted on 40.2% of the underlying mortgages, reflecting an increasing trend of agency mortgages being originated without them.

February 3 -

Although investor properties, which are prone to higher chances of default, account for 58% of the pool, the strong borrower and collateral quality mitigate the credit stress.

February 2 -

DRMT 2026-INV1, is backed by a pool of 1,153 non-prime investment property mortgages, which have a moderate leverage levels of an original, combined loan-to-value (CLTV) ratio of 69.9%.

January 29 -

The estimated range for net income to common shareholders at the company formerly known as Ocwen rose in part due to a deferred tax asset valuation.

January 26 -

The moderate leverage reflects the quality of RMBS pools from recent issuance years. Borrowers have a non-zero WA annual income of $1 million, with liquid reserves of $594,348.

January 23 -

The notes are expected to pay coupons of 4.94% on notes in the A1FCF tranche, rated AAA from KBRA and Fitch Ratings, to 6.78% on the B1 notes.

January 16 -

Trump's proposed $200B MBS purchase briefly tightened mortgage spreads, but analysts question the long-term impact on mortgage rates and GSE balance sheets.

January 9 -

Largely strong credit qualities were offset because by loans on single-family homes in the pool dropping by 0.5%, and that the percentage of loans that received due diligence decreased by 0.4%.

January 7 -

With limited seasoning and primarily a clean payment history, OBX 2026-NQM1 had a seasoned probability of default of 33.3% among the AAA stresses and 11.4% among the B.

January 6 -

Late last year, commercial bank holdings of mortgage paper reached the highest level since 2023 as these depositories are flush with deposits.

January 6 -

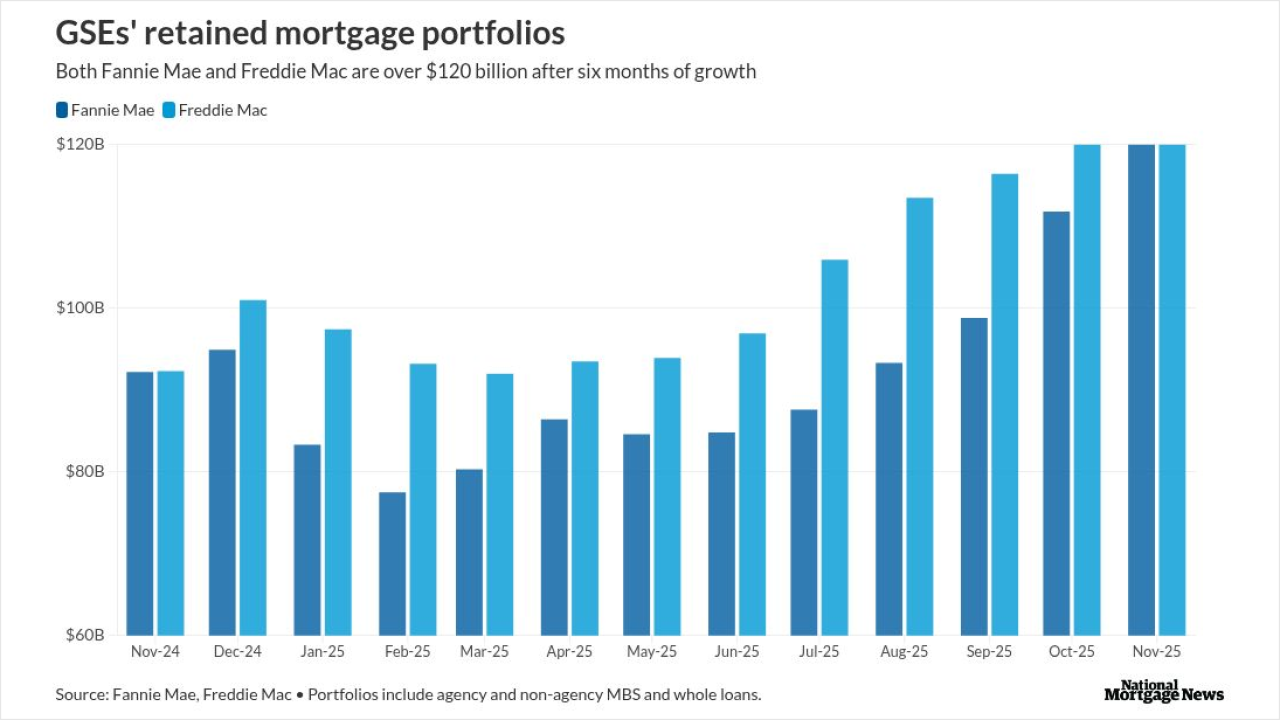

Keefe, Bruyette & Woods attributes Fannie Mae and Freddie Mac portfolio growth for the narrower spreads, but other reasons include lower volatility.

January 5 -

A significant portion of the loans in the pool by balance, 44.5%, are designated at non-QM, according to DBRS, adding that about 50% of the loans in the pool were made to investors for business purposes.

December 29 -

Some action items could make a big difference for both mortgage lenders and consumers, but the Trump Administration is not yet focused on these concerns.

December 29 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Rialto Capital allegedly engineered a way to keep it in default so that the company could win extra fees over time, according to a lawsuit filed Tuesday.

December 26 -

Three Democratic Senators say Demotech's assessments "raise profound governance and reliability concerns" in letters to Fannie Mae and Freddie Mac.

December 26 -

Principal will be distributed pro rata among the senior A1 through A3 certificates, and subordinate bonds will not receive any principal until all senior classes are reduced to zero.

December 19 -

Monthly excess spread will confer credit enhancement to the notes, KBRA said, and while it will be released it will not be available as credit enhancement in future payment periods.

December 18 -

Fannie Mae and Freddie Mac have added billions of dollars of mortgage-backed securities and home loans to their balance sheets in recent months, fueling speculation that they're trying to push down lending rates and boost their profitability ahead of a potential public offering.

December 15